Bitcoin (BTC) fell below $9,000 for the first time in almost a week on Oct. 31 as rumors of a correction intensified among analysts.

Cryptocurrency market daily overview. Source: Coin360

BTC short-term outlook could call for $8.2K

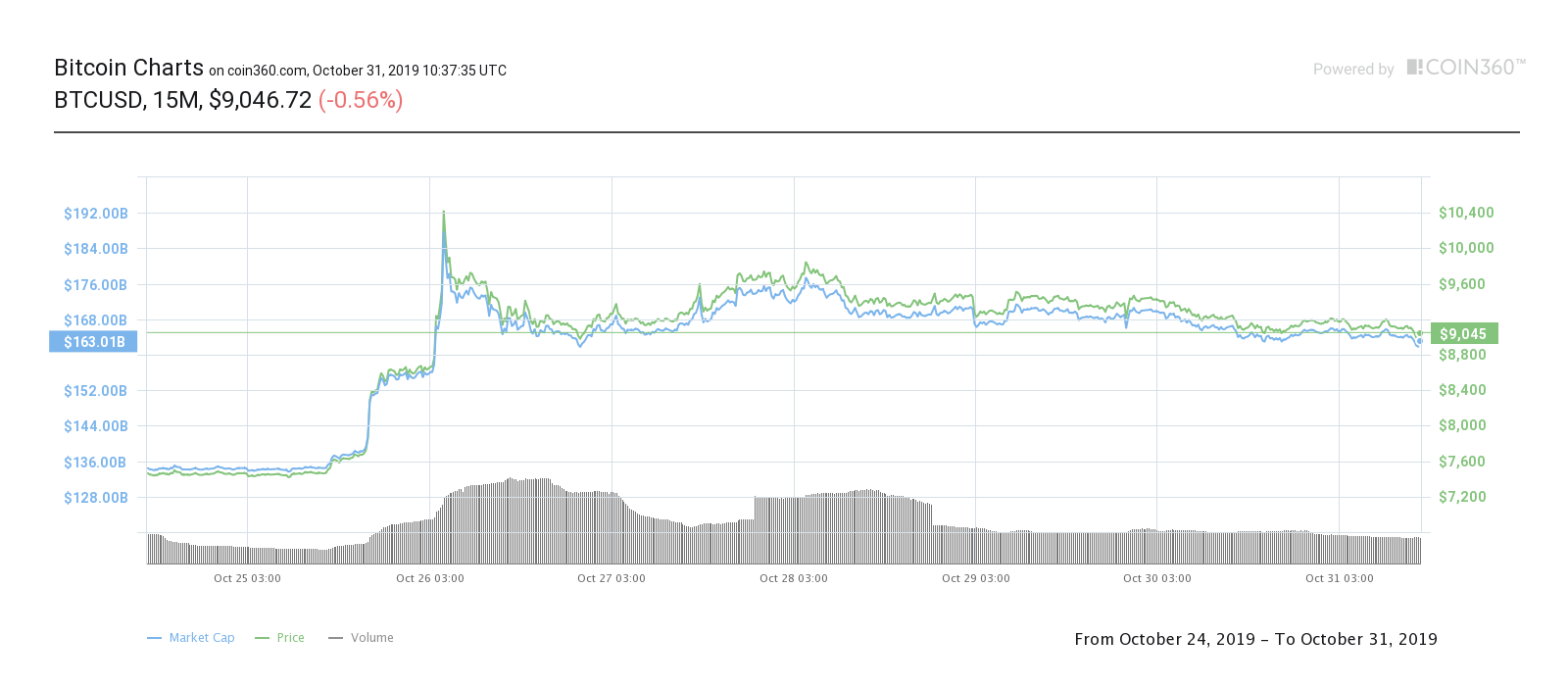

Data from Coin360 showed BTC/USD dipping below the $9,000 mark in Thursday trading — a level that has acted as support since last weekend.

At press time, the largest cryptocurrency was circling $9,050, having bounced off a local low of $8,960.

BTC broke support after three days of slow grind down from an area closer to $10,000. 24-hour losses currently total 2%, while compared to a week ago, Bitcoin is still up more than 20%.

Bitcoin seven-day price chart. Source: Coin360

Now, traders were eyeing the coming days potentially delivering lower prices in a consolidatory period to even out the recent volatility.

“Something like this,” regular CryptoX contributor filbfilb told subscribers of his Telegram trading channel on Thursday, forecasting a dip to just below $8,200.

