“YOU’VE TRANSCENDED. You are here because you’ve opened your eyes to a new type of society; one powered by a decentralised economy and full of shimmering new possibilities.”

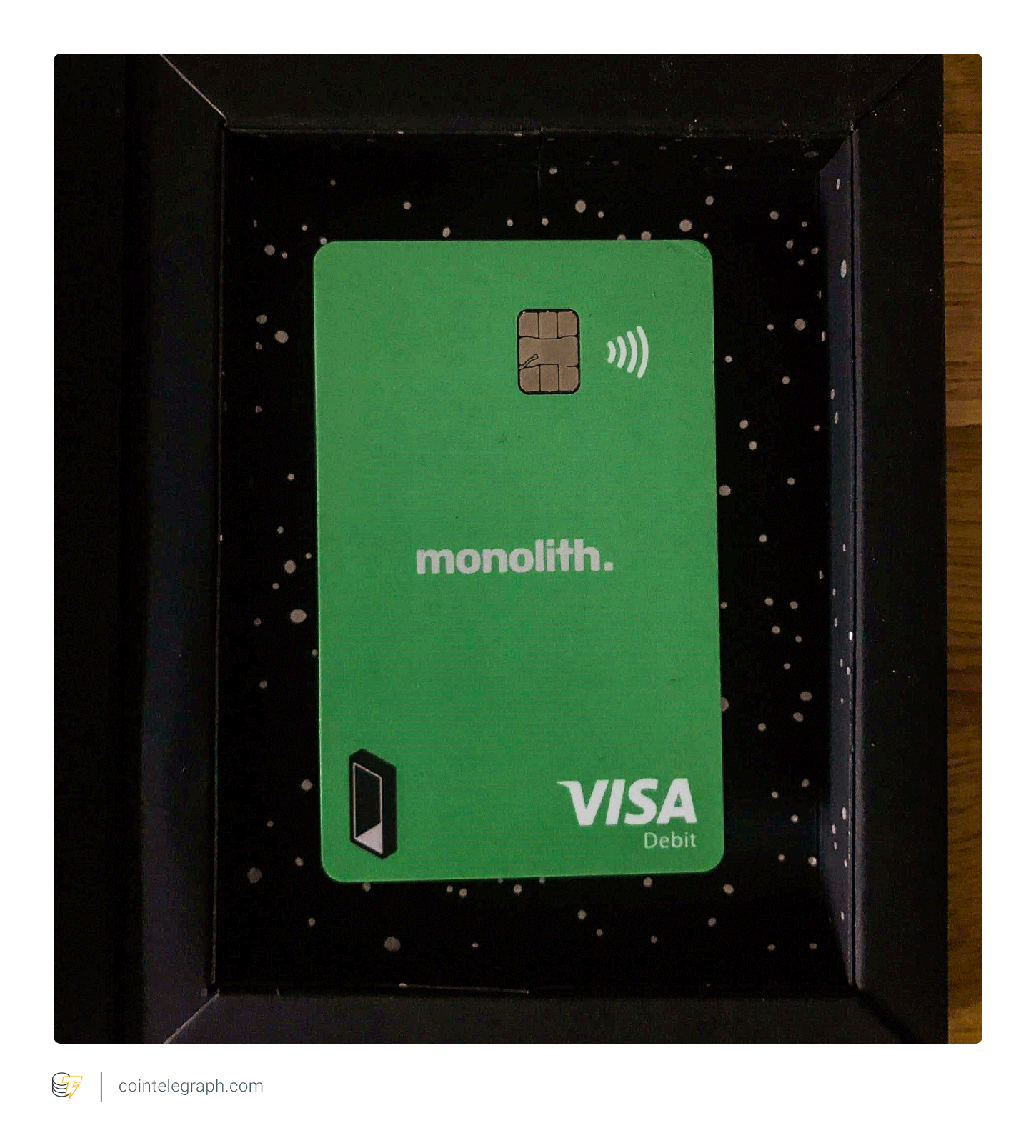

This is not the calling card for a new religion. This is what new Monolith customers are met with when opening up the box for the first time. Narrative is a central part of cryptocurrency, whether people like it or not. Monolith has taken that narrative and made it central to its branding.

When I fished the Monolith crypto debit card out of my letterbox in South Berlin one morning, I was no longer an ordinary man. I became a man on a mission. A mission to live on crypto in Germany’s capital city.

Although the wall separating East from West in Berlin may have come down 40 years ago, I would take a virtual sledgehammer to financial divisions within this city of sin and ambition. For 7 days, I became a one-man disruption machine.

Out of this world

After opening up the sleek black package, a smaller box slides out. It depicts a post-apocalyptic landscape, somewhere halfway between the Earth and the other side of the Oort cloud. It’s equal parts Planet of the Apes and Interstellar.

From the matte black of the outer-space background, the card glows green like an alien lifeform. The unboxing may expose customers of a weaker disposition to lethal levels of nerdiness. The dramatic branding and transformative message is labored, but it doesn’t make me like it any less.

