Bitcoin briefly climbed above $16,000 for the first time in three years before quickly falling back below the psychological threshold.

Digital-asset market traders and analysts say the cryptocurrency is likely to make another run higher, with strong demand expected from traditional investors looking for a hedge against inflation, at a time when sellers appear unwilling to part with their bitcoin holdings.

“Against the backdrop of stimulus from the Federal Reserve, we expect investors holding cash to continue to allocate to bitcoin,” said Kyle Davies, co-founder of the digital-asset fund Three Arrows Capital.

In traditional markets, European shares headed toward their first drop of the week on disappointing earnings reports, and U.S. stock futures pointed toward a lower open.

A powerhouse panel discussion between Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey is scheduled for 5:45 p.m. central European time (16:45 universal coordinated time, 11:45 a.m in New York). The topic is “central banks in a shifting world.”

Gold strengthened 0.2% to $1,870 an ounce.

Market Moves

Ok, so apparently hedge fund titan Ray Dalio doesn’t like bitcoin.

But guess who’s not selling? People who already own it – and look to profit handsomely from doing so.

The oldest and largest cryptocurrency doubled last year, and it’s doubled again in 2020. Compare that with the Standard & Poor’s 500 Index of large U.S. stocks, which has gained 44% since the start of 2019.

So what’s happened, according to data extracted from the Bitcoin blockchain, is that holders of a common form of the cryptocurrency are now nearly unanimously in the money – sitting on paper profits, as it were. And that might be because they simply don’t want to part with the digital asset that’s already made them so much money.

It also means that nobody’s really even close to needing to cut bait. And since many investors view bitcoin as an of out-of-the-money option on economic armageddon, rampant inflation, a revolution in financial technology or all of the above, they’re just letting the bet ride.

As reported Thursday by CryptoX’s Omkar Godbole, the percentage of so-called “unspent transaction outputs,” or UTXOs, recently topped 98%, a level not seen since the bull run in late 2017. As well, the number of UTXOs in profit reached a record high of over 110 million. A UTXO is leftover bitcoin after a transaction, akin to receiving change after making a large cash payment.

“A high percentage of UTXOs in profit potentially signals that there is relatively low sell pressure since there’s a low risk of capitulation,” the cryptocurrency analysis firm Coin Metrics wrote this week in a report.

Sure, bitcoin might be the biggest bubble the world has ever seen – and the holders might be deluding themselves to believe that these gains can continue forever. It also could be that bitcoin is just at the beginning of that bubble.

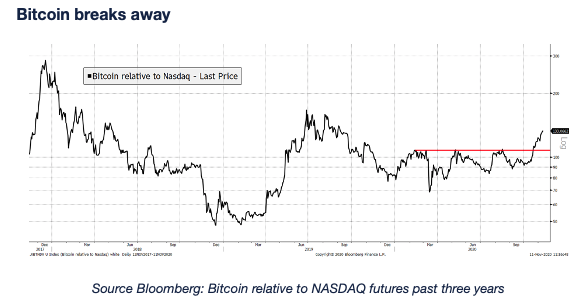

Charlie Morris, CEO of the cryptocurrency fund manager ByteTree, has been arguing all year that bitcoin is really a technology, which partly explains why it has historically traded in sync with the tech-heavy Nasdaq stock index. On Thursday, Morris noted in a newsletter that bitcoin has recently, and noticeably, started to outperform large tech stocks. (See chart below.)

“Just as investors flock to gold when they see it outperforming the stock market, I believe bitcoin will attract capital from tech,” Morris wrote. “We can be fairly certain that tech is a bubble, yet bitcoin isn’t.”

It just so happens that many hedge funds like Dalio’s Bridgewater tout their own track records when they’re casting about for funds from big investors like pension funds, endowments and rich family wealth offices. (At least one Twitter troll was quick to compare Dalio’s fund performance with bitcoin’s. Spoiler alert: Dalio loses.)

Whatever the case, bitcoin holders appear satisfied with the cryptocurrency’s performance, and they appear to be sticking with it.

Bitcoin Watch

Bitcoin’s first attempt to establish a foothold above $16,000 has failed for now. The cryptocurrency rose to a three-year high of $16,157 early Thursday only to fall back quickly to $15,700.

The failure to keep gains above the psychological hurdle could be attributed to overbought conditions signaled by technical indicators.

Analysts told CryptoX Wednesday that the cryptocurrency is likely to consolidate for a couple of weeks before resuming the uptrend and challenging the record high of $20,000 by the end of December.

It remains to be seen if the bulls take a breather as anticipated by analyst or push for early test of record highs. The latter cannot be ruled out as the market is facing sell-side liquidity issues and it’s easier for the bulls to force rapid price rallies. The options market is showing strong bullish sentiment with the demand for call options outstripping the demand for put options by the most on record.

The cryptocurrency has recovered back to $15,900 and could soon cross back above $16,000. Another rejection above that level would validate overbought signals and may yield a bigger pullback than the one seen early Thursday.

What’s Hot

Stablecoin issuer TrustToken taps Chainlink (LINK) for on-chain proof of reserves for TrueUSD dollar-linked token (CryptoX)

U.S. representatives rip OCC Commissioner Brooks for ‘excessive focus’ on crypto industry (CryptoX)

Bridgewater’s Dalio sees governments banning bitcoin should it become “material” (CryptoX)

African startups should tokenize debt and equity on blockchain to “break the white man’s curse” (CryptoX Opinion)

Pakistan securities regulators publish position paper on regulating digital assets (SEC Pakistan)

Venezuela’s peer-to-peer bitcoin volume relative to the size of its economy is the highest in the world, due to factors including migration, capital controls, risk of government seizure, demand for hard money and exposure to the petro, the cryptocurrency backed by the government (CryptoX)

Ethereum heavyweights launch LiquidStake loans to stake the stakers in staking system 2.0 upgrade tests get underway (CryptoX)

Flash loans aren’t the problem, centralized price oracles are (CryptoX Opinion)

Analogs

The latest on the economy and traditional finance

OPEC deepens forecast for drop in global oil demand, down 10% from 2020 levels, trims expectations for 2021 rebound (WSJ)

U.S. commercial banks are reducing already-low interest rates on customer savings as deposits swell to $15.9T from $13.2T at start of year (WSJ)

Russia says “Sputnik V” vaccine is 92% effective at preventing coronavirus cases (Reuters)

Japan’s Nikkei Index hit a near 29-and-a-half-year high on the back of favorable tech shares trading in Asia and the U.S. (Reuters)

Failed IPO of Jack Ma’s Ant Group has led to several companies advancing their own offerings in Hong Kong looking to take advantage of surplus liquidity (Nikkei Asian Review)