Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

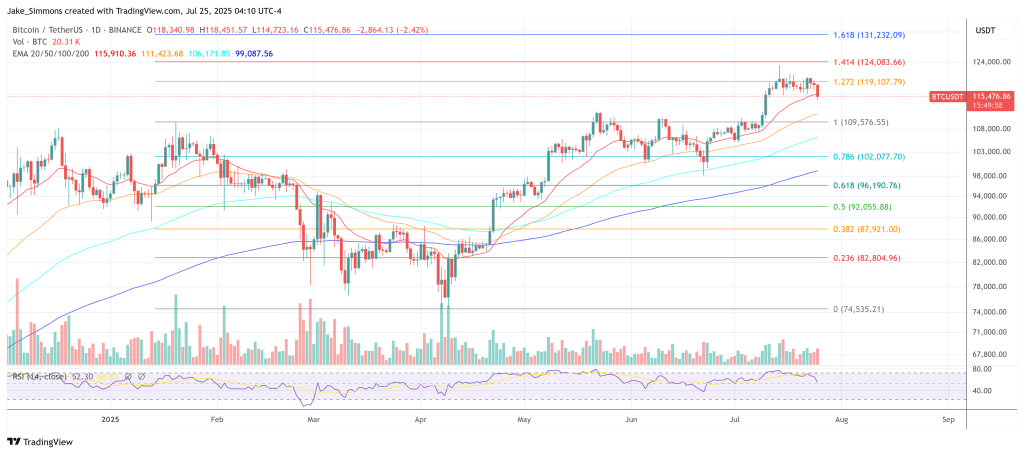

Bitcoin’s summer melt-up has come to an abrupt halt. The benchmark cryptocurrency slipped from an intraday peak above $119,000 late Thursday to trade as low as $115,800 in European morning hours, its weakest print in a fortnight. The 2.7 percentage-point slide followed an unmistakable on-chain signal: Galaxy Digital quietly pushed more than 10,000 BTC—worth about $1.18 billion at the time—onto major exchanges in less than eight hours, according to wallet-tracking firm Lookonchain.

Galaxy Digital Triggers Bitcoin Slide

“Bitcoin sell-off still underway! Galaxy Digital deposited another 2,850 BTC ($330.44M) to exchanges,” Lookonchain warned on X in the early European morning hours, noting that the transfer originated from a Satoshi-era whale that re-awakened this month. Prior to that, the analytics account posted an alert: “Note that Galaxy Digital has deposited over 10,000 BTC ($1.18B) to exchanges in the past 8 hours!” Screenshots of Arkham Intelligence dashboards showed a series of multi-million-dollar transactions converging on Binance, Bybit and OKX.

Related Reading

The flows are the latest chapter in a saga that began on 4 July, when an address dormant since 2011 started chopping an 80,009-BTC trove into 10,000-coin tranches. By 18 July the final 40,191 BTC—worth $4.8 billion—had landed at Galaxy, a move many analysts interpreted as a potential sale.

That potential is now reality. On-chain data shows Galaxy sends Bitcoin to various crypto exchanges almost every minute to sell it. The BTC price is reacting with textbook symmetry: spot BTC slipped through $118,000 during the Asian session before knifing to $116,000 as London desks opened, wiping roughly $55 billion from bitcoin’s market value in just 4 hours.

Galaxy Digital, run by billionaire Michael Novogratz, offered no public comment at the time of writing and has not filed any Form 8-K that might indicate a balance-sheet reshuffle. The firm’s most recent media appearance came on CNBC yesterday, where Novogratz repeated his view that Ether could “outperform” bitcoin over the next few months,” but did not hint at near-term selling.

Related Reading

While motives remain opaque, market spectators were quick to theorise. “Looks like the Bitcoin selloff is Galaxy Digital market dumping from a batch of 80K BTC. Could be because they were asked to for a client, something related to Saylor, or moving into Ethereum as Novogratz suggested ETH may move more than BTC in the next few months (today on CNBC). Not worried. They have about 27K left to sell (if they’re selling the full 80k), people buy, life goes on, it continues upwards,” the crypto-focused account Autism Capital posted via X.

Capriole Investments founder Charles Edwards commented via X: “At the same time that this OG whale is dropping 10K slugs into spot markets today, we have 30K of leveraged longs opening on the dip. Not a price prediction and changes nothing mid- to long-term, but this is not a great sign for the short-term price action. Even if all 80K BTC are nuked, if Treasury Company demand remains consistent, it will all be consumed in a couple weeks.”

At press time, BTC traded at $115,476.

Featured image created with DALL.E, chart from TradingView.com