Fellow contributor Michaël van der Poppe was more upbeat, arguing that a drop to the mid-$8,000s would not constitute a bearish signal. The influential 200-day moving average (MA) price was still in play.

“Still hanging on the 200-Day MA. Even a retest of $8,600 or $8,800 wouldn’t be bearish after a $3,000 candle. Stuck in this trend, but overall ranging it is,” he summarized on Twitter.

As CryptoX reported, Thursday marked the eleventh anniversary of the publication of the Bitcoin whitepaper. On its tenth birthday, BTC/USD traded at $6,600.

Altcoins continue downward trend

Altcoin markets saw largely negative performance on the day. Out of the top twenty tokens by market cap, most fell by around 3%.

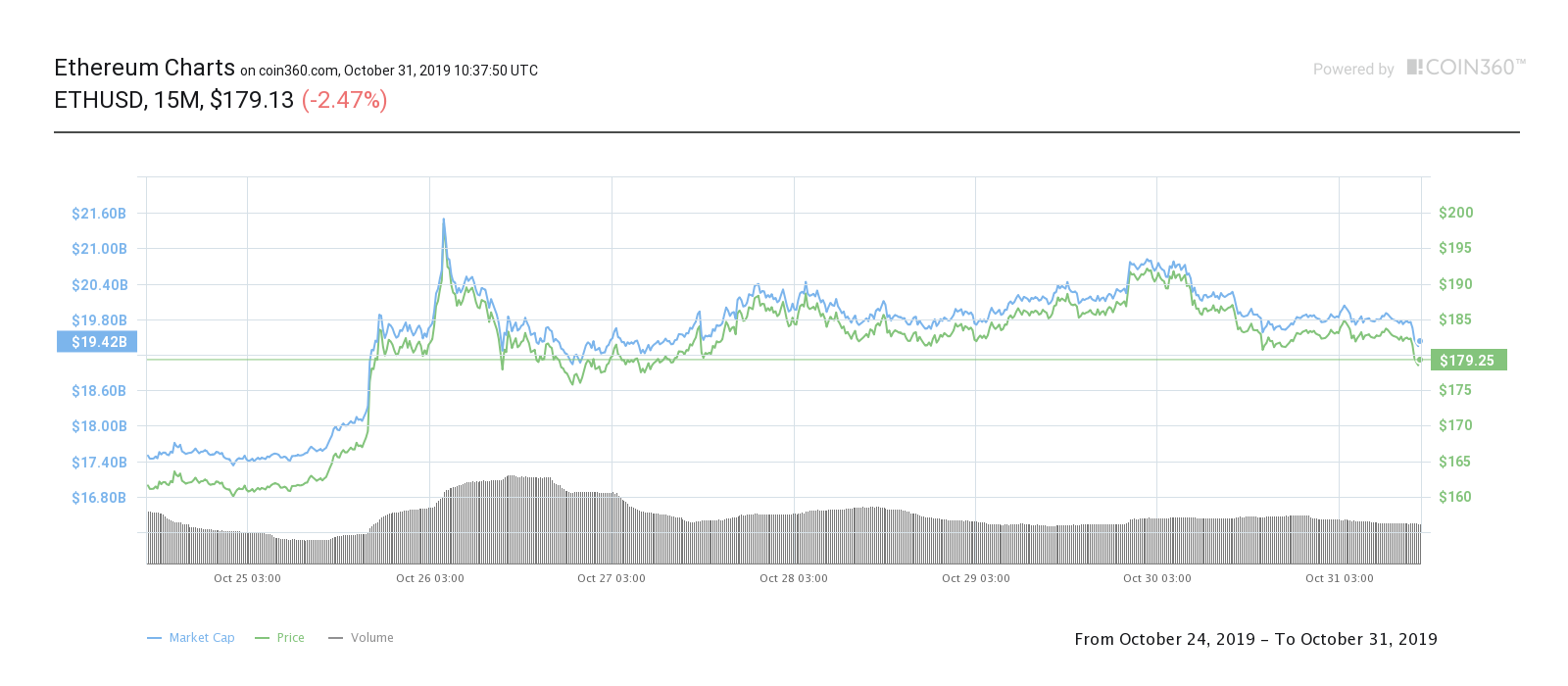

Ether (ETH), the largest altcoin, shaved 2.5% off its price to fall below $180.

Ether seven-day price chart. Source: Coin360

Faring worst was Bitcoin SV (BSV), which lost 6% after previously making above-average gains.

The overall cryptocurrency market cap was $241 billion at press time, with Bitcoin’s share at 67.5%.