Photo: Shutterstock

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis

- The capitalization of the crypto market has fallen by $35 billion overnight

- The BTC hashrate has returned to its standard values after a slump

- French shops are beginning to accept the Bitcoin for payment

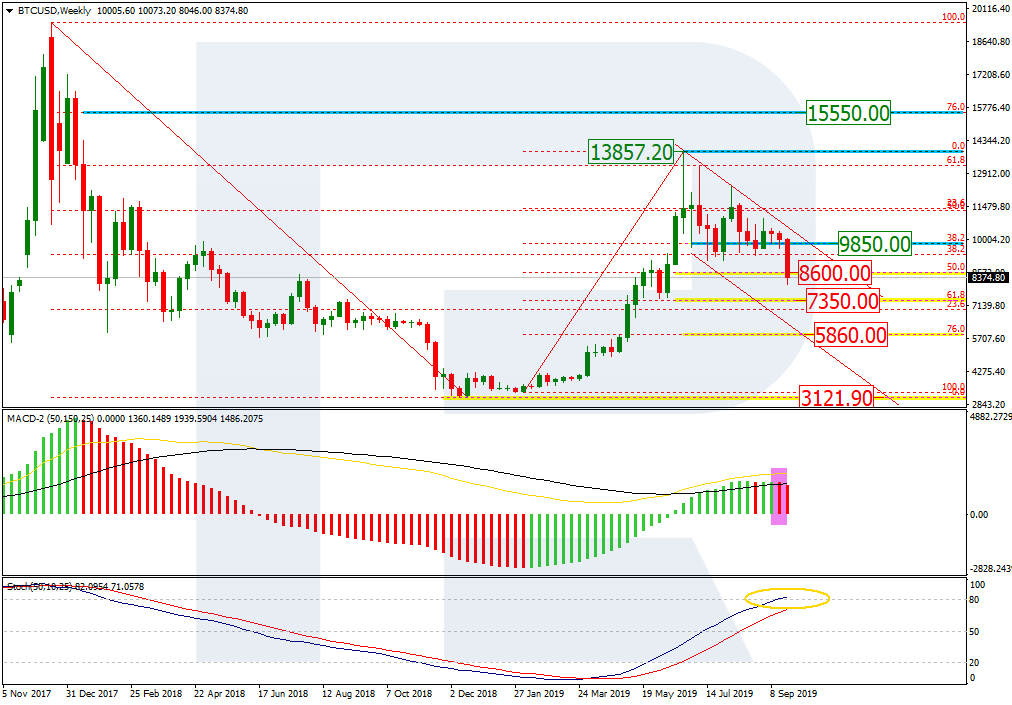

On W1, the Bitcoin has completed the correction in the shape of a Triangle: the strong declining impulse has broken through the former support while the present dynamics is acquiring the shape of a classic descending channel. The quotations have reached 50.0% Fibo and may go on declining. A breakaway of the resistance level at $9850.00 may signal the end of the correction and the beginning of new growth to a peak of $13857.20; upon renewing the maximum, the quotations may rise to $15550.00.

Additionally, we should have a look at the indicators. The MACD has started forming a red zone of the histogram, while the Stochastic is entering the overbought area. This data altogether may signal the beginning of a downtrend. The main confirmation of such a trend will be a Black Cross on the Stochastic.

