As the summer season arrives, an unexpected heatwave is gripping financial markets

This heat is coming in the form of the US Dollar (DXY) which has been on a remarkable uptrend since late April, reaching levels unseen since early March’s banking crisis when the dollar wrecking ball wreaked havoc on asset prices.

This surge in the dollar has raised concerns among market participants due to its high inverse relationship with Bitcoin (BTC), a topic many macro and crypto analysts have discussed repeatedly in 2023.

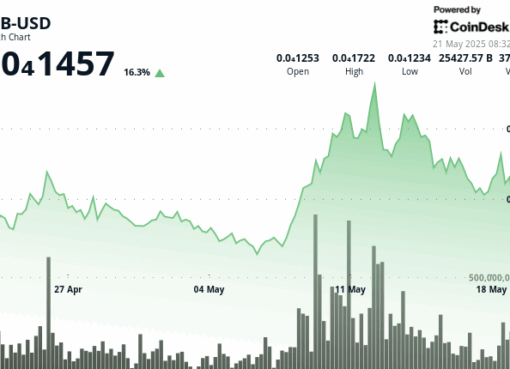

The implications of this inverse correlation means that when the dollar rises, BTC falls and vice versa. The chart below showing the year-to-date performances of DXY (blue line) and BTC (orange line) underscores this relationship a step further.

Notice how, Bitcoin’s 2023’s performance has been propelled by a downward dollar. Not coincidentally, DXY reached its year-to-date low near 100.80 on April 13, nearly the exact date BTC reached its year-to-date high of just over $31,000. Since then, however, both have been trending in opposite directions.

Feelings of unease over what sort of summer could be in store for markets should the dollar’s uptrend continue are certainly justified at present. After all, the last time DXY broke above these levels BTC was trading below the $20,000 mark.

On the surface, this would imply that BTC still has quite a deep correction ahead before any hopes of new year-to-date highs emerge.

Taking a look deeper however, it’s clear that some divergent signals beginning to emerge which suggest this dollar rally could be nearing an end.

Let’s take a look at them to see what’s been driving DXY’s recent strength, and zoom in on a notable segment of the market who has remained un-phased by Uncle Sam’s recent resurgence.

The relationship between BTC and DXY is terminal

Back in March, similar to now, plummeting federal funds futures were the primary driver of DXY’s strength.

For readers who might not be macroeconomic nerds, the federal funds futures represent the terminal rate, or the market’s expectation of when the Federal Reserve’s hiking cycle will come to an end.

When federal funds futures fall, the terminal rate rises and consequently the dollar rises as well. The opposite is also true, which is nother inverse correlation.

To track this leading indicator, traders follow the federal funds futures ticker (ZQN2023 on TradingView). The chart can be a bit intricate, with 100 representing zero interest rate expectations, and each 0.10 increment below indicating a 10 basis point (0.10%) rate hike.

Currently, the chart reads 94.83, implying a terminal rate of 5.27%. This suggests that the market still anticipates the Fed to hike rates by at least 27 basis points beyond its current rate of 5%.

This is the lowest level federal funds futures had reached since early March, just before the banking crisis unfolded.

Looking at the chart again below with BTC (orange line) laid overtop shows that the mid-March reversal in terminal rate expectations were a huge driver of DXY’s drop and consequently Bitcoin’s rally above $30,000.

If the federal funds futures were again to fall back below the 94.50 level, as they did in March, it would become very likely that the market would fall back under heavy sell pressure due to this correlation.

Notably, these federal funds futures made a strong surge on the afternoon of Wednesday May 31 when they rose over 10 basis points from the lows.

Should this trend continue and the ZQN2023 contract rise back above 95, it would signal the market’s belief that the Fed’s hiking cycle has concluded, potentially paving the way for rate cuts. Such easing of monetary policy would more than likely be quite bullish for BTC, and bearish for DXY.

This is especially true if the dollar index falls back down to new 2023 lows from here, and breaks below its long held support level near 100. Such price action would open up the gates for BTC to make a refreshed run above $30,000.

And with that thought in mind, there is one notable cohort of crypto market participants who appear to be front running such a reversal, Bitcoin whales.

