Since the start of the week Bitcoin (BTC) price has dropped more than $38 billion as traditional markets also fell by more than 10%. As reported throughout mainstream media, this week’s collapse of the largest equities markets is the worst correction since the 2008 meltdown and more than $3.8 trillion in value was erased as daily news of the Coronavirus spreading throughout the world dominated headlines.

Investors are now wondering if the rally which propelled Bitcoin price from $6,400 to $10,500 is over and as the end of the month approaches, Bitcoin is on course to record a monthly loss in February for the first time in 6 years.

On Friday Bitcoin price appeared to be on the second day of finding stability in the $8,500 to $8,750 zone, whereas traditional markets continued to fall. The freefall amongst altcoins also appears to have stopped and Chainlink (LINK), Huobi Token (HT), Tezos (XTZ) being standout performers.

Crypto market daily price chart. Source: Coin360

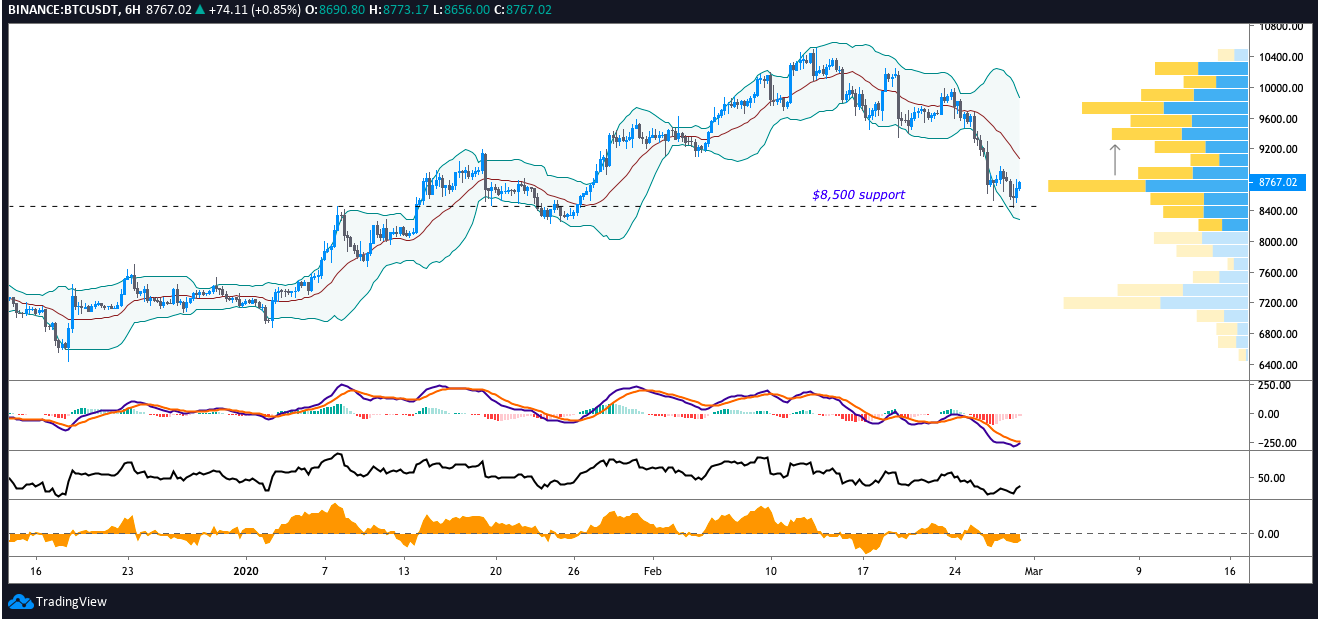

At the time of writing, Bitcoin price is forming higher lows and trading above the high volume node of the VPVR at $8,750. If the price can sustain above $8,750, traders may begin to feel more confident about a bottom having been reached at $8,432 and as they step in to open long positions the price could quickly rise through the volume gap in the VPVR from $8,870-$9123 where the 20-MA of the Bollinger Band indicator currently resides.

Next week a high volume breakout driven by improving equities markets or some positive news related to the Coronavirus could see buyers press the price above the $9,100 level to $9,300.

BTC USDT 6-hour chart. Source: TradingView

The shorter time frame also shows the moving average convergence divergence on the verge of pulling above the signal line and as bull volume increases another positive is the MACD histogram bars shortening and drawing closer to 0 on the indicator. The relative strength index (RSI) has also bounced from oversold territory, currently registering 37.

As mentioned in a previous analysis, trading volume will be the tell on whether a bullish reversal is in the making or if day traders are simply trading support levels and oversold bounces to bag quick profits.

BTC USDT daily chart. Source: TradingView

Over the short-term, it would be encouraging to see the price cross above the Bollinger Band moving average to reclaim $9,100 in order to consolidate in the $9,100 to $9,400 range before having a go at $9,500.

The $8,500 support also lines up with the 128-day moving average and losing this support would raise some concern as the price history shows Bitcoin price taking a turn for the worse when below the 128-MA.

If the price were to drop below $8,500 traders might anticipate a bounce at $8,000 where the 61.8% Fibonacci retracement level is, and below this, there is support at $7,400 which is slightly the 78.6% Fibonacci retracement.

At the moment the market is still soft and while indicators like the MACD and RSI are providing some positive symbols, the state of traditional markets and the situation with Coronavirus could continue to negatively impact crypto prices next week.

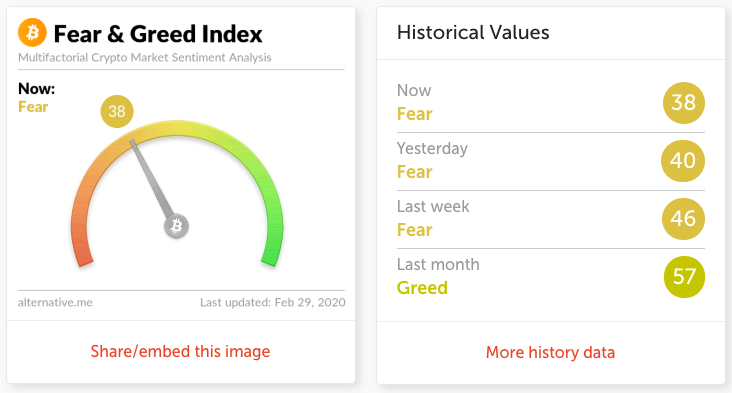

The Crypto Fear and Greed Index, a popular indicator used to gauge investor sentiment in the sector, currently reads ‘Fear’ at 38.

Crypto Fear & Greed Index. Source: Alternative.me

This shows that investors remain bearish about the short-term price action within the crypto market but it’s a well-known fact that many traders countertrade the signal by buying Bitcoin when the indicator is extremely bearish and selling when it is overwhelmingly bullish.

Obviously, every investor should do their own research before purchasing crypto-assets, especially with the current state of the market, but it also seems likely that investors will soon view Bitcoin prices in the $8,500 to $7,400 as an opportunity to open long positions. More risk-averse traders will probably look to buy a breakout above $9,400-$9,500.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.