Tether’s USDt (USDT) surpassed a $150 billion market capitalization for the first time on May 12, marking a new milestone amid growing stablecoin adoption.

USDt’s circulating supply has expanded by over 36% in the past year, with growth accelerating in November following the election of US President Donald Trump.

At its current supply, Tether accounts for 61% of the global stablecoin market, according to CoinMarketCap data. It’s followed by Circle’s USDC (USDC), which accounts for nearly 25% of the stablecoin market.

As the world’s largest stablecoin, Tether is widely viewed as a barometer for cryptocurrency demand, given its central role in providing liquidity and funding for crypto trading.

Tether is part of a broader trend toward digital fiat currencies, with recent data from Dune and Artemis showing that the number of active stablecoin wallets has surged more than 50% over the past year, from 19.6 million to 30 million.

Related: $1T stablecoin supply could drive next crypto rally — CoinFund’s Pakman

Tether eyes US reboot

Despite its large presence globally, Tether’s usage is restricted in the United States, a country now at the forefront of pro-crypto legislation.

Against this backdrop, Tether is planning to enter the US with a new dollar-backed stablecoin later this year.

“A domestic stablecoin would be different from the international stablecoin,” Tether’s CEO, Paolo Ardoino, reportedly said on the sidelines of the Token2049 conference in Dubai, United Arab Emirates.

According to a CNBC report, Tether is increasing lobbying efforts in Washington as US lawmakers consider several stablecoin-related bills, including the STABLE Act, introduced by House Financial Services Committee Chair French Hill and Digital Assets Subcommittee Chair Bryan Steil.

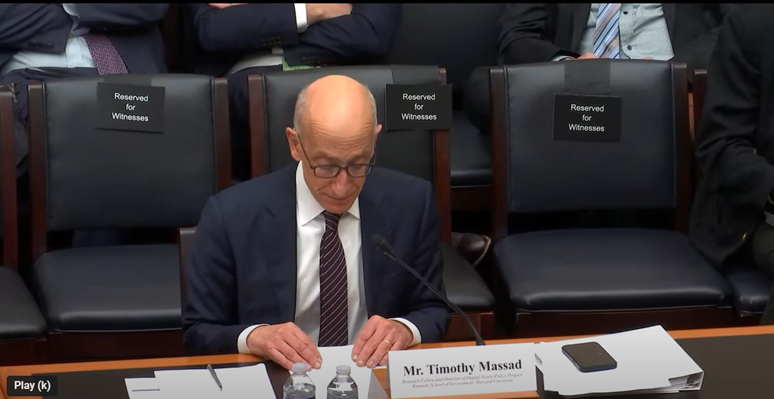

However, the STABLE Act has drawn criticism. As reported by Cryptox, former Commodity Futures Trading Commission Chair Timothy Massad argued the bill would do little to rein in Tether.

Speaking during a Feb. 11 hearing of the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence, Massad said the proposal poses “far too much risk of weak state standards” and suffers from “an inadequate review process,” noting the lack of “ongoing federal supervision of state issuers.”