Bitcoin (BTC) mining companies are employing derisking strategies by offloading BTC to exchanges, according to a market report from Bitfinex.

The cryptocurrency trading platform’s latest newsletter addresses the Bitcoin mining sector at length, highlighting a recent surge in miners selling large volumes of BTC to exchanges. This has led to a corresponding increase in the value of shares in Bitcoin mining companies as institutional interest in BTC picks up in 2023.

The report notes that Poolin has accounted for the highest amount of BTC sold to the market in recent weeks. Bitfinex analysts also note that the Bitcoin mining difficulty recently hit an all-time high, which it labels as an indicator of “robustness and miner confidence.“ The report states:

“Miners are clearly bullish on Bitcoin as they commit more resources to mining, hence triggering the mining difficulty, but they are hedging their position, hence the despatch of more Bitcoin to exchanges.“

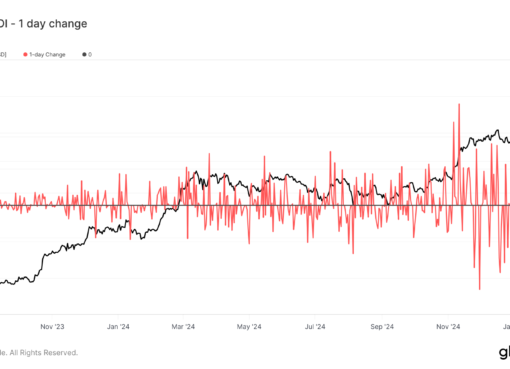

The report goes on to suggest that miners are hedging positions on derivatives exchanges, with 70,000 BTC in 30-day cumulative volume transferred in the first week of July 2023.

Related: Bitcoin miners raked $184M in fees in Q2, surpassing all of 2022

While miners historically transfer BTC to exchanges using derivatives as a hedge for large spot positions, the report labels the high volumes as uncharacteristic:

“A transfer to exchanges on this scale is extremely rare and potentially showcases new miner behaviour.”

Bitfinex also cited data from Glassnode indicating that Poolin has been responsible for a large portion of this activity, with the mining pool offloading BTC to Binance.

The analysts note that several plausible reasons could be behind recent mining behavior. This could include hedging activities in the derivatives market, carrying out over-the-counter orders or transferring funds through exchanges for other reasons.

The increase in mining difficulty also indicates new mining power being added to the Bitcoin network. Analysts suggest that this is seen as a sign of increased network health, as well as increased confidence in the profitability of mining, either by increased BTC prices or improved hardware.

“Thus, miners are at a peculiar situation where they are rapidly increasing their mining potential as the Bitcoin halving inches closer whilst simultaneously hedging their exposure to an extent which is higher and more cautious than previous cycles.”

The report also suggests that on-chain Bitcoin movements reflect a transfer of supply from long-term holders to short-term holders. This investor behavior is said to be commonly seen in bull market conditions, as new market traders look for quick profits while long-term holders capitalize on increased prices.

Cointelegraph has reached out to a handful of mining companies and pools to ascertain why Bitcoin outflows from miners have increased over the past month. As recently reported, miners sent over $128 million in revenue to exchanges at the end of June 2023.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises