Bitcoin (BTC) starts a new week with $30,000 intact and a message of support from the world’s richest man — what can we expect next?

As trading resumes around the world, the largest cryptocurrency is still lacking decisive momentum up or down.

Cryptox takes a look at five factors which could play a part in shaping Bitcoin price trajectory in the coming days.

Stocks wary of “Reddit raiders”

Equities began Monday with volatile behavior after seeing their worst performance since October last week.

In what is likely to become a continued narrative, markets are still feeling the impact of a retail investor revolt which turned sour after regulators and trading platforms stepped in to stop them from participating.

While involving United States companies, the knock-on effects have been felt around the global economy, with Asia likewise seeing pressure before a Monday rebound.

Nonetheless, a repeat of last week’s mayhem could weaken an already shaky stocks environment, analysts warn.

“We think that the vulnerabilities are there, and while we do not know precisely which catalysts might emerge or their exact timing (including some of the recent retail-oriented pushes against heavily shorted stocks), we suspect that they would derail the current rally and provide entry points that may be 10% lower,” Tobias Levkovich, chief U.S. equity strategist at Citigroup, wrote in a note to clients quoted by CNBC on Sunday.

The timing of the retail move could hardly have been more apt, coming as many stocks indexes see all-time highs despite restrictions on daily life and economic activity increasingly across the U.S. and the western world due to coronavirus.

A separate thorn in the side of U.S. policy comes in the form of continued disagreement over the size of a fresh economic stimulus package. New President Joe Biden’s $1.9 trillion plans have been challenged, and Republicans are instead offering a package worth $600 billion — almost 70% less.

Ammous warns over “shitcoin” silver

With global consciousness waking up to the disparities between how those restrictions affect the rich and the poor, investors’ appetite for a wake-up call seems little dented despite warnings from authorities.

This time, however, it seems not more stocks are on their radar, but precious metal silver. In Monday trading, silver hit its highest levels since 2012 at nearly $29 per ounce.

Gains have been brisk, with 15% added in the past four days alone — since the retail stocks frenzy took a turn for the worse.

Silver soars past $30 a troy ounce as Reddit-fuelled buying frenzy continues for 3rd day. #Silversqueeze pic.twitter.com/mLmasUBrq1

— Holger Zschaepitz (@Schuldensuehner) February 1, 2021

Unsurprisingly, the phenomenon has been accompanied by a slew of calls for those investors to abandon relatively lackluster silver and instead pile into Bitcoin.

“REMINDER… SILVER IS A SHITCOIN,” Saifedean Ammous, author of the popular book, “The Bitcoin Standard,” summarized to Twitter followers at the weekend.

“Its stock to flow ratio is around 3. Whatever happens in the paper market doesn’t matter because it’s very easy to mine and recycle tons and tons of silver and bring it on the market, crashing the price. Pumping silver is a losing game.”

Ammous was referencing the widely-acclaimed stock-to-flow method of analyzing the scarcity of an asset based on how much is added to its existing supply in a given period. The same model delivers the verdict that Bitcoin is the “hardest” of all monies to ever exist thanks to its fixed diminishing emission.

Nonetheless, some saw the potential if the same group of retail investors were to buy up silver en masse. For veteran trader Peter Brandt, a possible target is $102 or 250% from current levels.

Musk: I’m “late to the party” with Bitcoin

Just when Bitcoin supporters were feeling left out, however, did the richest man in the world step in with rare words of encouragement.

In an interview with Clubhouse aired late Sunday, Elon Musk openly confirmed that he was a “supporter” of Bitcoin.

“I’ve gotta watch what I say here; some of these things can really move the market,” he began.

Musk revealed that even his friends had tried to onboard him over the years, even feeding him a slice of a Bitcoin cake in 2013. Nonetheless, having held off on closer involvement, he now admits that he is “late to the party.”

“So I was a little slow on the uptake there, my apologies,” he continued.

“I had to think about it for a bit, but I do at this point think that Bitcoin is a good thing and so I am a supporter of Bitcoin, like I said — late to the party but I am a supporter of Bitcoin.”

