Bitcoin price has rebounded 10% after tumbling to a 50-day low of $38,500 on Jan. 23, as market data trends hint that investors are positioned for a bullish start to February.

Bitcoin (BTC) suffered bearish price action after the SEC delivered a spot ETF approval verdict on Jan. 11, as speculators capitalized on media euphoria to secure profits, sending BTC to a 50-day low of $38,500.

After fiercely defending the $39,000 support, bullish Bitcoin investors are now making strategic moves to stage a significant price rebound in February.

BTC open interest up by $350 million in last three days

Bitcoin ETFs have traded for two weeks, and the sell-the-news wave is cooling. Furthermore, Bitcoin’s resurgence above the $42,000 level appears to have restored confidence across both the spot and derivative markets.

Coinglass’ open interest data shows the nominal value of all active futures contracts for a specific cryptocurrency. The chart below shows that on Jan. 27, BTC’s open interest stood at $17.3 billion. But as of Jan. 29, it has increased to $17.7 billion. This marks an increase of over $350 million over the last three trading days.

A $350 million increase in open interest suggests a boost in investor confidence and market participation as BTC swiftly recovered from the $38,500 local bottom. While BTC price has consolidated within the $41,000 to $42,000 range, rising open interest indicates a potential price breakout in the days ahead.

Investors moved BTC worth $220 million into long-term storage

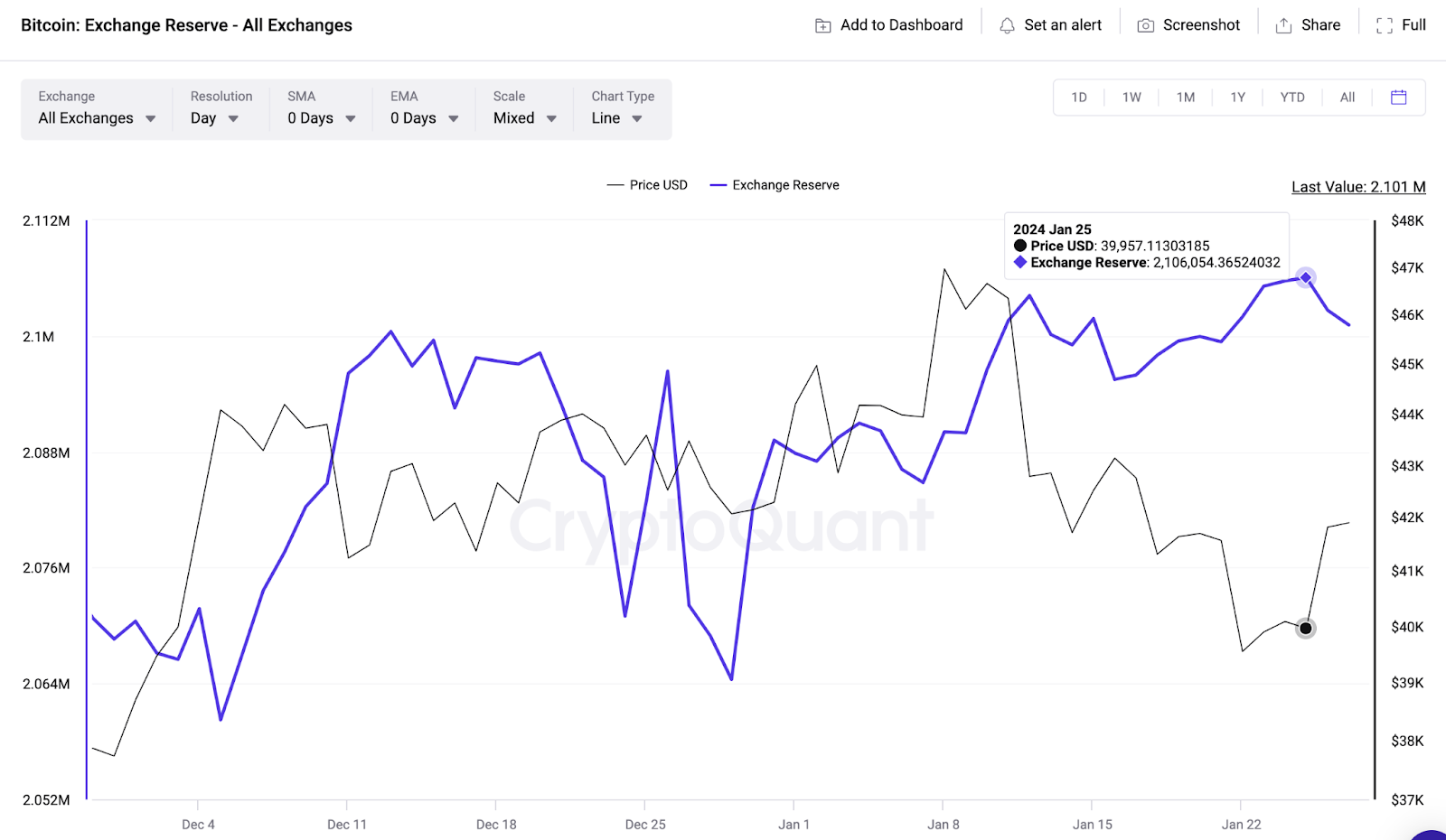

While Bitcoin investors in the derivatives markets increased their positions, spot market traders have also taken strategic bullish moves recently. CryptoQuant’s exchange supply data monitors real-time changes in the number of BTC coins deposited across trading platforms.

The most recent data indicates a substantial movement of BTC off exchanges since the rebound phase began on Jan. 25.

As illustrated below, the total BTC deposited in wallets hosted by crypto exchanges was just over 2,106,054 BTC on Jan 25. This figure has since decreased to 2,100,821 BTC as of the current press time on Jan. 29.

This suggests that investors have transferred 5,233 BTC into long-term savings within the last four trading days.

A decline in exchange supply means that investors are opting for long-term storage options rather than seeking short-term profit opportunities on trading platforms, and this could have a bullish impact on Bitcoin price.

With investors now opting for long-term storage, the selling pressure on Bitcoin is expected to decline significantly. Valued at the intraday average price of $42,000 on Jan. 29, the 5,233 BTC shifted from exchanges are worth approximately $220 million.

Such a large deficit in market supply, suggests that an increase in demand in the coming week could trigger a Bitcoin price breakout toward the $45,000 level.

Forecast: Can BTC price reach $45,000 in February?

Bitcoin price looks set to retest $45,000 in February. Market data trends show that selling pressure from the post-ETF approval euphoria has cooled and investors have recently shifted BTC worth $220 million into long-term storage.

The Bollinger Bands signal highlights the key reversal points that could impact Bitcoin price action in the days ahead.

The technical indicator depicts that the BTC price is now trading at $43,088, breaking above the 20-day simple moving average (SMA) price of $42,163. This rare market trend affirms that BTC’s short-term market momentum has flipped bullish.

As depicted below, the next major resistance is now at the upper Bollinger Band at $45,300

Still, the bears could invalidate this bullish narrative if they can force a reversal below $38,000. But as highlighted by the lower Bollinger Band above, the bulls will likely regroup at the $38,572 area to prevent further losses.