Quick take:

- Bitcoin took a nosedive from $11,600 to $10,460 levels in 6 hours

- BTC has lost several support zones on its way down

- Over $348 Million in Bitcoin contracts has been liquidated in the last 4 hours

- Bitcoin could well be on a path to fill a CME Gap at $9,700 set in July

The month of September has continued to bombard the price of Bitcoin (BTC). Earlier today, the King of Crypto fell hard from $11,600 levels to retest $10,460. This was a quick drop of approximately 9.8%. On its way down, Bitcoin has lost several crucial support zones including $11,600, $11,500, $11,200 and $11,000.

Over $348 Million in BTC Liquidations in the last 4 Hours

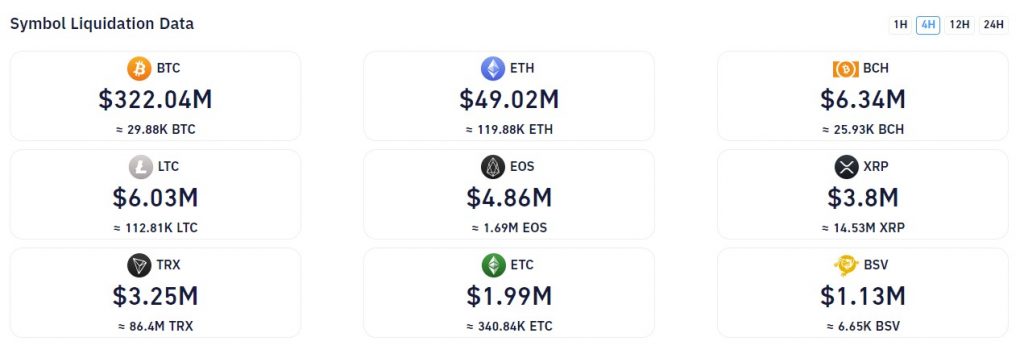

Due to Bitcoin’s downward trajectory, over $366 Million in Bitcoin trading positions has been liquidated in the last 24 hours. Of this amount, $322 million has occurred in the last four hours and in tandem with BTC retesting $10,460.

Below is a screenshot of liquidation data of the last 4 hours that also includes liquidated positions of other digital assets such as Ethereum (ETH), Litecoin (LTC), EOS and more.

Bitcoin (BTC) Could Be On a Path to Fill a CME Gap at $9,700

Bitcoin’s fast and furious drop below $11,000 has left many traders wondering whether the CME gap at $9,700, would finally get filled. The gap was set on the 27th of July and resulted in Bitcoin breaking the $10k ceiling, eventually breaking $11k and $12k

in the days that followed.

What the Bitcoin Chart Says

At the time of writing, Bitcoin’s price has slipped under the $10,800 support zone and is currently trading at $10,700. The 6-hour chart points towards a potential short term bounce that could have Bitcoin attempting to reclaim $11,200.

Reports of Bitcoin Miners Selling

However, Bitcoin’s short term future might not be an easy ride as new information points towards several miners moving unusually large amounts of Bitcoin to crypto exchanges. This activity began yesterday, September 2nd, and was captured by the team at Unfolded in the following tweet.

Miners are moving unusually large amounts of #Bitcoin since yesterday.

Poolin, Slush, HaoBTC have taken the bitcoins out of the mining wallets and sent some to the exchange.

via @cryptoquant_com pic.twitter.com/dXRir7kcdF

— Unfolded (@cryptounfolded) September 3, 2020

Therefore, Bitcoin could be in for a rough few hours and/or days as the mentioned miners offload their BTC. Once this is complete, Bitcoin might have some room to breathe and possibly still maintain the $10,000 psychological price zone.