Bitcoin’s (BTC) recent volatility highlights how markets tend to overreact, especially in situations that can escalate, such as trade wars. The 6.5% drop in the S&P 500 since its all-time high on Feb. 19 might seem minor in absolute terms, but the potential earnings impact is more significant. However, derivatives markets suggest Bitcoin’s dip below $83,000 should be short-lived.

Traders tend to sell off assets when they sense a recession coming. Presently, investors are moving into cash and short-term government bonds. This shift explains why the US 2-year Treasury yield recently hit its lowest level in five months. Traders are willing to accept lower yields, which shows strong buying interest.

US 2-year Treasury yield (left) vs. Bitcoin/USD (right). Source: TradingView / Cryptox

Bitcoin derivatives markets held firm despite the 16% correction since the rejection at $99,500 on Feb. 21, indicating that whales and market makers do not expect further declines. More importantly, even if the much-anticipated United States strategic digital asset reserves fail to secure congressional approval, there is still strong political momentum at the state level, keeping the initiatives alive.

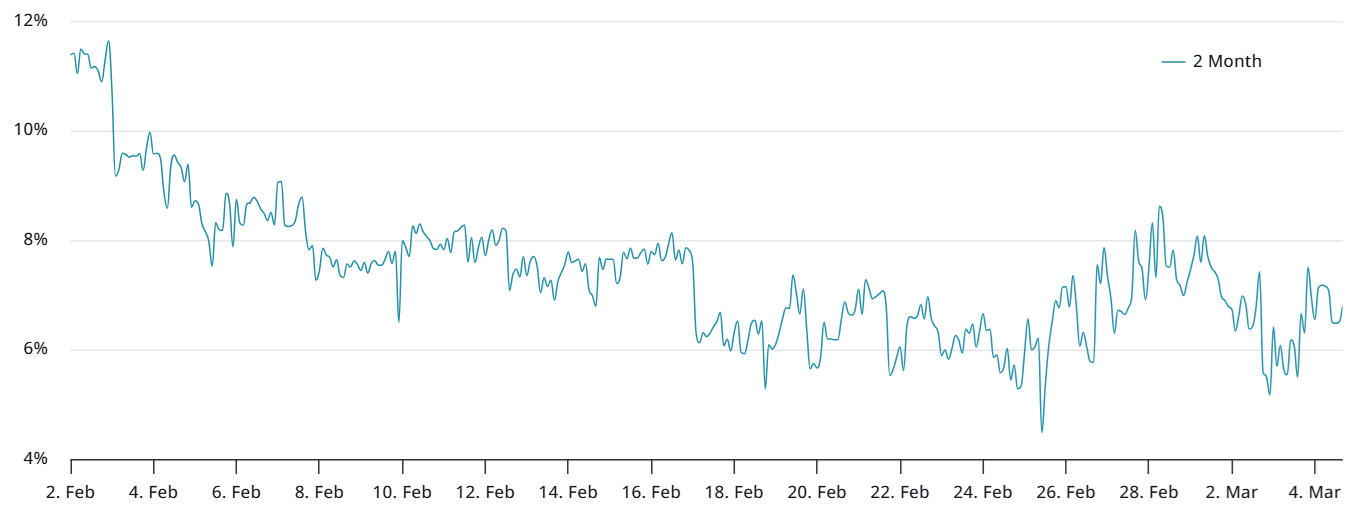

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

Bitcoin futures have maintained a stable 6.5% annualized premium (basis rate) over spot markets as of March 4, unchanged from the prior week. This metric remains within the neutral 5% to 10% range observed over the past four weeks—a clear indication that professional traders are unfazed by recent volatility, showing confidence in market stability.

Bitcoin 30-day options delta skew (put-call). Source: Laevitas.ch

The Bitcoin options 25% delta skew (put-call) stood at 4% on March 4, reflecting balanced pricing between put (sell) and call (buy) options. Given the failed attempt to reclaim the $94,000 support on March 3, the low demand for protective puts signals resilience among investors.

Bitcoin’s dip below $83,000 reflects macroeconomic uncertainty

US Senator Cynthia Lummis predicted that state governments will likely adopt Bitcoin into strategic reserves before the federal government. Utah’s HB230 “Blockchain and Digital Innovation Amendments” bill has already passed the House and, if approved by the Senate, could allocate up to 5% of state reserves to Bitcoin through a qualified custodian or exchange-traded funds (ETFs).

However, Bitcoin’s ability to regain bullish momentum remains closely tied to traditional market sentiment. Traders worry that 20% or greater two-week price drops in companies like Tesla, TSM, Broadcom, and ARM signal that the artificial intelligence sector has entered a bear market, potentially impacting sales of the world’s largest corporations and reducing investor appetite for risk assets.

Investors are worried that US economic growth will slow down, and this seems likely based on the Atlanta Fed’s real GDP estimate. If the US economy contracts by 2% or more in the first quarter, the valuations of publicly listed companies could drop sharply. At the same time, higher vacancies in commercial real estate could increase credit risks, putting serious pressure on the banking sector.

The recent drop in Bitcoin below $83,000 is not really tied to the success or failure of the US digital asset strategic reserve. Instead, investors are pulling out of riskier assets like artificial intelligence stocks and consumer cyclical companies. On March 3, spot Bitcoin ETFs saw $74 million in outflows, adding to the uncertainty. Investors worry that institutional demand will remain weak, reflecting a tougher macroeconomic environment.

Chances are Bitcoin’s price will remain below $90,000 until the S&P 500 shows that a normal correction is over—when investors fear a recession, they cut back on risky assets. Still, Bitcoin derivatives data suggests the risk of a bigger drop is low for now.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cryptox.