As Cryptox reported, last week, the Tesla and SpaceX CEO added Bitcoin as the only content on his Twitter biography. Amid suspicions that it was a hoax, Musk nonetheless sent BTC/USD skyrocketing for a brief period, the pair adding $5,000 in minutes as users caught on.

The latest interview, however, has seemingly had little impact, with Bitcoin remaining at the lower end of its broad trading corridor which stretches between $30,000 and $40,000.

Huge withrawals leave exchanges

While it remains unknown whether Musk has bought BTC or whether he plans to do so in a personal or corporate capacity, outflows from exchanges continue to signal big players are buying for the long term.

As noted by Danny Scott, CEO of United Kingdom based exchange CoinCorner, and others, a single recent movement out of major exchange Coinbase alone was worth $500 million.

“Are we about to kick off February with another institute buying,” he quizzed on Monday.

A large amount of #BTC just left Coinbase

… large amounts leaving nearly all exchanges really pic.twitter.com/AegGKOMQLS— Alistair Milne (@alistairmilne) January 31, 2021

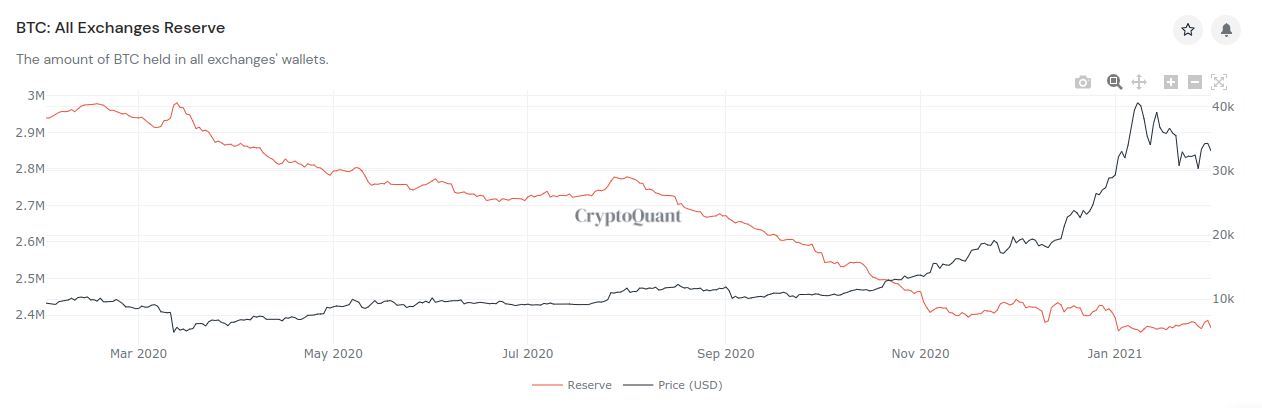

Data additionally shows large amounts of BTC leaving exchanges for private wallets, a classic indicator of the desire to hodl rather than trade or sell.

According to on-chain analytics resource CryptoQuant, meanwhile, the total BTC balance across exchanges is now back at its lowest in at least one year after a brief period of increases.

Altcoins overshadowed by XRP, DOGE

Bitcoin may have to fight for prevalence not with non-crypto investment options but with altcoins in the coming days.

