Bitcoin (BTC) touched $40,370 on July 26 as a solid day of gains saw the return of a major price milestone.

BTC price daily gains near 20%

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD touching $40,400 before consolidating nearby later on Monday.

The pair had held on to previous gains from the night before throughout the day, circling $38,000 before another surge took hold after the Wall St. open.

Amid some understandable excitement from investors who had waited for upside to finally resume, Cointelegraph contributor Michaël van de Poppe cautioned on being overly bullish at current levels.

“Bitcoin still showing strength, although sentiment is getting euphoric again while approaching the range resistance,” he wrote just before $40,000 hit.

“The trend has shifted, as the market has created a higher high. I think we’re still looking at an HL at $34.5-36K in the coming weeks unless breaking $41K.”

That would mark an exit from a long-established trading range which has been in place for over two months.

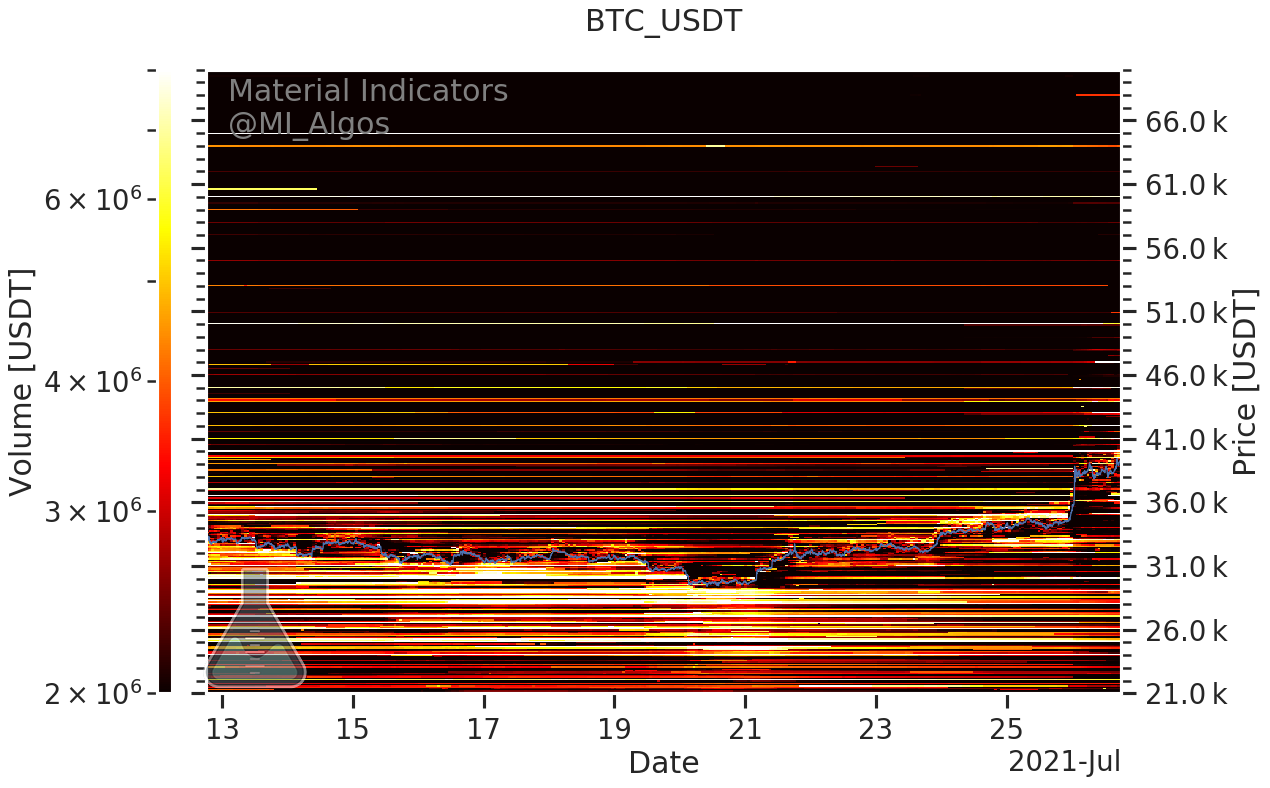

A look at support and resistance levels on major exchange Binance at the time of writing showed relatively little buyer activity above $36,000, with $41,000 still in place for sellers.

Material Indicators, which provides the Binance data, added that moving averages were important to consider when attempting to understand current movements.

Support at the 50 DMA, 200 DMA and 21 WMA are key levels that that failed as #BTC dropped from it’s ATH. Trend Precognition forecasted this uptick and Bulls reclaimed the 50 DMA. Now eyeing overhead liquidity at 40k. If they can take it, expect more resistance at the 200 DMA pic.twitter.com/r131CZWgtv

— Material Indicators (@MI_Algos) July 26, 2021

“Quiet” on-chain activity may dampen bulls

While Monday’s gains were impressive, Van de Poppe was not alone in calling for a pragmatic appraisal of the Bitcoin market at large.

Related: BTC price burns bears en route to $40K: 5 things to watch in Bitcoin this week

In the latest edition of its weekly newsletter, “The Week On-chain,” data analytics firm Glassnode likewise highlighted the need for on-chain activity to catch up with price performance in order to sustain the market.

“Overall, on-chain activity remains somewhat bearish and continues to be quiet,” analysts wrote.

“Perhaps utilisation of the Bitcoin network is lagging prices in this case. Ideally, renewed volatility and constructive price action sparks back demand for block-space. If not, it may suggest a more cautious framework is necessary in the weeks ahead.”

The last time that Bitcoin interacted with the $40,000 mark was during a brief revisit from lower levels in mid June.