The crypto markets are experiencing a small relief rally during the week, as the price of Bitcoin (BTC) bounced from $8,400 towards $9,150.

This bounce was heavily needed after a massive red candle the week before. However, is the upward momentum back in the fields? Or is it just a dead cat bounce before more downside?

Crypto market daily performance. Source: Coin360

Bitcoin breaks back above $9,000, but can’t break $9,150 resistance

During the week, Bitcoin has seen a breakthrough in the $9,000 level, which is currently providing support for the markets.

However, given that the price of Bitcoin lost the $9,400-9,600 support area, means there’s a substantial amount of resistance lying above us to break through.

BTC USDT 1-day chart. Source: TradingView

The daily timeframe shows that the $8,200-8,500 area managed to hold for support, after which price jumped to the current price of $9,100. The daily candle of yesterday closed above $9,050, as that level is regained for support. A critical level to hold right now, as it can warrant continuation towards $9,300-9,400 as the next major pivot.

For a continuation and bullish perspective, the price of Bitcoin needs to break back above $9,300-9,400 and preferably $9,600. If either of these levels becomes resistance then the levels are tested as a bearish retest and downwards tests are evident to occur.

If a bearish retest occurs, the primary support zones are found at $8,200 and possibly $7,500.

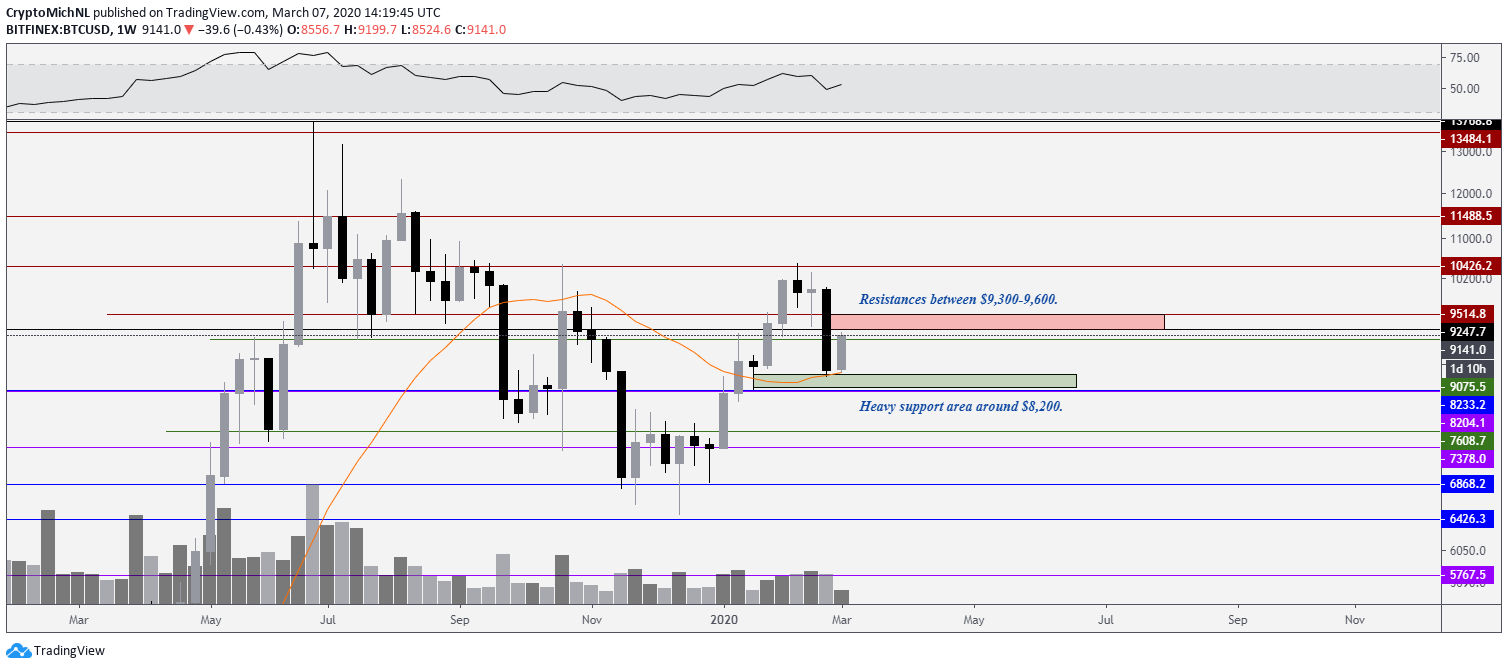

Weekly holds the 21-MA for support

BTC USDT 1-week chart. Source: TradingView

The weekly chart of Bitcoin is showing that the 21-week Moving Average (MA) is currently holding the price of Bitcoin. That’s essential since the moving average served as support through the previous bull cycle of 2015-2017. Hence, it’s a significant indicator for traders for bullish and bearish momentum confirmation.

However, as discussed in the previous section, the resistances are found between $9,300-$9,600 and are essential to break to sustain further upwards momentum.

The supports are found at the 21-week MA and further around $8,200 as there’s a monthly and weekly level lying there. Losing the $8,200 level regularly gives a continuation towards the $7,400-7,600 area.

Bitcoin stuck in a range on the smaller time frames

BTC USDT 2-hour chart. Source: TradingView

The 2-hour chart of Bitcoin is showing clear range-bound movements in the past few days. The price of Bitcoin has found resistance at $9,150-9,180 and found support between $8,950-8,980.

Another support level is found at $8,900-8,920. As long as that level remains support, a continuation upwards and test of the $9,300-9,400 is on the table.