The app setup is quick and relatively painless. Loading screens are punctuated with painfully sappy messages about “kitties clogging the network,” but thankfully I am not met with much waiting time. The total time to set up the wallet was around 10 minutes, several of which were taken up as the wallet is “deployed.”

The sci-fi branding is consistent throughout Monolith. It’s the gamification of finance — you’re not just buying a pint with crypto, you’re also a space invader and Neil Armstrong all at the same time.

The whole user experience is geared toward convincing you that you are on a journey. They even use it to disguise when you need to cough up the cash for fees. Since the Ethereum network has branded these charges as “gas,” the Monolith card has a “gas tank” that you need to top up in order to pay for your transactions.

Berlin: A cardholder’s nemesis

If I truly had to live for a week with this card — from the moment I ordered it to the moment my money ran out — I would have died. I’d have starved to death in the time it takes for the card to arrive. “10 business days” is a sweet nothing that Monolith whispers into the consumer’s ear. Morning, noon and night I checked my postbox for that card like a forlorn child in small-town America looking for his ticket to the big city. But when it did arrive, boy did I forget about the life-threatening hunger.

I checked my account balance. The figures shimmered back at me from the slick mobile application. “Spend it all in the pub. All of it,” a voice whispered in my brain. It appealed to my deepest primal urge as a British man.

My liver whimpered in anticipation. I could bathe in Rioja like the Elizabeth Bathory of the crypto world. I put the thought to the back of my mind. Monolith had placed its faith in me to eke out a livable existence powered by the Ethereum blockchain. I would not let the technology down.

Withdrawing money from an ATM

Germans love cash. Newcomers to Berlin are usually astounded that you can rarely pay for anything with credit or debit cards. In any restaurant or bar, it is only a matter of time before you hear a disillusioned tourist loudly wail, “What do you mean you don’t take card?” Visitors will soon find themselves pounding the streets in search of somewhere to withdraw some cash.

Luckily, Berlin is well served by a number of banks and card machine providers. It’s said in life that there are two unavoidable things: death and taxes. But that quick-witted soul has clearly never been to Germany.

Any visitor to the city will know there is a third constant with exorbitant cost: ATM fees. In the United Kingdom, you can pop to a cash point and idly withdraw a 5 pound note, free of charge. In Berlin, you can routinely expect to pay between 4 euros and 7.5 euros for every withdrawal.

And that’s before your local bank charges you for using its card abroad. For this reason, Berliners visit cash machines as rarely as possible — and when they do, they take out enough to last them weeks at a time.

Related: Crypto Hold’Em 2019 – What are cryptocurrency debit cards?

Not all cash machines are made equal in Berlin. But, having been stung by a 6 euro charge when in desperate need of a kebab one time too many, I’ve learned there are ways to avoid having your credit card savaged with each all-important withdrawal.

Sparkasse, a semi-state-owned bank, does not charge fees for withdrawing cash. It is high time for the creaking titans of state finance to meet a new financial force. I thrust the Monolith card into the glowing ATM slot. The machine swallows up the alien technology. At this stage, crypto has infiltrated the mainstream financial network. I am inside.

The Monolith card is a crypto-Agent Smith, hell-bent on transforming the financial matrix from the inside out. The process is as smooth as a silken slide. The machine whirrs and clanks as it gives up guardianship of the euro notes. I check my balance in the app. No charges. It was as easy as that.

Ease of use: 5/5

Charges/fees: 0 euros

Paying for food

Even for the most hardened crypto enthusiasts, hunched over a screen, pale from months of furious hodling, hunger comes at least once a day. Bearing my luminous green Monolith card, I venture out onto the mean streets of Berlin to sate my growling stomach. Of all the things people like to buy with money, food is almost universally acknowledged as the most important. But Berlin’s cash culture also spits on card users. It is almost impossible to find a decent bar or restaurant that will accept card payments. I try several places that have people with beards typing on laptops outside them. I witness a sprawling morass of avocado, but no one willing to take a card payment. Tired of staggering from one artisan cafe to the next, I turn a corner and see the golden arches of McDonald’s glimmer through the November gloom.

Has anyone eaten in a McDonald’s in the last 10 years? I don’t think they have. Certainly, no one has done it without a head injury or imminent threat of violence. I was about to buck that trend. It starts badly. I can’t remember the German word for chips. I just say potato and mime lacerating it into small strips.

Monolith’s contactless chip fails, as it is worryingly prone to do. The woman behind the counter looks at me the way a naive child would look at a wounded puppy. She gives me a sad, pitying smile and asks me to pop the card in, if I can remember the pin. She gently coaxes me through the rest of the process.

Monolith might have stumbled at the first hurdle, but when it comes to the crunch, it did not let me down. It was a seamless, instant transaction. In only a matter of seconds, I am the proud owner of a succulent McDonald’s meal. I look down at the tray full of salty, disgusting food. All mine. I eat it all, knowing that I am doing this for the purpose of meaningful journalism.

In paying for this food, surrounded by builders and railway workers in uniforms, many of whom have clearly not washed their hands, I am furthering the adoption of cryptocurrency. I am a one-man force of fintech power; the titans of finance quiver before me. I think about Jamie Dimon as I force down mouthful after mouthful of horrible chips. I’d show him.

