Bitcoin (BTC) is facing a “bottoming candle” in 2023, but BTC price action is still more than able to surprise the market.

In a tweet on Jan. 11, popular trader and analyst Rekt Capital predicted that BTC/USD could see “decent upside” this year.

Chart teases serious Bitcoin upside potential

Analyzing Bitcoin’s four-year market cycles around block subsidy halving events, Rekt Capital drew attention to 2023 being the deadline for its next “bottoming candle.”

With the next halving due in 2024, the coming 12 months should see a price floor, followed by a rally as the event draws nearer.

2024 thus forms the fourth candle in Bitcoin’s current cycle, and 2023 the third.

“Candle 3 is a Bottoming Candle in the BTC Four Year Cycle. But it can still generate decent upside,” Rekt Capital commented.

The scope for Bitcoin to take traders by surprise is clearly visible in the four-year cycle chart.

“Candle 3 in 2015 saw a +234% move. Candle 3 in 2019 saw a +316% rally,” he continued.

“Candle 3 in 2023 may see stronger upside than most think.”

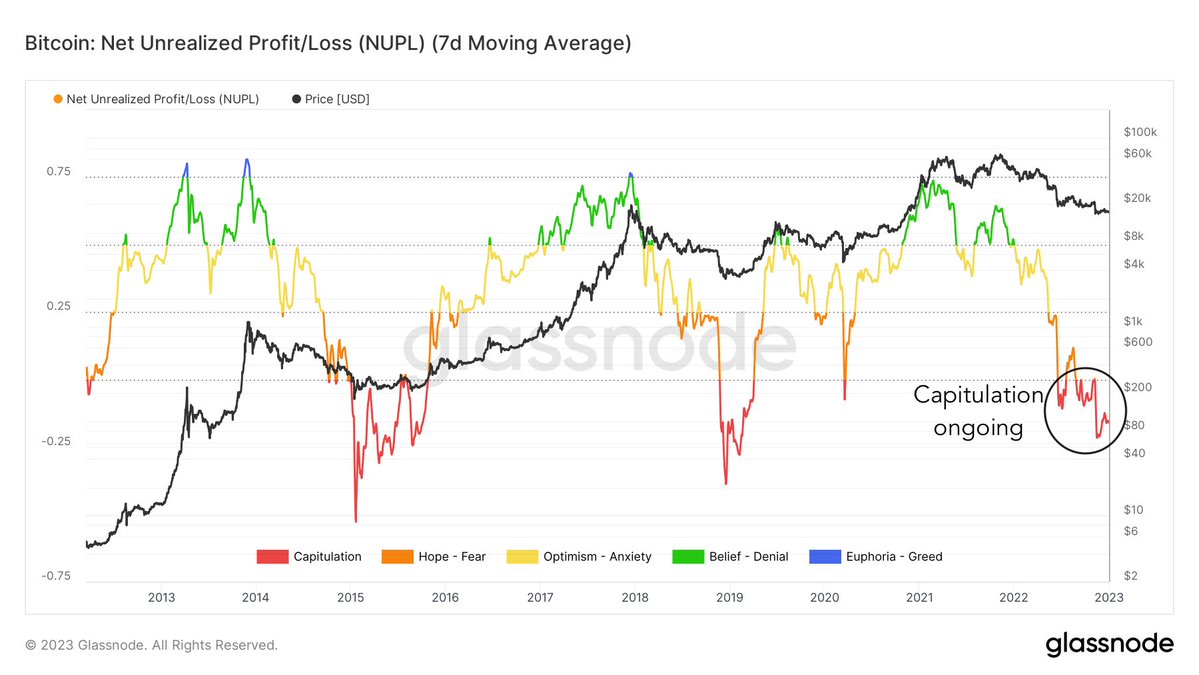

Certain other on-chain observations have led market participants to similarly optimistic conclusions.

Among them, the ratio of unrealized losses held by BTC hodlers continues to eke out a “capitulation” phase, according to a dedicated indicator monitoring the status quo.

“These have been the most profitable times to accumulate Bitcoin. The net unrealized profit/loss is still in deep capitulation terrority,” trading and analytics account Game of Trades wrote on Twitter on Jan. 11.

2023 macro climate echoes GFC, warns analyst

Given the current macroeconomic environment, however, rising from the ashes may demand considerable luck when it comes to suppressed crypto asset prices.

Related: BTC price 3-week highs greet US CPI — 5 things to know in Bitcoin this week

With the United States Federal Reserve still raising interest rates as inflation abates, concerns now focus on long-term policy implications.

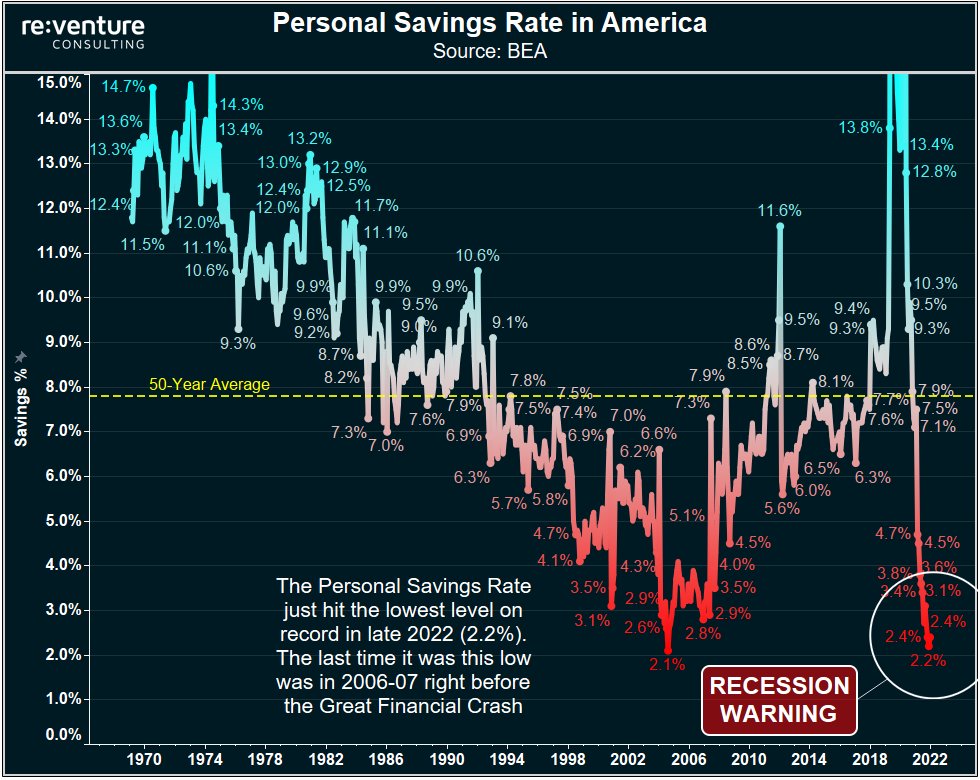

What could afflict sentiment next, analysts including Reventure Consulting founder and CEO Nick Gerli say, is not inflation but deflation.

Commenting on a chart of U.S. savings trends, Gerli warned on Jan. 10 that conditions were ripe for a repeat of the 2008 Global Financial Crisis (GFC) in terms of recession.

“The Savings Rate just collapsed down to 2.2%, the lowest level ever,” he revealed.

“Means Americans are running out of money. Last time it was this low was 2006-07. Right before GFC. Major Recession Warning. Expect a big decline in consumer spending in 2023.”

Jan. 12 will see the first U.S. Consumer Price Index (data release of 2023, and bets are already in as to how Bitcoin will react.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cryptox.