- The bitcoin price is putting the crypto community to the test.

- Bitcoin fundamentals, however, remain solid.

- Altcoins are down in sympathy.

It’s not easy being a crypto investor these days. China is sending mixed messages, the bitcoin price is in the doldrums, and there is major FUD being spread around the industry that is only exacerbating already precarious market conditions. In fact, the only thing harder than being a bitcoin investor these days is being an altcoin investor, given they are subject to the whims of a violently volatile larger peer, the latter of which currently boasts a dominance rating of more than 66%.

Fundamental Focus

Bitcoin is currently trading where some said it would never trade again – below $10,000. In fact, it’s down 15% in the past week alone and is trading at May 2019 levels. But if you focus on the fundamentals, you just might be able to see the glass half-full like crypto investor Brian Kelly.

Time and again, crypto investor Brian Kelly has proven to be the grown up in the crypto room. Kelly, author of “The Bitcoin Big Bang,” doesn’t appear to get spooked by bitcoin’s volatility, pointing instead to the underlying fundamentals of the leading cryptocurrency. For Kelly, that means BTC addresses. He said on CNBC:

What we’re seeing over the last 30 days is we’re seeing growth in addresses of about 5%, but the market is pricing in a decline in addresses of -3%. So it’s mis-priced here. Fundamentals are improving on a sell-off so i think that’s why the odds are stacked that this is probably a low.

Bitcoin breakdown? The cryptocurrency just dropped 15% in a week. Here’s what @BKBrianKelly thinks of the move. pic.twitter.com/n9kHpRrYDN

— CNBC’s Fast Money (@CNBCFastMoney) November 22, 2019

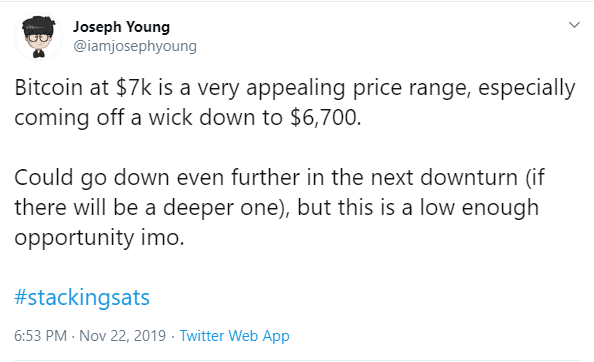

Analyst Joseph Young provided some technical analysis, noting that “bitcoin at $7k is a very appealing price range.” Young sees the price potentially dropping to lower levels. If the bottom does fall out and the BTC price plummets to its lowest support at $4,200, Young says he will take it as an opportunity to #stacksats.

“Parabolic Uptrend”

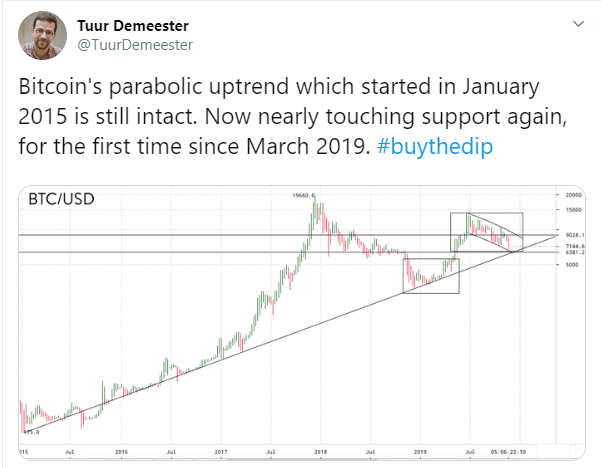

Believe it or not, the bulls have not completely left the building. According to Adamant Capital Founding Partner Tuur Demeester, “bitcoin’s parabolic uptrend which started in January 2015 is still intact.” Adamant Capital also observes bitcoin’s fundamentals, which according to a recent report by the firm includes themes such as:

- “Bottom up scaling” via Lightning Network for payments

- Sidechains such as the Liquid Federated Sidechain

- Bitcoin mining, where the threat of hard forks is less likely

Demeester’s technical analysis drew some ire on social media. He likened the response to the December 2018 crypto market when the bitcoin price plummeted to the $3,200 level only “the emotional pain was certainly more palpable then,” he concludes. Demeester’s advice remains steadfast – “buy the dip.”