“Bitcoin is a bubble” is something that has been thrown around a lot ever since the last bull run began in 2017. A lot of prominent personalities in the finance industry took this stand when the digital asset hit its then all-time high of $19K. The bear market that followed seemed to validate this for the next few years. Then the bull run of 2020 started and a lot of those sentiments were put on the back burner. But now, John Paulson has come to hit the market with the same thing.

Related Reading | Here’s How Much Your $1,200 Stimulus Check Would Be Worth In Various Cryptocurrencies In 2021

Over a decade ago, billionaire John Paulson had bet against the housing market. Paulson had reportedly made his fortune from carefully placed bets against the housing market in 2007. The billionaire had used credit default swaps to bet against the housing market, which looked to be in its subprime. By 2010, Paulson himself had made $4.9 billion from his bet. The complete total Paulson made for himself and his clients from shorting the market in 2007 came out to about $20 billion, making it one of the biggest fortunes ever made in the history of Wall Street.

Bitcoin Has No Intrinsic Value

Paulson was on Bloomberg’s Wealth with David Rubenstein to talk about trading and financial markets. Paulson remained bullish on gold, as he has been for a number of years now, which he believed is coming into its moment. The billionaire although had nothing good to say about cryptocurrencies. Cryptos received harsh criticism from Paulson, where he stated, “I am not a believer in cryptocurrencies.”

Related Reading | Deloitte Survey Shows 76% Of Finance Execs Think Physical Money Is Nearing Its End

Paulson then went on to call cryptocurrencies a “bubble.” Paulson attributed the value of cryptocurrencies to the high demand for them. One could argue that this is the way economics works. Demand always plays the biggest role in how something is valued. Paulson also explained that there were way too many downsides to bitcoin. He added that the digital asset was just too volatile too short. Hence, the short methods

“I would describe cryptocurrencies as a limited supply of nothing. There is no intrinsic value to any of the cryptocurrencies.”

Although Paulson spoke critically on other investments like SPACs, he was harshest on bitcoin. The billion said that cryptocurrencies “will eventually prove to be worthless.”

Gold Versus BTC

Paulson’s track record after his famous 2007 short has not been noteworthy. Although his assets under management grew after the notoriety he gained from that trade, it soon dwindled down as investors pulled out their money. In 2019, Paulson went from managing $38 billion to only about $9 billion assets under management, at this point mostly managing his own money. So Paulson turned his hedge fund into a family office.

BTC has surpassed gold year over year | Source: BTCUSD on TradingView.com

Paulson is bullish on gold, despite the fact that bitcoin has outperformed the asset consistently over the past decade. While gold has brought consistently negative results to its investors, bitcoin has returned over 200% year over year in returns.

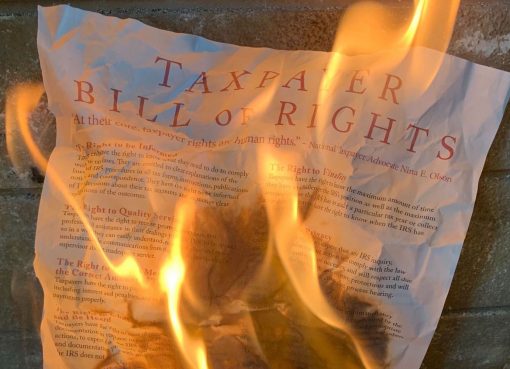

Featured image from Bitcoinist, chart from TradingView.com