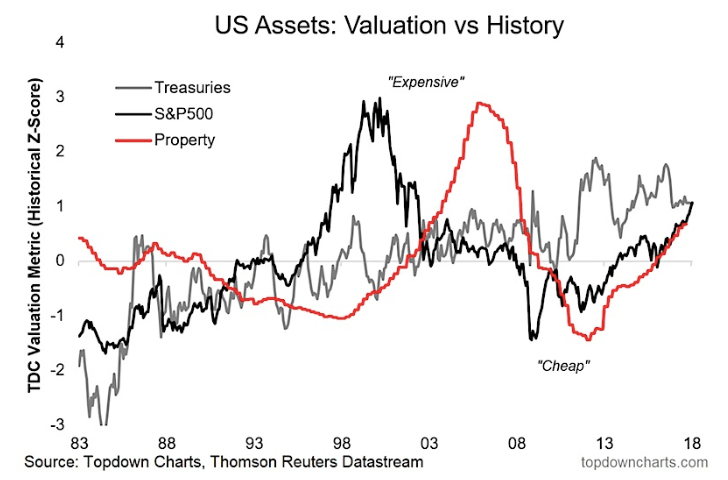

The U.S.-China trade war, the Hong Kong protests, and now the attack on Saudi Arabian oil producer Aramco – these events add more pressure to financial and commodity markets that already look overextended; stocks are trading close to all-time highs. On top of that, central banks are slashing interest rates and printing money while the real-estate market is still overpriced.

If you’re an everyday investor, it appears that your options to protect your wealth are becoming limited. The good news is that there’s an asset that you can use as a hedge. Best of all, this asset is not correlated with other traditional markets.

Bitcoin’s Price Movements Are Uncorrelated With Other Assets

The value of stocks, bonds, and other asset classes is tied to factors such as GDP, earnings, and interest rates. Bitcoin, on the other hand, appears to be dancing to its own tune. Bitcoin is dubbed by many as the “new gold.” However, the dominant cryptocurrency is not correlated with any asset, especially gold.

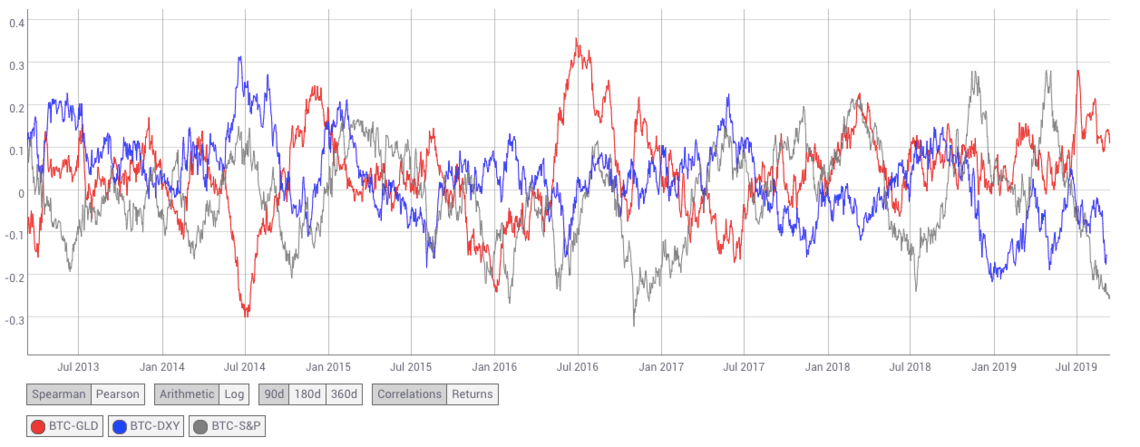

A look at the Spearman correlation chart reveals that overall, the No. 1 cryptocurrency has no correlation with other assets such as gold, stocks, and even the U.S. dollar.

There were stretches when gold appeared to be moderately correlated with bitcoin. This relationship appears to be a deviation rather than the norm. On the other hand, there were also moments when stocks appeared to have a moderate inverse correlation with bitcoin. Here again, these periods seem to be out of the ordinary.

In addition, a recent study used a quantile-on-quantile regression approach to examine the relationship between the king of cryptocurrencies and oil. The study concluded that bitcoin serves as a hedge and a diversifier against oil price movements.

Therefore, these findings suggest that bitcoin appears to be an ideal hedge – especially in a global environment that’s charged with geopolitical risks. The stock market, the U.S. dollar, gold, and oil may go up or down and bitcoin would still continue appreciating considering that it is in a bull market.

People Are Already Using It as a Hedge

With instabilities gripping various countries, many are already looking at bitcoin to protect their wealth. Clem Chambers, CEO of ADVFN and Online Blockchain plc, spoke exclusively to CCN.

He said,

“Bitcoin is the new gold and as such it is used as ‘flight capital’- an asset which can be moved and stashed in times of trouble. These days there aren’t many objects you can use for this purpose; gold, for example, being difficult to buy, secure and move.”

The difficulties that gold presents as a store of value may be the reason why it is uncorrelated with bitcoin. In addition, the financial market website executive also stressed:

“The U.S./China trade war brings about conditions where flight capital is in demand because if it continues, in addition to all manner of instabilities, currency depreciation is highly likely. Rich Chinese cannot send their money abroad to stash in foreign currencies in foreign banks, but they can get access to bitcoin. This is almost as good as having U.S. dollars offshore.”

Lastly, Mr. Chambers affirms our findings that bitcoin serves as a hedge against geopolitical crises.

“Bitcoin is the axis of this year’s rally and it is driven by the U.S./China trade war, with the Iran situation and Hong Kong protests adding to the demand.”

With countries in turmoil and traditional assets offering limited upside, it appears that bitcoin may be a good way to protect your wealth.

Last modified (UTC): September 16, 2019 5:55 PM