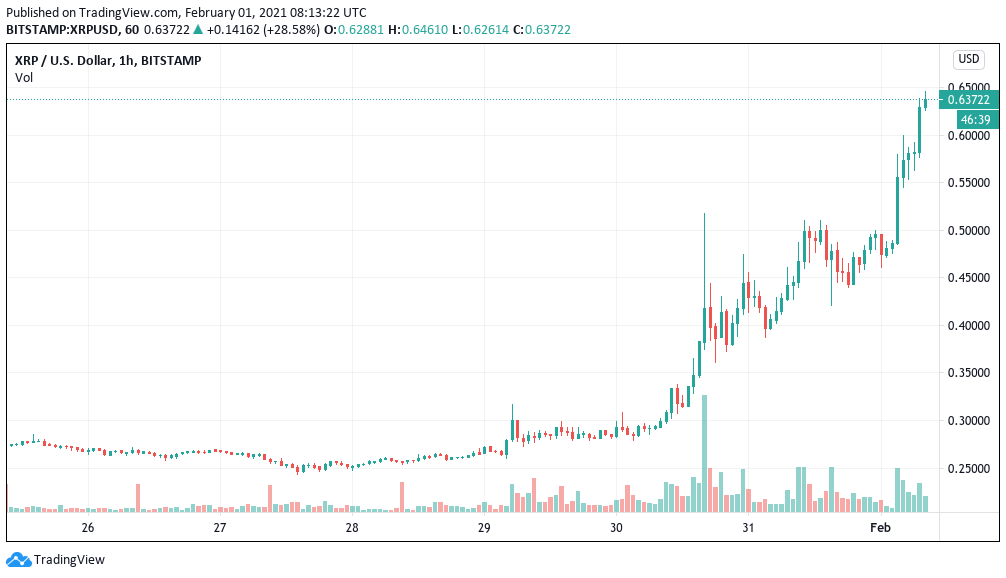

As rumors spread that Reddit investors plan to target XRP this week, the fourth-largest cryptocurrency began outperforming the major market cap tokens on Monday. 24-hour gains have hit almost 40%, marking a comeback for the embattled coin which previously dipped as low as $0.16 from highs above $0.60.

“Today is the day we should be seeing a massive pump on $XRP. My guess: we’ll see 95% of the people lose money on it,” Cryptox Markets analyst Michaël van de Poppe forecast on Twitter.

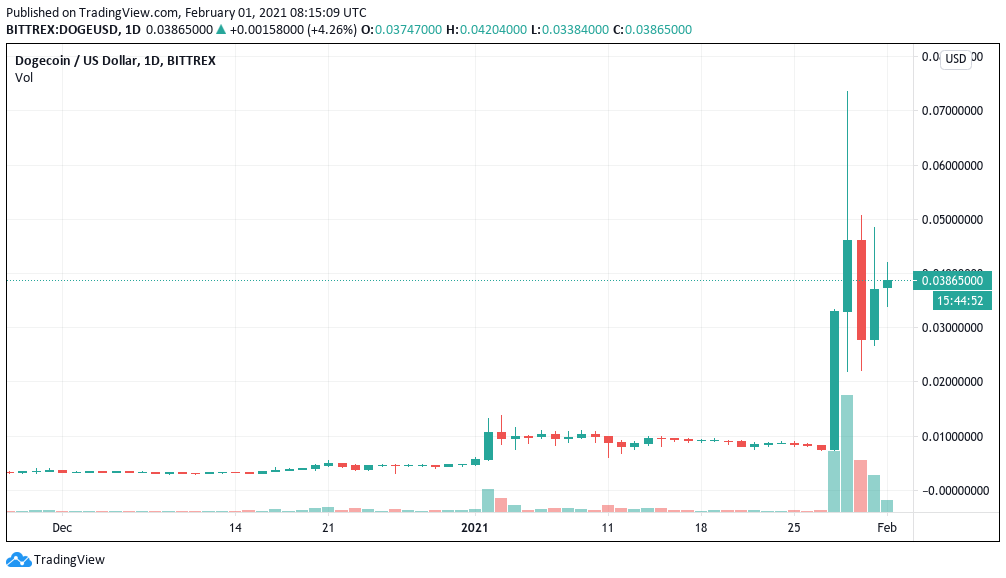

Last week saw a concerted effort to pump the price of meme-based altcoin Dogecoin (DOGE), a trend which continues as DOGE/USD increased 37% on Monday.

The pair is now almost at $0.04, a transformation versus even days ago and an easy new all-time high.

In his interview, Musk, who is responsible for previous lesser DOGE pumps, chose his words carefully about altcoins in general.

“I don’t have a strong opinion on other cryptocurrencies, I mean, I occasionally make jokes about Dogecoin but that was really just meant to be jokes,” he said.

“Dogecoin is made as a joke to make fun of cryptocurrencies, obviously, but fate loves irony.”