Monolith’s card service bursts with ambition, but Berlin’s cash culture means the ATM should be the first point of call for hungry hodlers.

Contactless: 0/5

Pin payment: 5/5

Transaction speed: 5/5

Charge/fees: 0 euros

Paying for transport

From the labyrinthine tunnels of London’s underground to Moscow’s palatial metro system, capital cities of the world are shifting to contactless payments. Despite having great public transport, Berlin is trailing behind the rest of Europe (surprise).

After a weekend of traveling on public transport in London, my bank account looks like a squirrel after an unfortunate encounter with a 10-ton truck. Fortunately for many of Berlin’s employees, companies here often provide year-long public transport tickets. But for those that don’t, the office beckons, and it’s down to you to foot the bill. With that, Monolith’s crypto card just found its next use case.

It is painfully early in the morning. I stand on the platform of Hermanstrasse station in South Berlin, channeling my inner office worker. If ever there should be a time for the card to fail me, I pray for it to be now. But the Monolith card steadfastly refuses to buckle under pressure.

I can both link the card to the city’s BVG travel app to buy a variety of tickets on the move and use the machine at the station. The show must go on. And I must get on that train. It was not long ago that I forced myself from the comfort of my bed, and, what seems only seconds later, I am pressed into the sweaty embrace of a full commuter train.

Nose to armpit contact before 9 a.m., facilitated by crypto. Like lambs to the slaughter, we make our way into the center of Berlin, backs bent before the cracking whip of the corporate world. The smell persists, but our journey continues unimpeded. Nonetheless, my breakfast is in serious danger of making a reappearance. Cautious consumers can take comfort in the knowledge that, out of the many factors that could make you late for work, paying with the Monolith card will sadly not be one of them.

As you might imagine in a city like Berlin, people who live here are often conscious of the environment. So, if using gas-guzzling public transport turns your stomach, plait your hair into pigtails, do your best Greta Thunberg impression and hop on one of the city’s myriad bike-sharing services. These are all done on mobile-based applications, and after linking the card up, you’re good to go.

I wondered if Monolith’s card would help me answer the oldest question in crypto. A question that hovers on the tongue of any investor worth their salt: When Lambo?

I looked into it. Rental prices in Berlin start from $850 per day. The answer to that timeless question? Not today.

Ease of use: 5/5

Speed: 5/5

Charges/fees: 0 euros

Ordering online

For many dedicated crypto customers, time is money. Glued to charts, stacking sats and checking stats, cryptocurrency can be a lonely road. For when you can’t leave the computer, or the luxurious charm of your apartment proves all too alluring on a cold winter’s night, ordering online is never far from your mind.

Lieferando, Germany’s largest delivery service, accepts Bitcoin. Unfortunately, ETH is not yet an option. Nonetheless, Monolith’s crypto card will not stand in the way of an empty stomach and a generous helping of pizza. My mind scarred by the frightening proliferation of currywurst in this peculiar country, I navigate the site, content only with the best.

I choose Nini e Pettirosso, purveyors of apparently the best pizza in Berlin. Only a short while later, my spent crypto manifested itself to me in the form of a delicious mound of mozzarella, salami and garlic.

The card worked seamlessly for other online payments. I bought tickets to a show in Berlin’s iconic Comedy Club, nestled away on one of Neukolln’s backstreets. The payment was as efficient as any using a fiat-backed card.

But it was crypto that had bought me entrance to a bar with some top-drawer comedy. To my enormous surprise, the comedy club bar accepted card payments. From then on, the only thing that the Monolith card would further contribute to decentralizing that night would be my balance.

Ease of use: 5/5

Speed: 5/5

Charges/fees: 0 euros

5/5

My seven days in the skin of an invincible crypto cyberpunk left me feeling empowered and mysterious. I have cultivated the air of a ‘60s Bond villain, short of a volcano lair. The Monolith card allowed me to skip around the city like a kid in a candy shop. If anything, I am saddened that my personal rampage has come to a close. The card holds up pretty well.

For a company that flirts with the notion of alien contact in its branding, it might want to sort out the contactless issues. Nonetheless, charges are mostly nonexistent, and when they do surface, they are low. For now, the Monolith service is not tied to an actual bank account, which means wire transfers are currently out of the question. For those looking for an all-in-one account, this might be a dealbreaker.

There are other card providers out there that do this. Wirex and Revolut both offer a seriously competitive service that both come with British pound or euro accounts for a seamless banking experience. For hardened crypto users, or people based in Europe that want an instant and reliable way to spend their crypto, this could be exactly what you need.

I’ll probably still use the card. I have had a taste of the cypherpunk philosophy, and one hit is not enough. The card might not replace the others in my wallet, but it will lie dormant, ready for the next time I feel Big Banking gets too big for its boots. One day soon, the banks will once again quiver before my wrath. The Monolith card might not turn water into wine, but it does turn ETH into Pinot Noir. That’s good enough for me.