On-chain data shows the Bitcoin miners have participated in a 3,000 BTC selloff recently, something that may explain the asset’s latest pullback.

Bitcoin Miner Reserve Has Taken A Plunge Recently

As pointed out by analyst Ali in a new post on X, the BTC miners have participated in some selling recently. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin sitting in the wallets of all miners.

When the value of this metric goes up, it means that the miners are receiving a net number of coins in their addresses right now. Such a trend suggests that these chain validators are choosing to accumulate the asset currently, which can naturally have bullish effects on the price.

On the other hand, a decline implies that this cohort is transferring coins out of their wallets at the moment. Generally, the miners make such outflows when they are looking to sell their BTC, so this kind of trend can have bearish implications for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past month:

The value of the metric seems to have sharply dropped in recent days | Source: @ali_charts on X

As displayed in the above graph, the Bitcoin miner reserve has registered a sharp drop during the past couple of days. During this withdrawal spree, these chain validators transferred out more than 3,000 BTC from their wallets, worth around $128 million at the current exchange rate.

Bitcoin had recovered to the $43,800 level earlier after news had come out about Microstrategy completing another substantial purchase. As the miners made these outflows, though, the cryptocurrency witnessed a drawdown towards the $42,000 mark.

Given the timing, it would appear possible that the miners had made these transfers to cash in on the recovery and this extra selling pressure may have contributed to the decline that the asset ended up seeing.

Miners are a group that has to pay constant operating costs in the form of electricity bills, so they regularly sell some of the BTC they mine and earn from transaction fees in order to cover these expenses.

More often not, though, the miners only participate in relatively low levels of selling, which is readily absorbed by the market and the cryptocurrency doesn’t feel too much impact

This time around, though, these chain validators have sold a sizeable amount inside a narrow window, which is potentially why Bitcoin has appeared to have been affected.

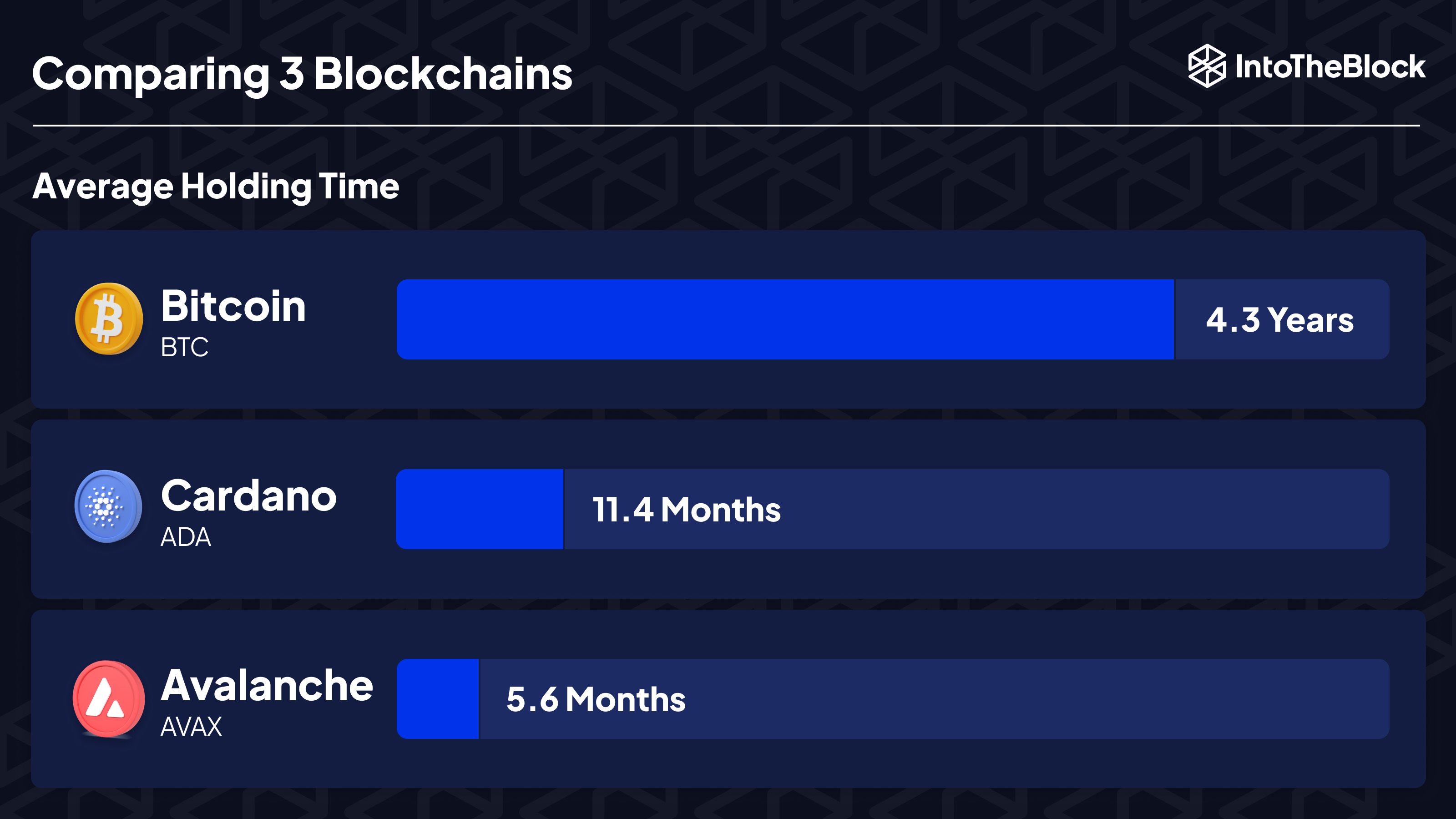

In some other news, the market intelligence platform IntoTheBlock has revealed the average holding time on the Bitcoin blockchain and how it compares against other networks.

The average holding time across three networks | Source: IntoTheBlock on X

As is visible above, Bitcoin holders carry their coins for 4.3 years on average, which is far greater than what Cardano (ADA) and Avalanche (AVAX) blockchains observe.

While miners don’t tend to HODL because of their running costs, it would appear that the normal investors on the BTC network are more than making up for it by holding for very extended periods.

BTC Price

The market doesn’t seem to be too discouraged after the drop due to the selling pressure from the miners, as Bitcoin is now once again making a recovery push. So far, BTC has climbed back to the $42,900 level.

Looks like BTC has been overall moving sideways recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com, IntoTheBlock.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.