Photo: Roboforex / TradingView

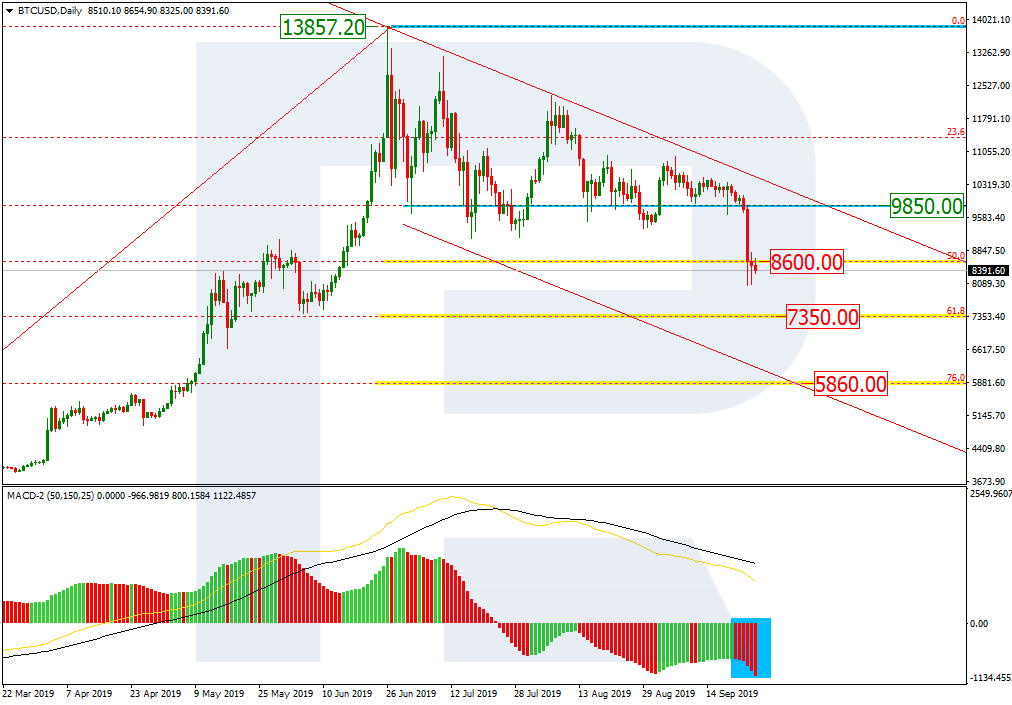

Photo: Roboforex / TradingViewOn D1, the BTC/USD is forming a descending correctional channel. Upon securing at 50.0%, further movement may be headed for 61.8% ($7350.00) and 76.0% ($5860.00) Fibo. As a confirmation, we should consider the descending of the lines and the red zone of the histogram on the MACD.

Photo: Roboforex / TradingView

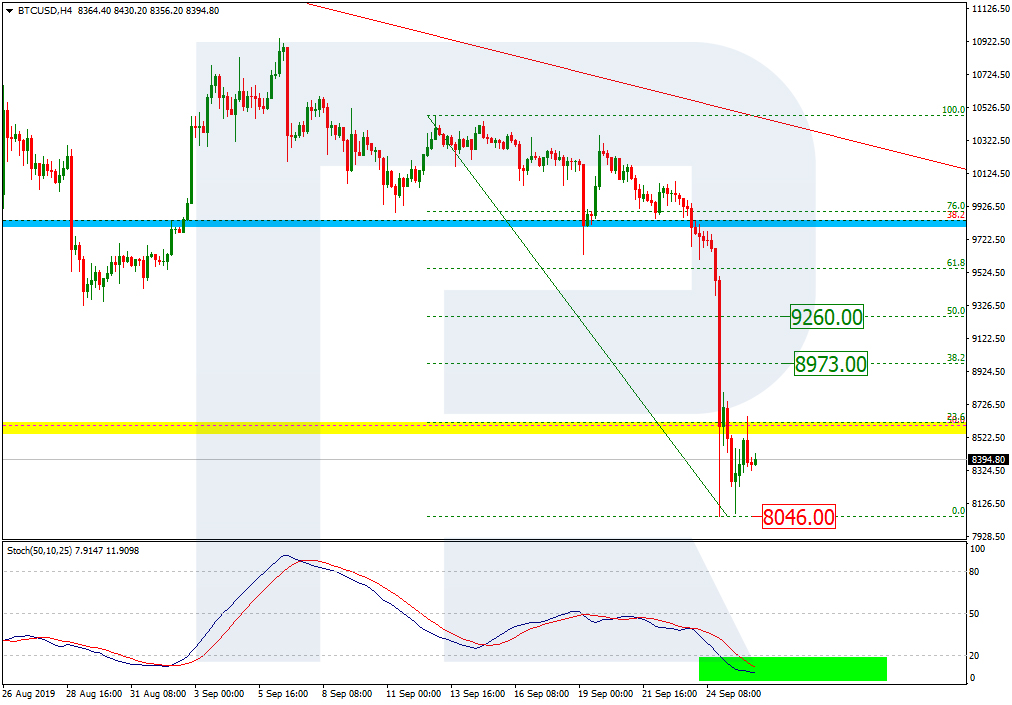

Photo: Roboforex / TradingViewOn H4, the descending impulse has stopped for a correction. The Stochastic lines entering the oversold area may signal the beginning of a pullback. The main aims of the correctional growth may be at 38.2% ($8973.00) and 50.0% ($9260.00) Fibo. The support is at the minimum $8046.00.

Photo: Roboforex / TradingView

Photo: Roboforex / TradingViewThe last 24 hours have been quite stressful for the cryptocurrency market. The market itself has lost some $35 billion; most cryptocurrencies have fallen by 8% to 10%. All this might be due to what is going on in the world of fiat money.

After a severe slump on September 24th, the BTC hashrate restored its normal values, now being around 92 EH/s. This week’s fluctuations of the indicator may be, in fact, connected to the peculiarities of the process for data collection by certain services instead of a safety breach or a decline of the processing power of the network.

However, not everyone is sure that the hashrate reflects the safety and processing power of the network.

As soon as the next year, some French brands, owning their own shops, are planning to start working with cryptocurrencies and accepting them as payment. Among the ones ready for this step are the sportswear brand Decathlon, the makeup network Sephora, Intersport, Norauto, Foot Locker and some other. For payment, the Global POS system is supposed to be used. It can convert cryptocurrencies to the euro immediately, which will be convenient.

For now, the sides are receiving all necessary permissions form regulators, upon which testing will be launched.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.