Goodbye, DAI and bitcoin sv. Hello, kyber and cosmos.

A swelling in volume in the crypto markets over the third quarter has changed the list of noteworthy digital assets beyond bitcoin and ether that matter most to traders and investors. That change is reflected in the CryptoX 20.

In the latest revision, based on data from the second and third quarters of this year, five assets were replaced by crypto assets that saw volume surges outpacing even the double-digit gains posted in market volume as a whole.

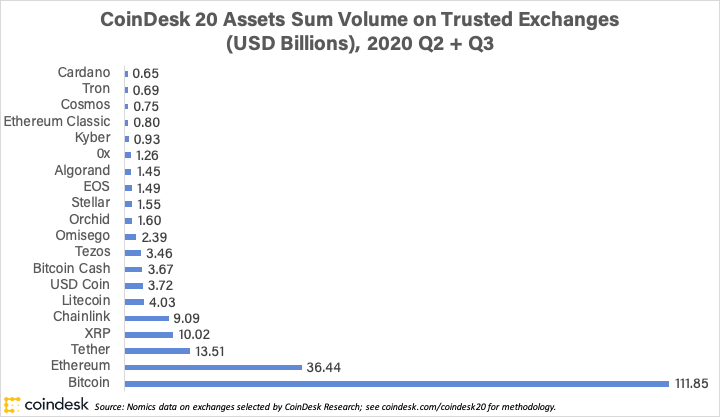

The CryptoX 20 list is designed to represent the assets that matter most to the market. While other rankings use market capitalization, the CryptoX 20 lists crypto assets ranked by market volume over two consecutive quarters, as reported by eight trusted crypto exchanges. The CryptoX 20 represents the 20 assets with the largest amount of consistent, trusted trading volume in crypto. These assets represent about 99% of total volumes on trusted exchanges, and about 90% of the entire sector’s market capitalization.

The new assets are algorand, cosmos, cardano, kyber network and omg network. On average, incumbent CryptoX 20 asset volume increased by 22% from Q2 to Q3. However, these crypto assets’ trusted market volume increased by much more.

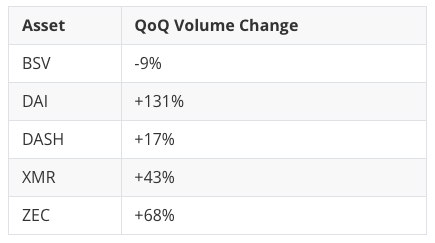

These five new crypto assets replaced incumbent assets that are well-known to crypto investors. Bitcoin sv, a 2018 fork of bitcoin and dai, the decentralized-finance (DeFi) stablecoin issued by MakerDAO, are both off the CryptoX 20. So are all three privacy currencies formerly listed: zcash, monero and dash. Of the five, just one, bitcoin sv, showed a decline in dollar volume on trusted exchanges, between Q2 and Q3.

New CryptoX 20 Assets, Q4 2020, Quarterly Volume Change

Three of the new assets, ALGO, ATOM and ADA, represent “Web 3” infrastructure developers, projects that are potential competitors to Ethereum.

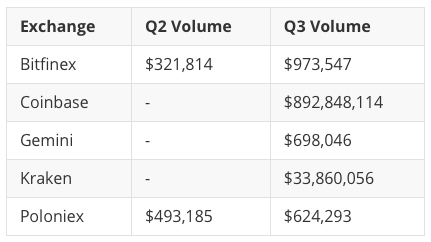

Kyber, in particular, grew by an eye-popping percentage, due to its listing on three new exchanges that are included on our trusted list. Coinbase, in particular, handled impressive volume in the KNC token, which is connected to Kyber Network, a decentralized exchange application.

Kyber 2020 Quarterly Volume by Trusted Exchange

Former CryptoX 20 Assets, Volume Change, 2020 Q3 Over Q2

All three of the privacy coins removed from the CryptoX 20 grew in volume in Q3, but not by the multiples of the average volume growth their replacements recorded. That doesn’t mean DeFi stablecoins and privacy currencies are no longer important or interesting. It means that, at least for now, the verifiable portion of volume in the crypto asset markets has shifted its activity into other assets.

We launched the CryptoX 20 in July; a September revision saw a small amount of turnover, with one Ethereum-based application token, orchid (OXT) moving in to replace another, basic attention token (BAT).

Orchid, which offers a decentralized virtual private network (VPN) service, remains on the list, with volume growing 562%, quarter over quarter from Q2 to Q3.

The CryptoX 20 methodology will be reviewed and revised periodically. If you have questions or comments on the method, please email them to research at coindesk dot com.