The Ethereum developer community is nearing the launch of Ethereum 2.0, a major multiyear milestone for the blockchain network. Ethereum 2.0 will mark the start of a shift from the miner-reliant proof-of-work consensus algorithm to a proof-of-stake algorithm. In a PoS system, miners are not needed to mine blocks and verify transactions. Instead, users — or stakers — verify data on the blockchain.

For now, there is no specific date at hand for the release of Ethereum 2.0, according to its testnet coordinator, Afri Schoedon. “The final spec is not implemented in any client and we didn’t launch a coordinated testnet yet,” Schoedon said.

Ethereum co-creator Vitalik Buterin also clarified that Ethereum 2.0 is on track, but if the client developers expect it to be done by the third quarter of 2020, then that is likely to be the case. However, three key metrics show that investors and users are highly anticipating the integration of Ethereum 2.0 within the year’s end. The metrics are rising growth of Ethereum addresses, increasing market demand for Ether (ETH) and surging on-chain user activity.

What is Ethereum 2.0?

When Ethereum’s client developers launch Ethereum 2.0, they will essentially release a new Ethereum network that will run in tandem with the existing network. Ethereum 2.0 will use sharding as its base scaling solution. District0x describes sharding as the most complex Ethereum scaling technology because it divides the blockchain network into many portions, or “shards,” and allows each portion to process data on its own. Sharding speeds up data processing on the Ethereum blockchain network because node operators can simply verify data on their own shards and not on the entire blockchain.

Related: Ethereum 2.0 Staking, Explained

Ethereum 2.0 is taking longer than the implementation of most blockchain network upgrades. But its complexity is also unprecedented, and as such, longer periods of testing are highly important. Responding to criticism that the Ethereum developer community is “changing” its narrative and delaying the release of Ethereum 2.0, Buterin said:

“People often complain that the Ethereum narrative ‘keeps changing’. This is false. Rather, the Ethereum narrative is inherently pluralist, containing bets that at least one of many kinds of applications will grow and prosper.”

Rapid address growth

On-chain data from Glassnode shows that 40 million addresses are currently holding Ether. In the first quarter of 2018, when the price of ETH reached its all-time high of around $1,400, the number of Ethereum addresses was below 10 million. Despite the price of ETH declining by 85% since then, the number of addresses has actually increased by 350%.

John Lilic, a business technology developer at ConsenSys, said on the matter: “There are only 35 countries in the world w/ a population of 40 million+. There are now 40 million ETH addresses. ETH is now more widely used money than 80% of countries around the world.”

The increase in Ethereum addresses indicates that the market is becoming more evenly distributed among retail and institutional investors, reducing the influence of whales on the market. It also shows that more investors are generally trying to acquire ETH before the release of Ethereum 2.0 in order to become eligible for staking and earning rewards over time, which requires 32 ETH. The growth of addresses also started to increase rapidly early this year when talks of Ethereum 2.0 by the year’s end emerged.

Rising market activity

When Ethereum 2.0 launches, users can become a staking agent by transferring 32 ETH to a contract. Staking 32 ETH will result in approximately 4.6% to 10.3% in rewards, as Collin Myers, the head of global product strategy at blockchain firm ConsenSys, reportedly said. But each staker cannot stake more than 32 ETH, as a hard limit is imposed. BitMEX Research said in its report on Ethereum 2.0:

“If more than 32 ETH are sent to the contract, then the staker does not receive benefits from these additional coins and if less than 32 ETH are sent, the staker will not activate. Therefore to transfer ETH into Eth2, one should do it in batches of 32 coins. Each batch of 32 ETH can be a seperate staking agent.”

The rewards stakers can earn through 32 ETH, which at press time is worth around $6,500, have led the demand for ETH to rise noticeably in recent months. A system that provides interest on Ether held over time is appealing to many retail investors as well as institutions. Within the past year, the Grayscale Ethereum Trust saw its assets under management, or AUM, grow from $11.7 million to $276.5 million.

Since institutions and accredited investors primarily use the Grayscale Ethereum Trust to invest in Ether in a strictly regulated ecosystem, it suggests surging institutional demand for ETH. The decentralized finance investor known as Arthur tweeted:

“@GrayscaleInvest [Grayscale] Ethereum Trust has grown its AUM from $11.7m to $276.5m, a 23.6x increase despite a lower ETH price. Redemption are not possible for this product now so the only path is upwards as well.”

Long-time Bitcoin (BTC) investors such as the billionaire co-founders of the Gemini exchange, Tyler and Cameron Winklevoss, are among many high-profile investors who have expressed optimism toward Ethereum as of late. Speaking to Camila Russo, a former Bloomberg journalist and the founder of The Defiant, the Winklevoss twins said: “We’re big fans of ether. We have a material amount.”

In the medium to long term, the Ether futures market tailored for professional traders and institutions will also see a structural change. Upon the release of physically settled Ether futures contracts on the ErisX platform, which allow investors hold the ETH they buy and not entirely leave it in the hands of a third party, the CEO of ErisX, Thomas Chippas, told Cryptox:

“We believe that Ether futures will bring broader market participation, a diversity of trading objectives and time horizons, more robust and resilient markets, as well as improved risk management tools, among other things.”

