Decentralized finance (defi) has continued to remain deeply ingrained in the cryptocurrency economy as the ecosystem provides users with a non-custodial way to exchange digital assets, lend cryptocurrencies, issue stablecoins, and ways to profit from arbitrage. In the lending sector of defi, a lot has changed during the last 12 months as lending applications like Terra’s Anchor Protocol bit the dust, and 71.95% of the total value locked in defi lending protocols evaporated.

From $37 Billion to $10 Billion: The Top Five Defi Lenders Then and Now

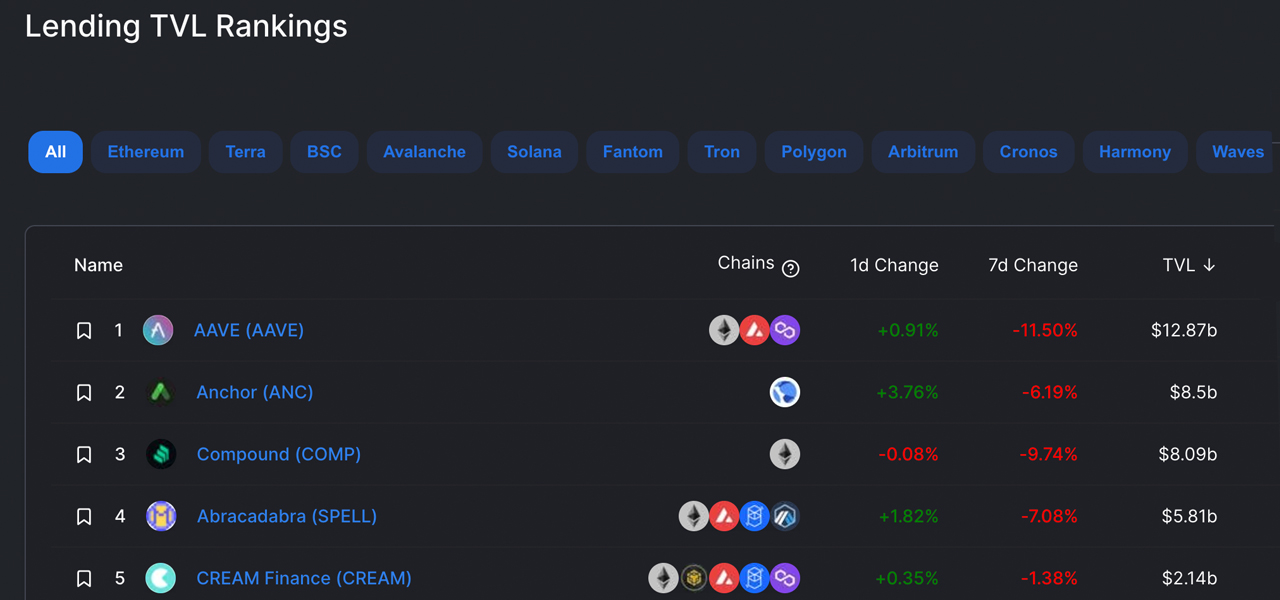

Last year around this time, decentralized finance lending protocols held $37.41 billion in total value locked (TVL), and the defi protocol Aave dominated with $12.87 billion. An archive.org snapshot from Jan. 10, 2022, shows that Aave’s $12.87 billion TVL was larger than the TVL the top five defi lending protocols held on Jan. 17, 2023.

Data shows that the top five defi protocols in mid-Jan. 2023 include Aave ($4.58 billion), Justlend ($3.02 billion), Compound ($1.85 billion), Venus ($813.63 million), and Morpho ($221.59 million). Currently, all five of the aforementioned defi protocols have a combined TVL of around $10.49 billion.

On Jan. 10, 2022, Terra’s Anchor Protocol held approximately $8.5 billion in value, but now the defi protocol is in ashes. Anchor was one of the main components in the Terra ecosystem as terrausd (UST) holders deposited UST for a 20% annual percentage rate return that compounded daily.

But in May 2022, UST depegged from its $1 parity, and Anchor holds only around $2 million today. Compound held the third-largest TVL in terms of defi lending protocols with $8.09 billion at the time. On Jan. 17, 2023, Compound’s TVL has shrunk to $1.85 billion.

The second-largest defi lending protocol today is Justlend with $3.03 billion. The Tron-based Justlend moved from the seventh-largest defi lending protocol TVL to the second by jumping from $1.72 billion to the current $3 billion. Justlend is one of the only decentralized finance lending applications that saw an increase during the last 12 months.

The fourth and fifth-largest defi lenders last year, Abracadabra and Cream Finance, are no longer in the top five standings and have been replaced by Venus and Morpho. Cream Finance is now in the 20th position, dropping from $2.14 billion to the current $42.94 million.

What do you think about the defi lending protocol shake-up over the last 12 months? Let us know your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.