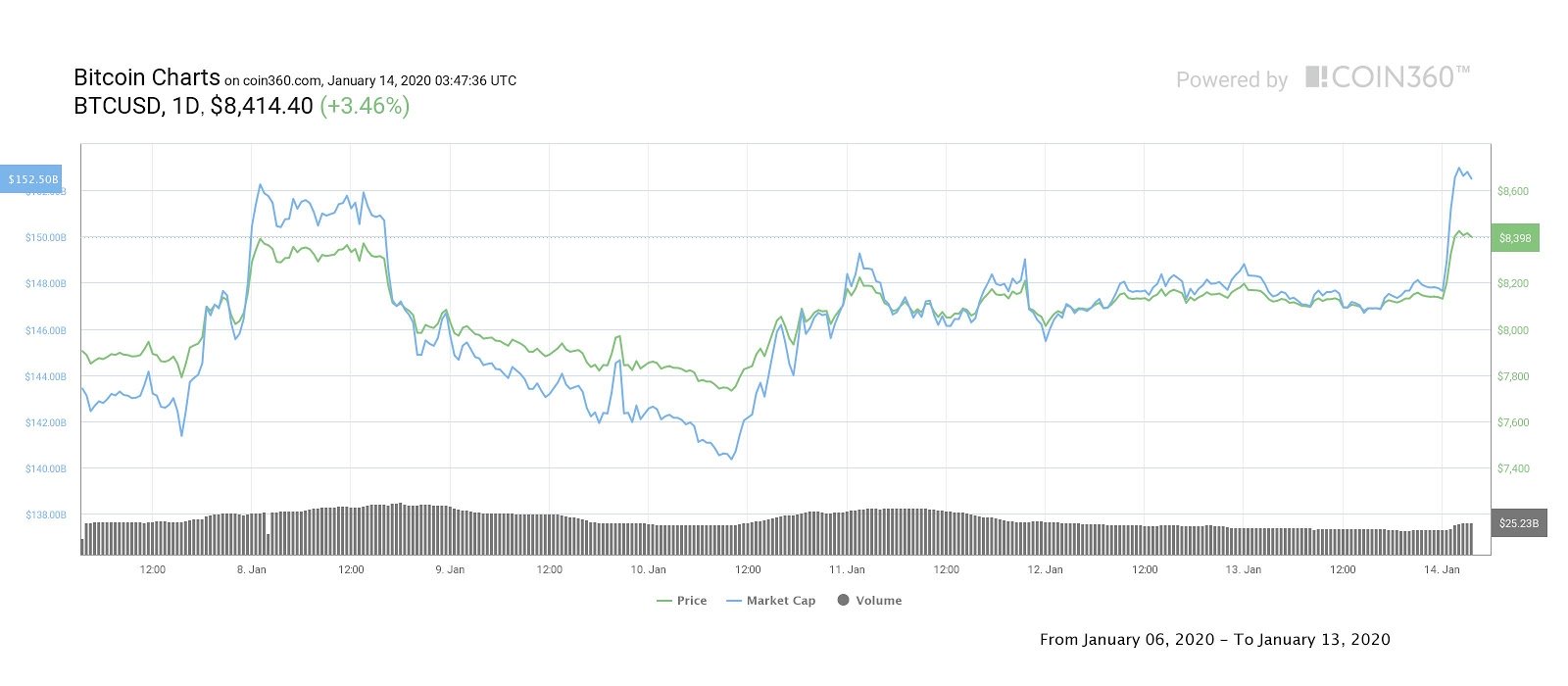

Bitcoin (BTC) price has at last crossed above the $8,300 resistance, setting the digital asset up for a run at $8,500 and restoring bullish momentum to the current uptrend which has seen the price rise from $7,655 to $8,536 over the past week.

Cryptocurrency market weekly overview. Source: Coin360

For the second time in a week, the price rose above the oft-referenced descending channel trendline which has served as a long term resistance for the last 7 months. While there are some traders who will have bought the breakout above resistance, cautious traders will closely watch the 4-hour close to see if the digital asset sustains above the trendline as previous price action shows Bitcoin repeatedly unable to hold above this level.

BTC USD daily chart. Source: TradingView

At the time of writing, Bitcoin continues to push higher, setting a daily higher high for the first time since the Jan. 8 run up to $8,464 and clearing the $8,500 resistance level. Earlier in the day, CryptoX contributor filbfilb suggested that:

“Bitcoin price is currently consolidating above resistance and the most significant volume node on the visible profile visible range, or VPVR. If Bitcoin can complete bullish consolidation above $8,000, a measured move to the upside would take the price of Bitcoin to the top of the previous range at $9,500 and possibly as high as the next high volume node of $10,100.”

Currently, Bitcoin price is above the 200-day moving average and the most recent price action suggests that $8,000 will function as strong support. Traders will now observe to see whether $8,300 will flip from resistance to support.

Bitcoin weekly price chart. Source: Coin360

The overall cryptocurrency market cap now stands at $223.8 billion and Bitcoin’s dominance rate is at 68.1%. Notable altcoins that moved alongside Bitcoin’s price increase were Bitcoin SV (BSV) with a surprising 22.87% gain, Bitcoin Cash (BCH) with a 6.46% gain, Litecoin (LTC) at 6.46% and Dash (DASH) which surprised investors by continuing last weekend’s rally to gain 14.32%.