Physically settled contracts typically affect the price of an asset more than other types of derivatives because they have an impact on the real supply of the asset, which in this case is Ether.

Rising user activity

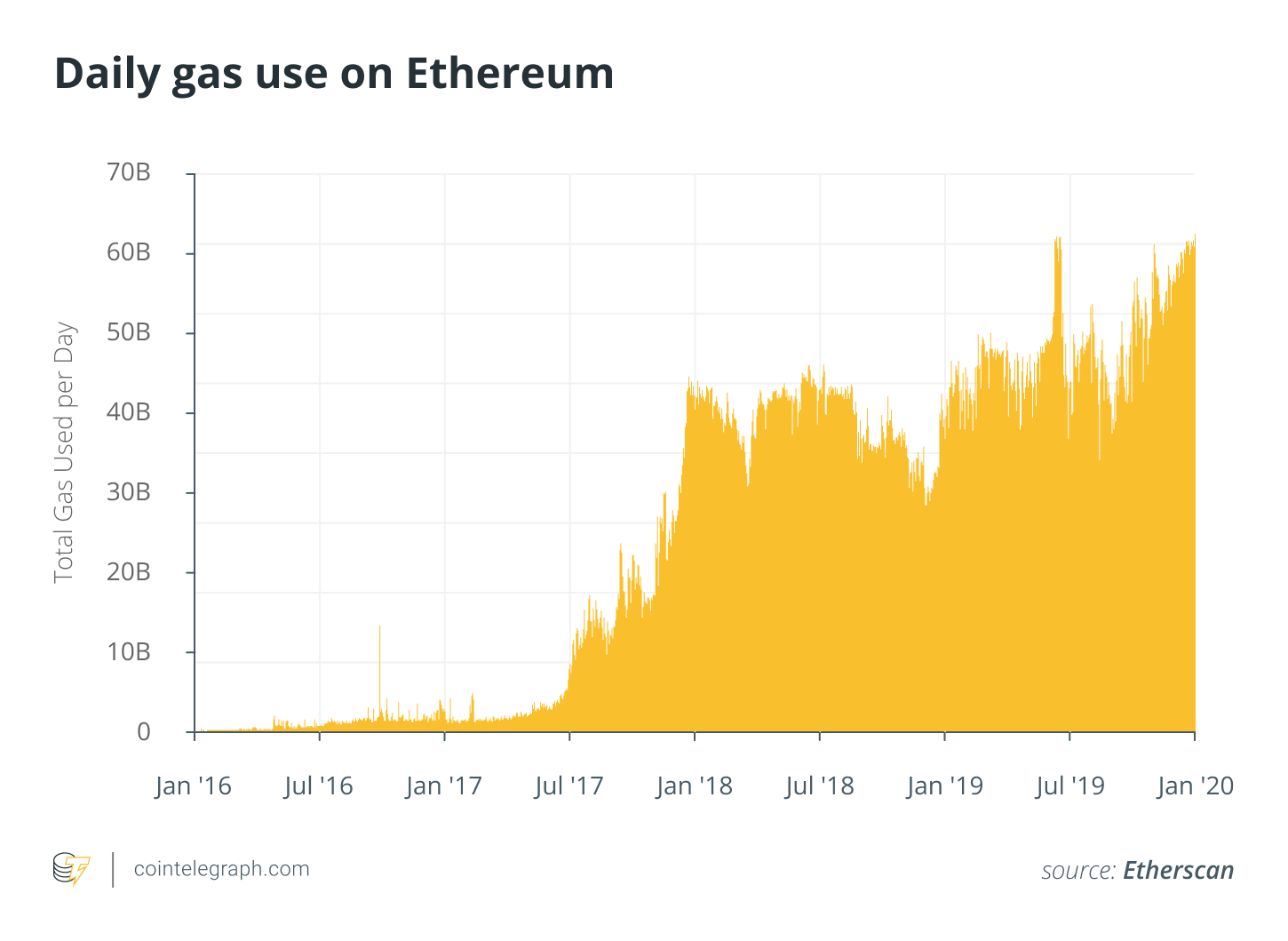

Data from Etherscan.io shows the total use of gas on Ethereum has reached a record high. It suggests the level of user activity on the Ethereum blockchain network is surging in anticipation of Ethereum 2.0.

Gas is a token that is used to power the Ethereum network. To transfer smart contract data or payments, users need to pay a fee in the form of gas. For example, decentralized applications that run on Ethereum and use smart contracts require gas to make the blockchain network process the information.

Total daily gas consumption hit 61 billion on May 23, double that of January 2019. The price of Ether has increased by nearly two-fold since then, which demonstrates a healthy recovery trend for ETH. As long as many users are utilizing the Ethereum network and paying gas to process information, Gnosis product developer Eric Conner said that the update from PoW to PoS will be smooth.