Quick take:

- Yesterday, Binance launched the BTCUSD Quarterly Futures Contract with a leverage of up to 125x.

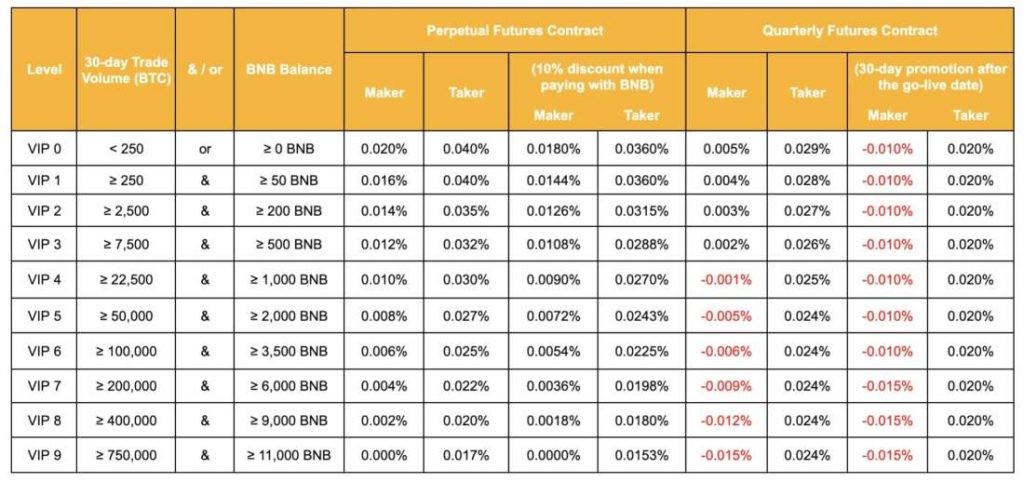

- To promote the derivatives product, the exchange will offer users 30 days of maker fee rebates and taker fees as low as 0.020%.

- Within 24 hours of the launch, the product has traded over $100 million in trade volume.

Early yesterday, the crypto exchange of Binance launched the Bitcoin Quarterly Futures contract with a maximum leverage of 125x. The new BTC quarterly futures contract has a very attractive fee structure with a maker rebate and taker fees as low as 0.020%. The fees of the quarterly futures contract are lower than the usual Bitcoin perpetual contract on the platform. A full breakdown of the fee structure comparing the two derivatives products can be found in the following table by the team at Binance.

New Bitcoin Quarterly Contracts Kick-Off on a High Note

The launch of the derivatives product was overshadowed by Bitcoin dipping below $9,300. However, 24 hours after the Bitcoin Quarterly futures contract was launched, the VP of Binance Futures, Aaron Gong, notified the crypto trading community that the new derivative had had more than $100 Million in trade volume since. According to Mr. Gong, the trade volume was 3 times the volume of the usual Bitcoin perpetual contract. His full statement highlighting the achievement can be found in the following tweet.

More than 100M in volume on day 1 for @Binance

’s Quarterly Futures. That’s 3x our day 1 perps volume. Will quarterlies 3x our perps by volume in the future?#BinanceFutures never stops #BUIDLing.

Check it out for yourself: https://t.co/ZLWUy4oukf pic.twitter.com/rpj7xdXYN6

— Aaron Gong (@AG_Binance) June 12, 2020

More on the Bitcoin Quarterly Futures Contracts by Binance

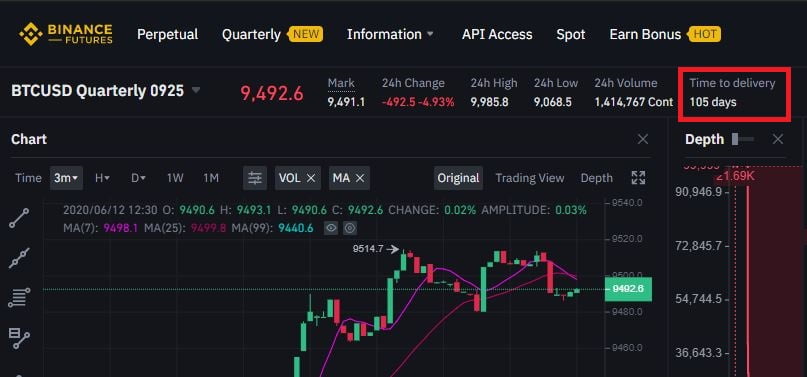

As with all quarterly futures contracts, the Binance version has a set expiration and settlement date. Traders can find a ‘Time to delivery’ tab on the Binance trading interface right above the depth chart as can be seen in the screenshot below.

Additionally, the team at Binance has aptly named the current derivative, BTCUSD Quarterly 0925. The four digits at the end of the name conveniently indicate the expiry date. In this case, the contract will expire on the 25th of September, 2020, at 8 am UTC. The derivative product uses BTC as collateral and is a cash-settled futures contract.

Risk Warning By Binance

Due to the maximum high leverage of 125x, the team at Binance has cautioned traders about the dangers of trading futures contracts.

Futures trading is a highly risky endeavor, with the potential for both great profits and significant losses. Please be aware that in the event of extreme price movement, there is a chance that all margin balance in your futures wallet may be liquidated.

(Feature image courtesy of Unsplash.com.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.