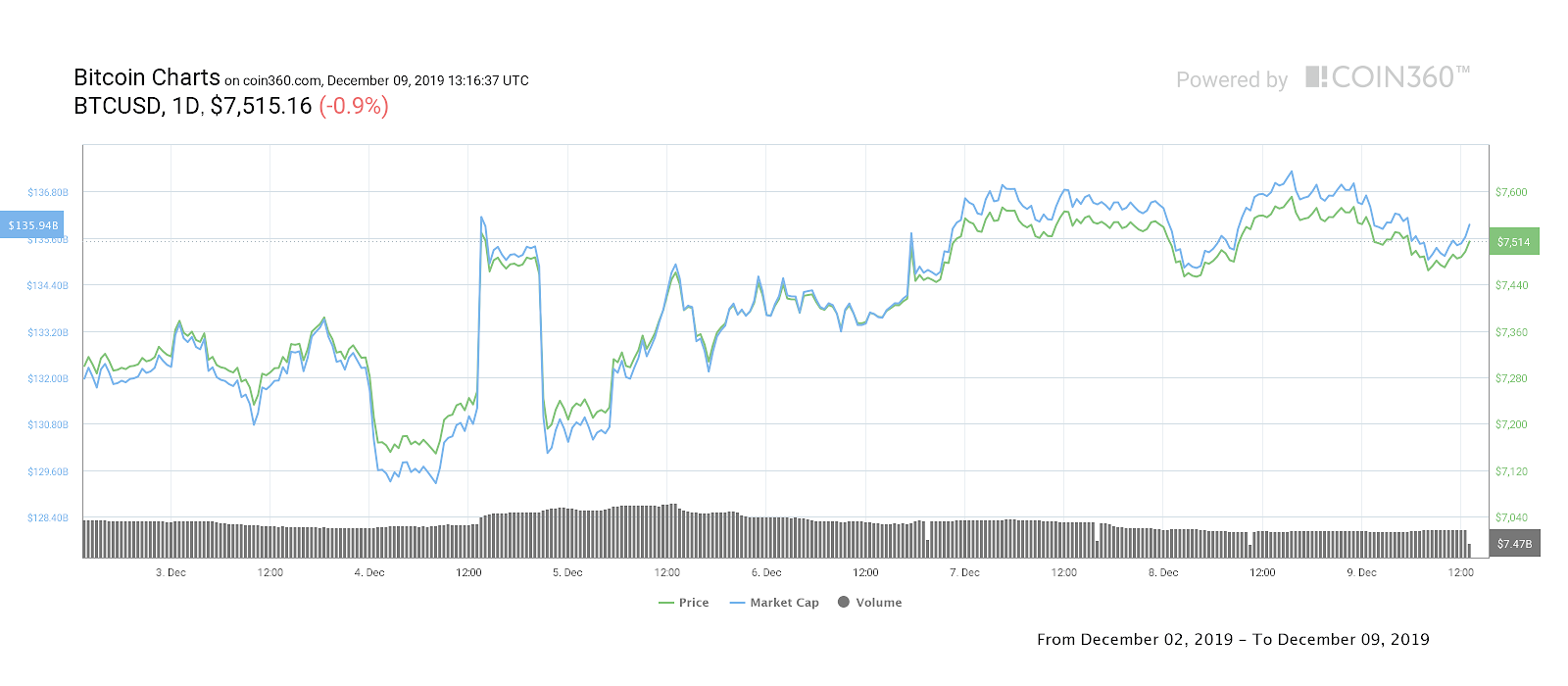

Bitcoin (BTC) fluctuated around $7,500 on Dec. 9 after a weekend of range-bound movement reduced volatility concerns for traders.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin delivers classic futures “bounce”

Data from Coin360 and CryptoX Markets showed the largest cryptocurrency trading in a $250 corridor since Friday, marking local highs of $7,604 before briefly reversing to $7,395 on Sunday.

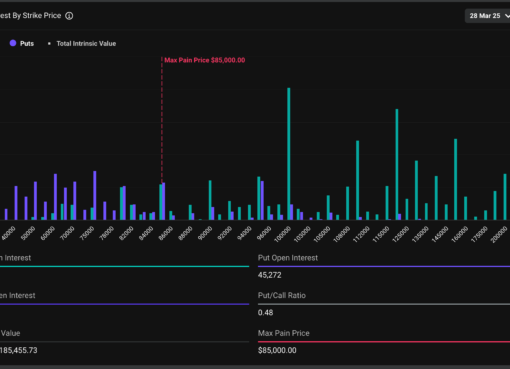

Since then, the $7,500 boundary has acted as a centerpiece for Bitcoin, which comfortably filled the latest “gap” in futures markets once again as the week began.

An increasingly common feature, futures gap-filling refers to BTC/USD targeting a zone between when futures finished trading in one session and resumed during the next. On Friday, CME futures closed at $7,460, opening again at $7,570.

For regular CryptoX contributor filbfilb, the predictable behavior was a source a positivity, despite Bitcoin overall remaining skittish within its current corridor.

“Looks like we got a bit of a bounce off the cme gap which was nice,” he told subscribers of his dedicated Telegram channel on Monday.

For fellow contributor Michaël van de Poppe, conditions were similarly choppy. Uploading a new chart to Twitter, he said upside potential hinged on BTC/USD preserving ground at $7,400.

“Boring, range-bound movements here,” he summarized in accompanying comments. Van de Poppe continued:

“However, if $BTC breaks the red zone around $7,550, I won’t be surprised with a move towards $7,800 and notably $8,000-8,200 zone. Crucial; holding $7,400 area as support.”

Zooming out from the short term, however, others were more bearish. In his weekly analysis for CryptoX, well-known pundit Keith Wareing warned that over the coming months, the potential for Bitcoin to drop as low as $2,500 remained.

Altcoins stay stable as volatility ebbs

The start of the week produced similar behavior to Bitcoin across altcoin markets. The top twenty cryptocurrencies by market cap avoided significant gains or losses, moving mostly by less than 1%.

Ether (ETH), the largest altcoin, traded down 0.7% at just above $150, that level having nonetheless failed to act as support in the past.

The exception to the trend was Algorand (ALGO), which gained 6% on the back of a new implementation agreement with Italy.

The overall cryptocurrency market cap was $203.4 billion, with Bitcoin’s share at 66.8% of the total.