Bitcoin (BTC) stayed higher on Oct. 2 after a “fantastic” break to the upside upended market sentiment.

Trader eyes $45,000 BTC price floor

Data from Cryptox Markets Pro and TradingView followed eerie calm on BTC/USD after Friday’s sudden upside volatility saw $3,000 added in an hour.

The classic “short squeeze” saw no significant pushback into the weekend, with Bitcoin preserving levels above the August close.

For Cryptox contributor Michaël van de Poppe, it was now a question of what form a consolidation period could take in the coming days.

“If we want to get any corrective move at all, I think you don’t want to see it go that far down,” he warned in a YouTube update Friday.

“I think the deepest you want to see it go is this level around $45,000.”

Van de Poppe nonetheless added that he favored bullish continuation as the conclusion to short-term price action rather than a deeper drop towards levels from earlier in the week.

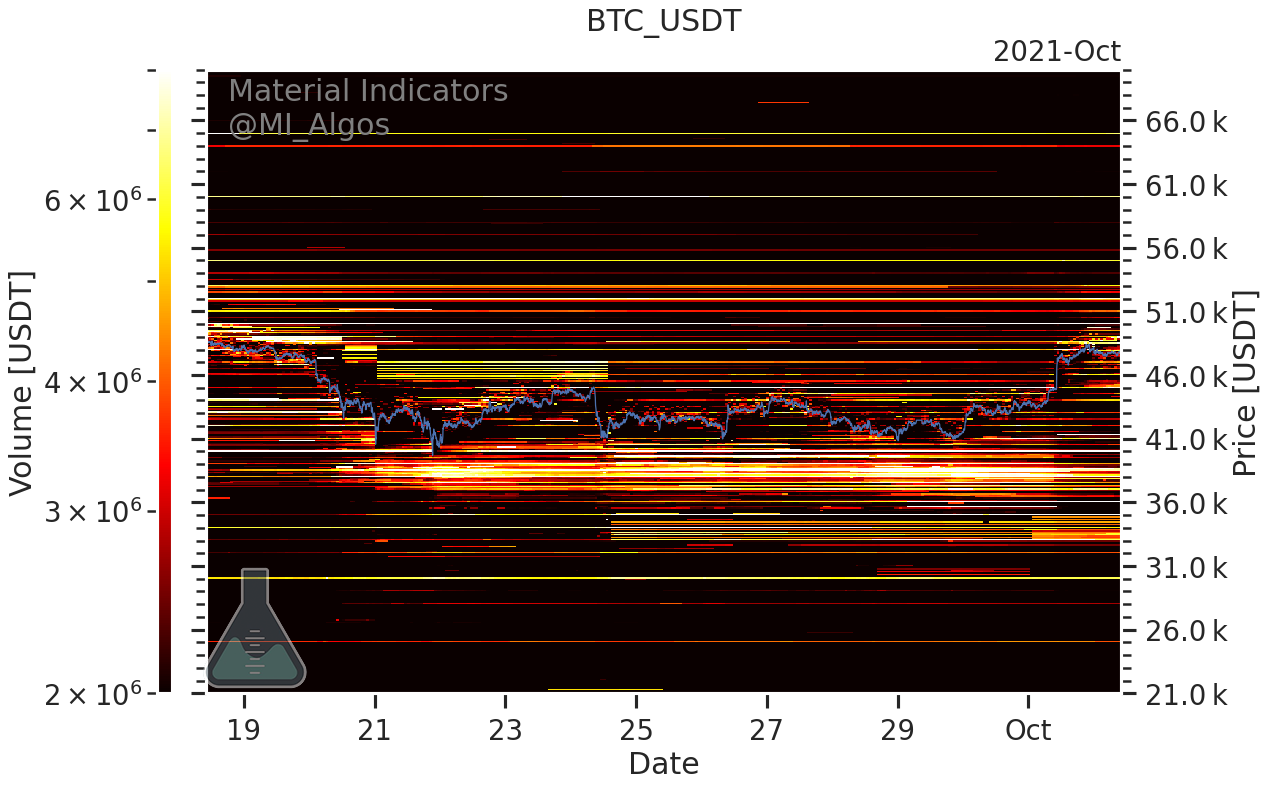

A look at buy and sell levels on major exchange Binance meanwhile revealed incremental resistance in place beginning at $48,000.

“Extreme fear precedes financial opportunity”

Equally optimistic was trader and analyst Rekt Capital, who noted that BTC/USD had been printing higher lows for four months, all of which had seen strong buyer support despite the price rising each time.

Related: ‘Say hi to Uptober’ — Bitcoin price surges above $47K in minutes, liquidating $270M in shorts

#BTC has been forming Monthly Higher Lows for 4 months straight now

Month to month, investors are becoming increasingly happy to be buying $BTC on retraces at higher and higher prices#Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 2, 2021

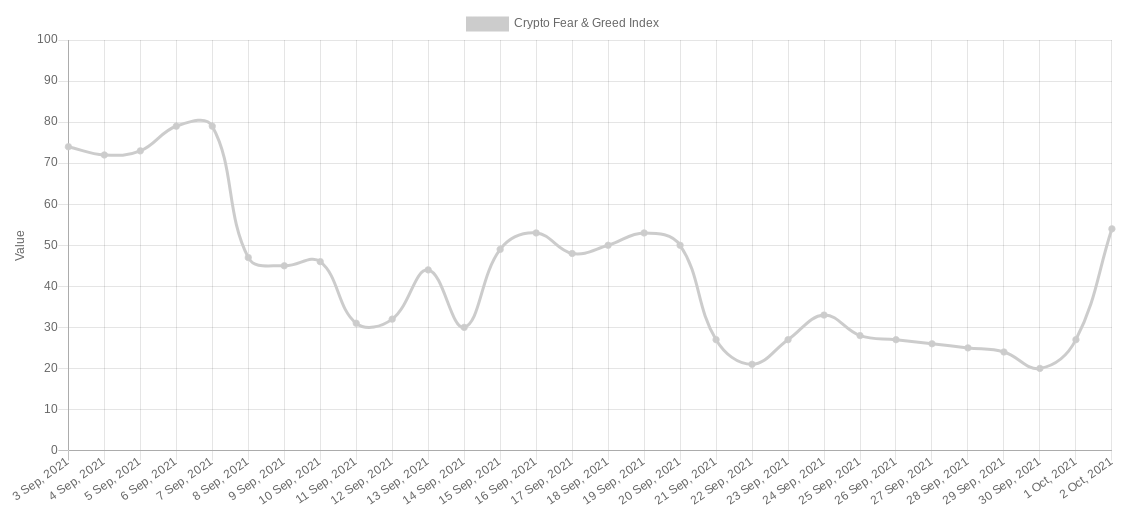

Referencing sentiment gauge the Crypto Fear & Greed Index, he noted that overall, fear had once more left the market thanks to Friday’s price action.

“Following BTC’s fantastic breakout move yesterday… Investors are no longer fearful towards Bitcoin,” he summarized.

“Extreme Fear precedes financial opportunity.”

Fear & Greed was languishing in its “extreme fear” zone as recently as Thursday, its score since increasing from 20/100 to current levels of 54/100, described as “neutral” for sentiment.