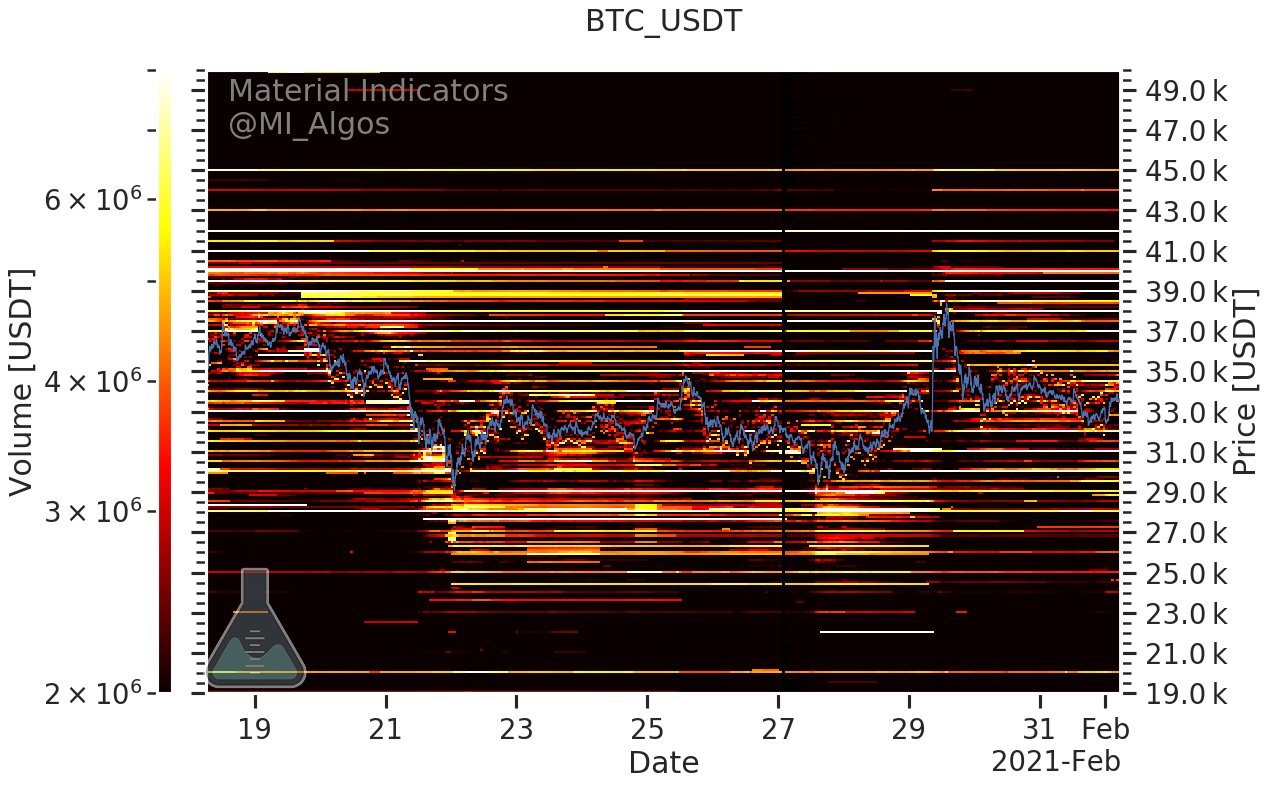

Eyes on $34,000 support flip

Finally, technical analysis of Bitcoin produces clear levels which need to be either reclaimed or avoided to determine market direction.

As Bitcoin has been ranging for several weeks since hitting $42,000 all-time highs last month, commentators are still waiting to see if lower levels need a retest before the overall bull market can continue.

For fellow Cryptox Markets analyst filbfilb and others, $34,000 now forms an essential barrier to flip to support in order to secure further upside.

“Overall Supply weighing down market, until this subsides sellers in control as seen by lower highs and lower lows. LTFs show some attempt to break this but first 34k must be reclaimed,” he summarized on Saturday.

Above $36,700, there is “aggressive selling,” he added, while demand outpaces supply at $30,000 and below.

Data from Binance’s orderbook at the time of writing shows incremental sell pressure from $34,000 all the way to the record highs.