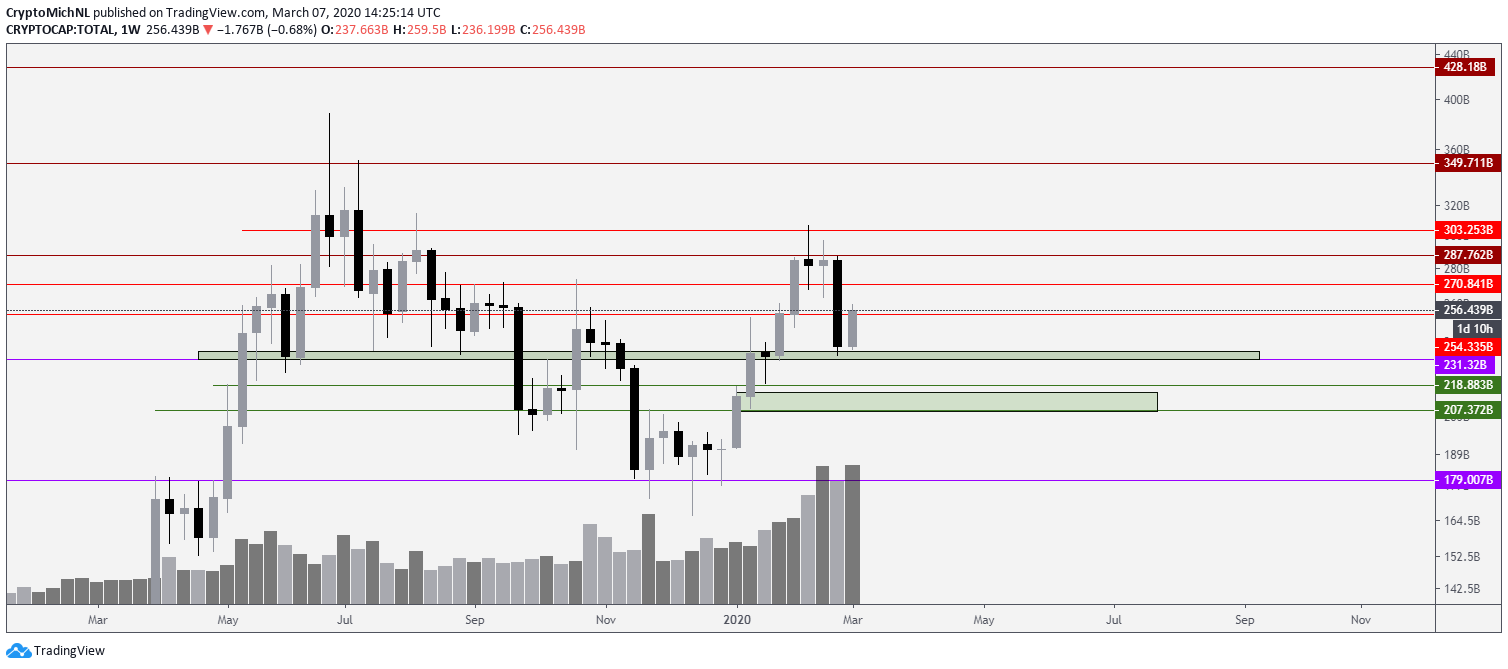

Total market capitalization holds $230 billion level

Total market capitalization cryptocurrency 1-week chart. Source: TradingView

The total market capitalization chart of cryptocurrency is showing a strong bounce from the $230 billion level. However, the weekly candle before shows a sharp selloff, indicating that some more things need to occur to maintain a bullish outlook.

One of them is reclaiming old support levels. Therefore, the weekly candle should close above $252-254 billion. If the total market capitalization closes above it, it’s likely to see continuation towards the next levels around $270 and $280 billion.

Total market capitalization cryptocurrency 1-day chart. Source: TradingView

The daily chart of the total market capitalization is showing an apparent breakthrough in the $252-254 billion levels. As long as that level remains support, the path towards $270-271 billion is open, which is pretty similar to the $9,300-9,400 area of Bitcoin.

However, a retest of the $230 billion levels is not out of the woods. The bounce up doesn’t show much strength at this point. Losing the $252-254 billion level opens up the possibility of another retest of $230 billion.

4 key levels to watch for: bullish

BTC USDT 4-hour bullish scenario. Source: TradingView

The bullish scenario is pretty straightforward for Bitcoin. The price of Bitcoin needs to hold $8,920 and preferably $9,000 as support, through which the upper resistances should be tested.

The resistances are shown at $9,300-9,400 and $9,600 (the last one is a weekly level). To be fully bullish, I’d want to see an apparent breakthrough of the $9,600 level with a high amount of volume.

The moment that the $9,400 or $9,600 level turns support, continuation towards $10,400 is the next step to go for and probably new highs. However, if these levels can’t be broken upwards, they’ll be confirmed as a bearish retest, and then lower support tests are needed.

The bearish scenario for Bitcoin

BTC USDT 4-hour bearish scenario. Source: TradingView

The bearish scenario is also straightforward. The first scenario is a massive rejection and bearish retest at the $9,300-9,400 area (could be having a wick towards $9,600), after which the price drops down.

In case of such rejection, it’s likely to expect retests of the $8,200-8,400 to occur. Such a move would cause the markets to drop down further. An example would be a drop of Ethereum (ETH) from $250 towards $195 for some more support tests.

Another bearish scenario is whether Bitcoin can’t break above $9,150 and immediately loses the $8,920 area. Losing that zone and we’ll see momentum and $8,200 retest downwards as the primary possible outcome.

Does that look bad for the macro perspective? Not at all. The market has seen a big rally in the first weeks of this year, a retracement and correction are only healthy for a sustainable continuation of the market.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CryptoX. Every investment and trading move involves risk. You should conduct your own research when making a decision.