Bitcoin (BTC) surged $1,000 in five minutes before the Nov. 10 Wall Street open as United States inflation and jobs data boosted risk assets.

CPI comes in lowest since the start of 2022

Data from Cryptox Markets Pro and TradingView showed BTC/USD climbing to daily highs of $17,782 on Bitstamp.

The pair was just hours from a more-than-two-year low below $15,700 at the time, taking its 24-hour low-to-high to 12.8%.

At the time of writing, BTC/USD circled $17,400 with volatility still rampant as U.S. markets opened to digest economic data.

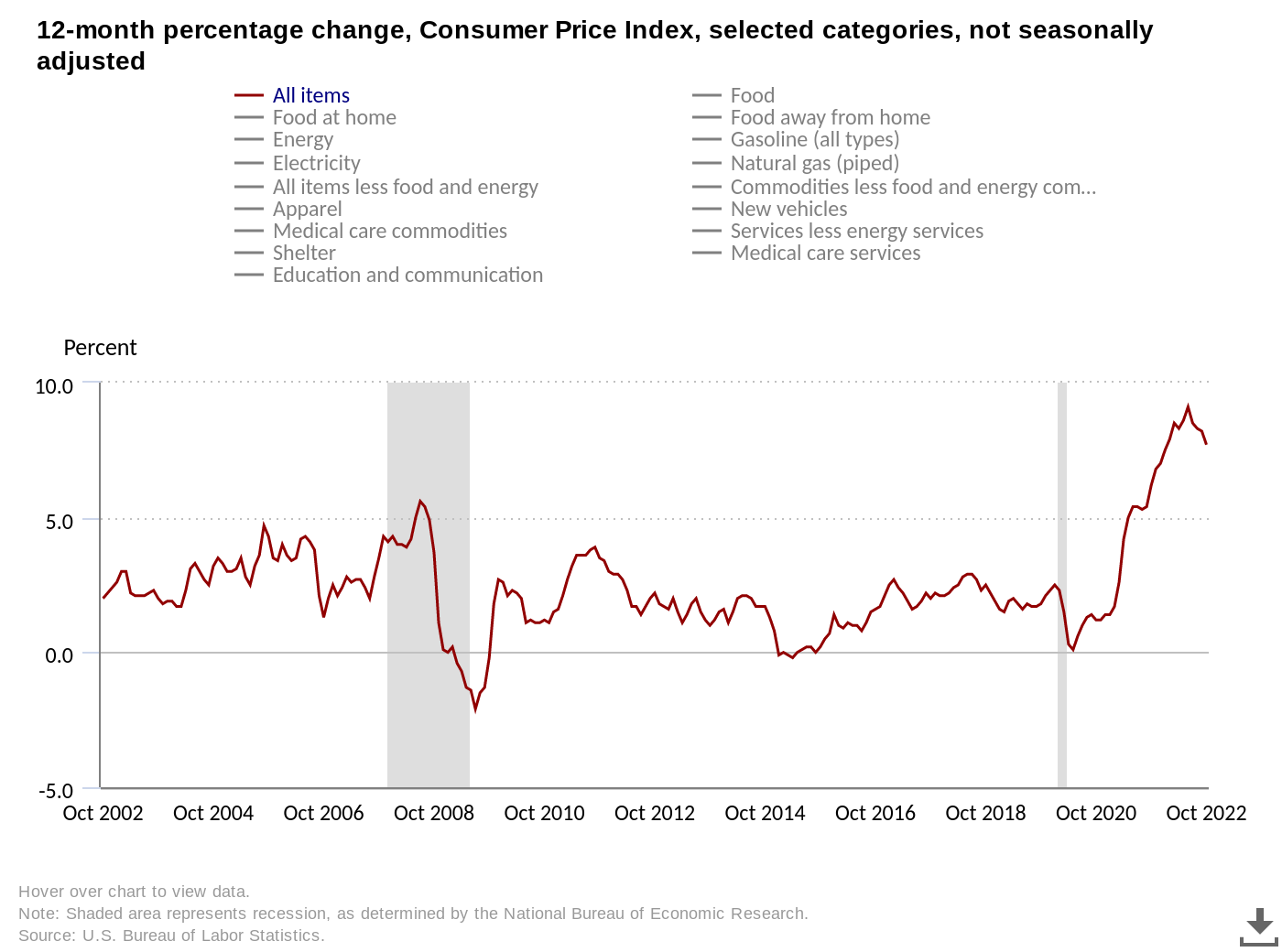

This had come in the form of the Consumer Price Index (CPI) print for October, along with jobless claims.

Both offered a positive surprise, CPI coming in below expectations and jobless claims above, both implying that the Federal Reserve’s rate hikes were working and that a pivot may come sooner than feared.

Analyzing Bitcoin’s reaction to the Binance order book, monitoring resource Material Indicators showed the nearest resistance hurdle at $18,500.

“Bear Market Rally is still alive,” part of accompanying comments read.

Trading account IncomeSharks was even more optimistic, arguing that $20,000 may return as part of the risk asset rebound.

“Bitcoin- Has an easy path back to $20k as Stocks pushing up and positive CPI numbers,” it told Twitter followers.

At 7.7% year-on-year, the October CPI readout marked the lowest since January, an accompanying press release confirmed.

“The all items less food and energy index rose 6.3 percent over the last 12 months. The energy index increased 17.6 percent for the 12 months ending October, and the food index increased 10.9 percent over the last year; all of these increases were smaller than for the period ending September,” it stated.

DXY tanks 2% on economic numbers

Meanwhile, an already weakened U.S. dollar index (DXY) felt instant pain at the release, dropping over 2% for the second time in recent days.

Related: Analysts urge calm as Tether depegs from USD, Bitcoin loses $17K rebound

DXY circled 108.6 at the time of writing, its lowest since Sept. 13.

At the same time, stocks opened markedly higher, with the S&P 500 up 3.5% and Nasdaq Composite Index gaining 4.6%.

Popular analyst John Wick, like others, nonetheless advised caution.

“Dollar falling out of the up-channel due to CPI numbers. This giving relief to assets,” he tweeted alongside a DXY chart.

“Just because an up-channel is broken does not mean a sustained downtrend always happens. Often another channel may form at a slower rate of assent, or may jump back to original channel.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.