Photo: Shutterstock

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis

- The US authorities could influence the BTC rate

- Opera has started supporting the BTC

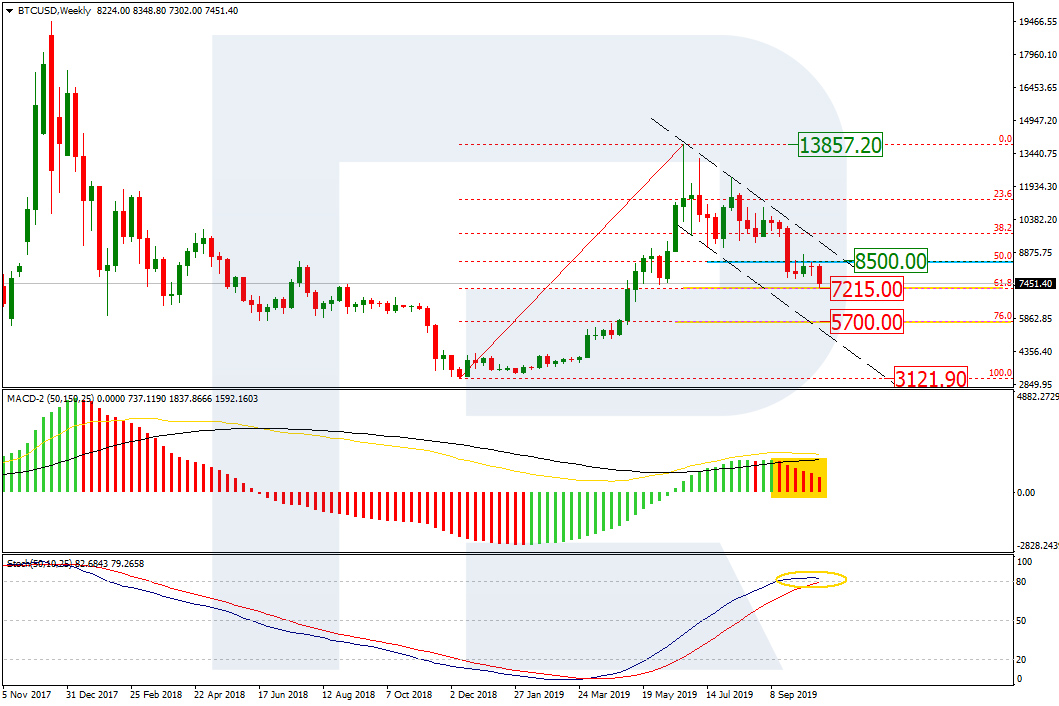

On W1, the Bitcoin keeps developing a downtrend inside the previous channel. The quotations have neared another target level of 61.8% ($7215.00) Fibo. Upon reaching this level, the quotations will be heading for 76.0% ($5700.00). However, the main goal of the mid-term wave is the long-term minimum of $3121.90.

The last impulse misplaced the resistance level. Currently, the resistance is at 50.0% ($8500.00). A breakaway of the resistance level may signal the beginning of an impulse of growth to the maximum of $13857.20.

The MACD histogram is in the “red zone”, and the Stochastic has entered the overbought area and is preparing for a Black Cross. These signals together support the development of the downtrend.

Photo: Roboforex / TradingView

Photo: Roboforex / TradingViewOn D1, the BTC/USD is demonstrating the development of the downtrend and a slump after a pullback in more detail. On the MACD, there is a convergence forming, which might mean a slow-down of the decline and a pullback approaching. In this case, the correction might start upon reaching $5700.00.

Photo: Roboforex / TradingView

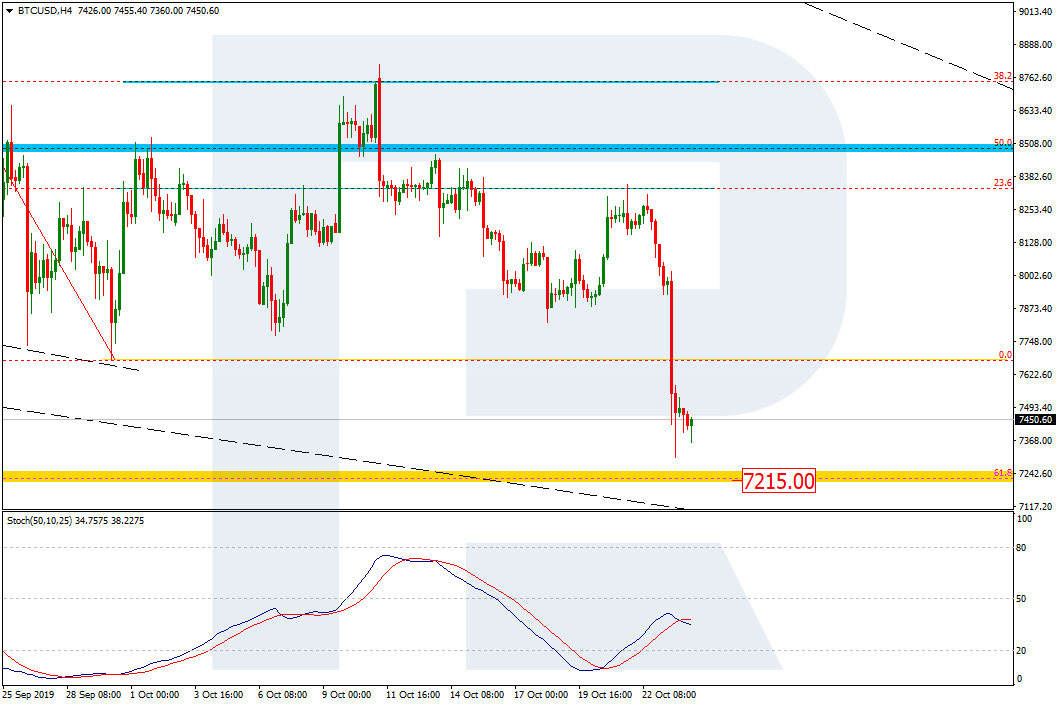

Photo: Roboforex / TradingViewOn H4, the previous correction has reached 38.2% Fibo, and after the impulse of decline overcame the previous minimum, the quotations stopped for a correction neat $7215.00. The Black Cross on the Stochastic points at the potential of further decline.

Photo: Roboforex / TradingView

Photo: Roboforex / TradingViewA couple of days ago, the CFTC ex-chairman Christopher Giancarlo mentioned the influence of the US authorities and the Commodity Futures Trading Commission in particular on the BTC behavior in 2017. He said that the CFTC, SEC, and White House deliberately allowed trading BTC futures to “pop” the BTC bubble because the rate of the cryptocurrency was growing stably. Giancarlo explained that the authorities considered “blowing up” the price bubble risky and decided to give the market an instrument of influence on the BTC – so that the investors could decide the fate of the cryptocurrency themselves.

As soon as the market got an opportunity to trade futures on the BTC, the investors became able to open short positions. The remaining they did by their hand.

We are not 100% sure that the information is true; however, such a strategy is very like the White House.

The Opera browser now features an opportunity to pay by the BTC via a built-in electronic wallet. The users can not only pay directly but also use a decentralized application. This is a useful function, though for now, it is available for Android only.

The opportunity to pay by the BTC will get a lot of people acquainted with the cryptocurrency, those people possibly becoming its active users in the future.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.