By CCN Markets: Bakkt, a bitcoin futures trading platform operated by ICE, the parent company of the New York Stock Exchange (NYSE), finally received approval from the Commodities and Futures Trading Commission (CFTC) to initiate its long-awaited launch.

“Our contracts have already received the green light from the CFTC through the self-certification process and user acceptance testing has begun. With approval by the New York State Department of Financial Services to create Bakkt Trust Company, a qualified custodian, the Bakkt Warehouse will custody bitcoin for physically delivered futures,” the official statement of Bakkt read.

Throughout 2019, especially since the soft opening of Bakkt’s testing platform, investors expected the firm to obtain approval from U.S. regulators by the year’s end. Bakkt’s first offerings will go live in September.

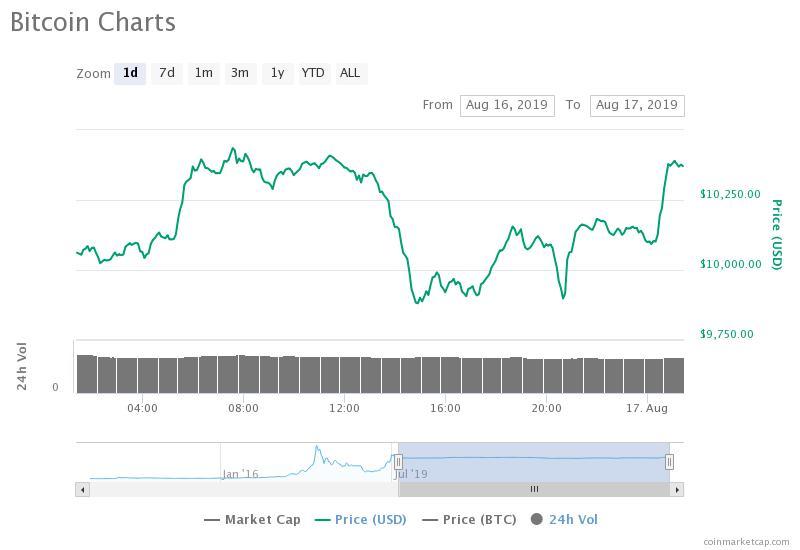

Following the official announcement, the bitcoin price surged by nearly $400, extending its two-day recovery and swiftly overturning a possible short-term downtrend.

On August 15, the bitcoin price slipped to $9,500, ranging below $10,000, which is widely acknowledged as an important psychological level for investors.

Within two days, the bitcoin price has increased by more than 10 percent against the U.S. dollar.

Why would Bakkt have an impact on the bitcoin price?

As emphasized by Compound Finance general counsel Jake Chervinsky in late 2018, Bakkt uses physically-settled contracts that allow investors to receive actual BTC when the contracts settle, rather than cash.

2/ Bakkt’s goal is to make digital assets easier to buy, sell, store & spend.

Bakkt will start by offering one-day, physically-settled bitcoin futures contracts. That means if you buy a futures contract from Bakkt, you get actual bitcoin the next day.https://t.co/NzkAFGhzoC

— Jake Chervinsky (@jchervinsky) November 6, 2018

“Also noteworthy is the fact that Bakkt will custody & deliver real bitcoin. That means institutional inflows would reduce supply & thus (maybe) increase price too. This is different from other regulated futures markets like CME & CBOE, which only deal in cash-settled futures,” Chervinsky said at the time.

Although the potential effect of Bakkt on the bitcoin price depends on the level investor demand, based on the consistent inflow of institutional capital throughout the past 18 months on platforms like Grayscale and Coinbase, Bakkt is expected to increase the liquidity in the bitcoin market.

Brian Armstrong, the CEO of Coinbase, a major cryptocurrency exchange valued at $8 billion, recently stated that the exchange, which just acquired Xapo‘s custodial business, has seen an inflow of $200 million to $400 million per week from institutional clients.

Whether institutions were going to adopt crypto or not was an open question about 12 months ago. I think it’s safe to say we now know the answer. We’re seeing $200-400M a week in new crypto deposits come in from institutional customers.

— Brian Armstrong (@brian_armstrong) August 16, 2019

The impending launch of Bakkt’s trading platform could serve as a fundamental catalyst for positive sentiment among cryptocurrency investors because it will provide institutional traders with the ability to trade bitcoin on an exchange with strong ties to the legacy financial industry.

High profile traders like Flood expressed optimism towards the short term price movement of bitcoin in awake of the Bakkt launch announcement.

imagine shorting into bakkt news lol

— Flood [BitMEX] (@ThinkingUSD) August 16, 2019

Click here for a real-time bitcoin price chart.

This article is protected by copyright laws and is owned by CCN Markets.