Bitcoin (BTC) slid below $29,000 around the May 4 Wall Street open as United States equities showed jitters over the resurgent banking crisis.

“Too much all at once” for U.S. banks

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD losing ground as the S&P 500 shed 0.7%.

The risk asset comedown accompanied more mayhem for U.S. regional bank stocks, withe PacWest Bancorp once again leading the way, falling over 50% on the day.

The embattled lender had already seen major losses, and at the time of writing was down 86.5% year-to-date. In a statement, the bank nonetheless described its position as “solid.”

As Cointelegraph reported, reassurances of U.S. authorities over the banking system stability appeared at odds with reality for many commentators, with confusion only increasing as the crisis continued.

Within the last 24 hours:

1. PacWest Bank, $PACW, explores potential sale

2. Western Alliance Bank, $WAL, explores potential sale

3. First Horizon Bank, $FHN, cancels merger with TD Bank due to “regulatory concerns”

4. Fed says “banking system is sound”

5. No comment from…

— The Kobeissi Letter (@KobeissiLetter) May 4, 2023

“For the first time in weeks, equity markets are responding to the banking crisis,” financial commentary resource, The Kobeissi Letter, wrote in part of Twitter coverage.

Kobeissi argued that the latest Federal Reserve interest rate hike, confirmed as 0.25% on May 3, had added fuel to the fire.

“Perhaps this is the equity market worrying that the crisis may not isolated,” it continued.

“The Fed rate hike is only making things worse.”

In addition to PacWest, First Horizon and Western Alliance were two more major losers on the day, down 53% and 38%, respectively.

“Confidence in a financial institution is built over decades and destroyed in days,” Bill Ackman, CEO of hedge fund management firm Pershing Square, continued in his own response.

“As each domino falls, the next weakest bank begins to wobble. Until investors are rewarded for betting on a wobbling bank, there will be no bid, and the best sale is the last price. We are running out of time to fix this problem.”

In a dedicated blog post on the crisis, meanwhile, Marty Bent, founder of crypto media firm TFTC, described it as a point of no return.

“Everywhere one looks things look absolutely terrible for the US financial system. This feels like the endgame,” he warned on May 3.

“I find it hard to believe there is anything that can be done to restore confidence in the system. No amount of backstopping, money printing, buybacks, consolidation, or World Wars will be able to put this genie back in the bottle. The Fed and the Treasury will try their hardest to make the public believe otherwise, but this is simply too much all at once.”

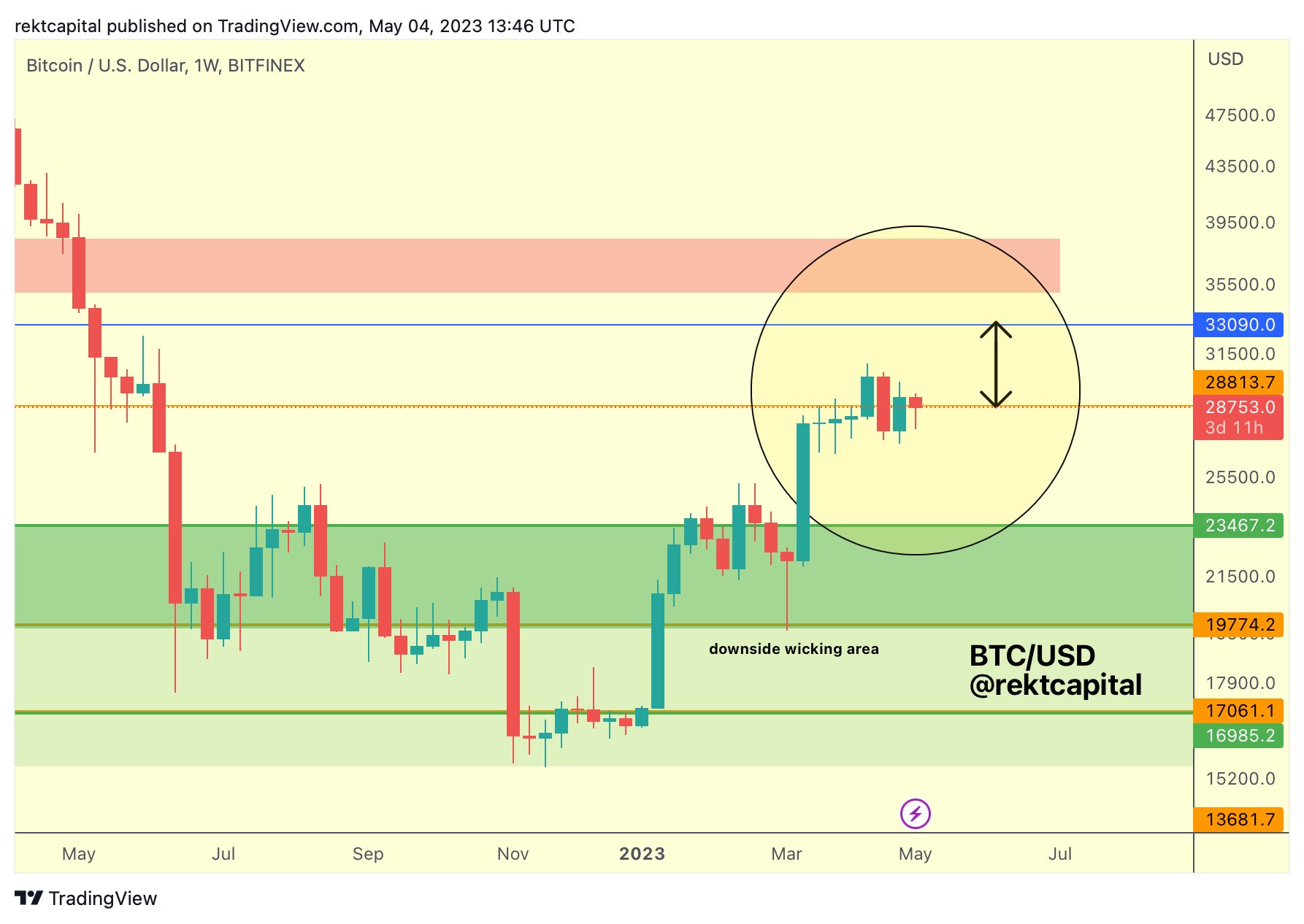

Weekly chart underscores $28,800 BTC price significance

Turning to Bitcoin, BTC/USD found itself in an area of low liquidity at the time of writing, with large-volume traders staying away.

Bitcoin miners have earned $50B from BTC block rewards, fees since 2010

Data from the Binance order book uploaded to Twitter by monitoring resource Material Indicators showed bid liquidity slowly increasing above $28,000.

If you are wondering why yellow is buying #BTC here and brown mega whales haven’t, it’s not likely retail vs smart money. It’s because liquidity between here and $29.1k is so thin that the slippage on a whale sized order would be significant so they are literally forced to make… pic.twitter.com/foZLhWeSuR

— Material Indicators (@MI_Algos) May 4, 2023

As various popular traders demanded higher levels return in order to provide a shot at $30,000 resistance, longer-time takes remained optimistic.

Popular trader and analyst, Rekt Capital, highlighted current spot price levels as the site of an important reclaim operation.

“Last week, BTC Weekly Closed above ~$28800. And this week, $BTC has done quite well to hold it as support, in large part due to the aggressive buying in recent days,” he explained about weekly timeframes.

“Reclaim of the $28800 level is technically in progress.”

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.