Related: Last BTC price dip before a $30K breakout? Bitcoin wipes weekend gains

Bitcoin whale songs

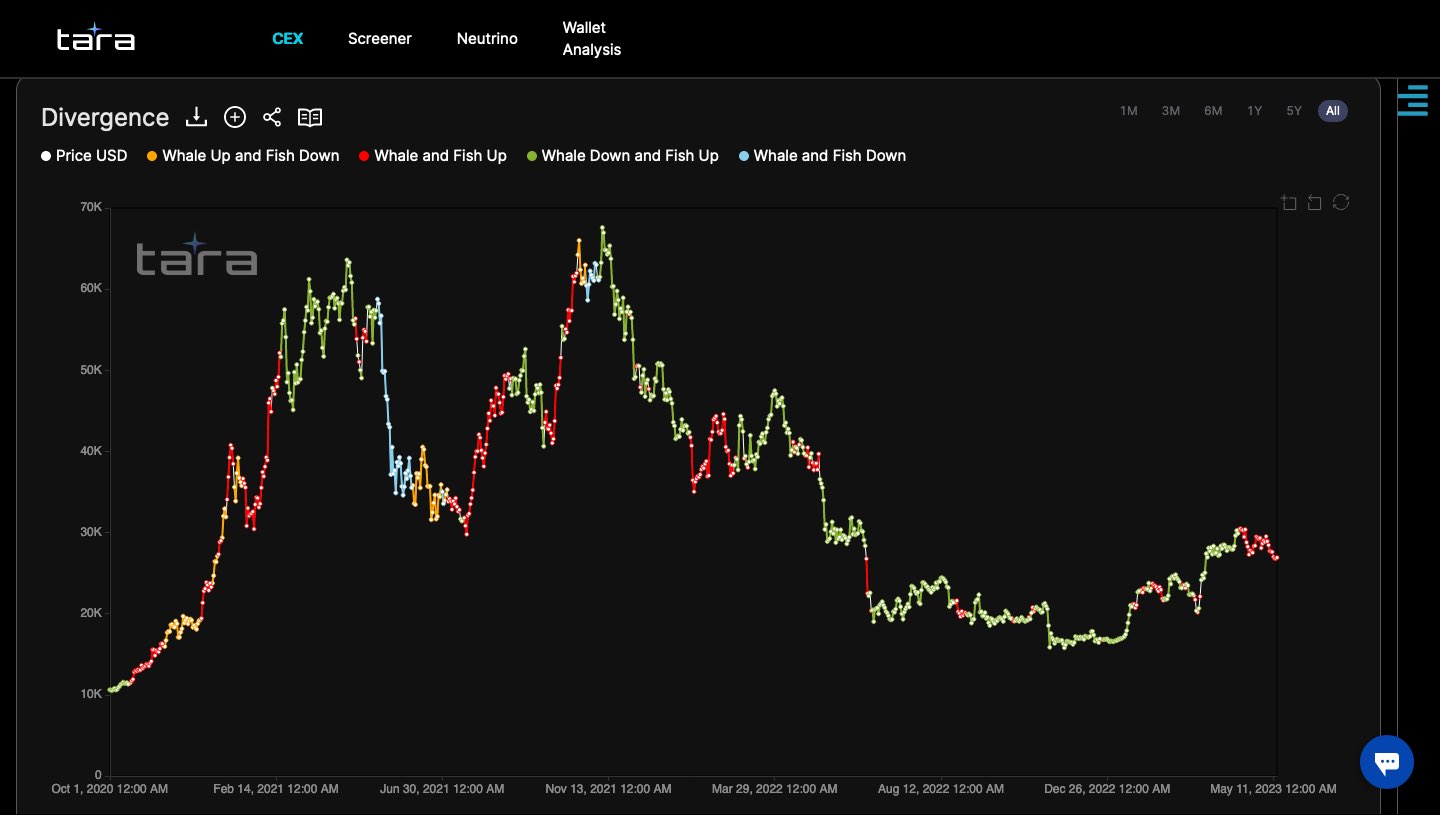

Bitcoin whales are classified by wallet addresses that hold more than 10,000 BTC.

A species of smart money that the on-chain data scientists study intensely.

As shown on the chart below, Bitcoin whales (represented by the red dots) have been steadily increasing their holdings on net every day since April 17, a trend which coincided with Bitcoin reaching its year-to-date high above $31,000.

This behavior diverges from previous trends, where whale wallets accumulated Bitcoin at market bottoms, or on the way to higher highs, rather than tops. This anomaly prompts a thought-provoking question: have these whale wallets bought the top for the first time, or was April 17 not the peak?

This behavior from the Bitcoin market’s largest players calls into question the legitimacy of May’s DXY pump and adds uncertainty to bearish outlooks, especially when combined with the notable rise in federal funds futures.

As always, the market is doing its best to keep participants a step behind the next trend.

What remains to be seen is how much the rise of terminal rates and DXY in May can be attributed to escalating fears over the US’s debt ceiling stand-off. With that issue now in the rearview (pending final votes) one wonders whether or not this will lead to the dollar reverting back to its downtrend, and Bitcoin heading back above the $30,000 mark.

For the remainder of Q3 it will be crucial to closely monitor the movements of terminal rate expectations, DXY, and Bitcoin whale activity as these data points are likely to provide actionable clues prior to the next big move happening.

The coming weeks will undoubtedly shed light on these intriguing dynamics, shaping the path for both the US Dollar and the cryptocurrency market at large into the summer months and beyond.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cryptox.