It’s been a brutal past 120 minutes for the Bitcoin market.

After holding the $9,800 support for 48 hours, the cryptocurrency began to dive lower approximately two hours ago. From its $9,800 perch, the flagship crypto-asset fell as low as $9,100 on leading Bitcoin exchange Bitstamp — a drop of over 7%. The price has since stabilized around $9,400.

Chart from TradingView.com

This was a crash that few traders anticipated.

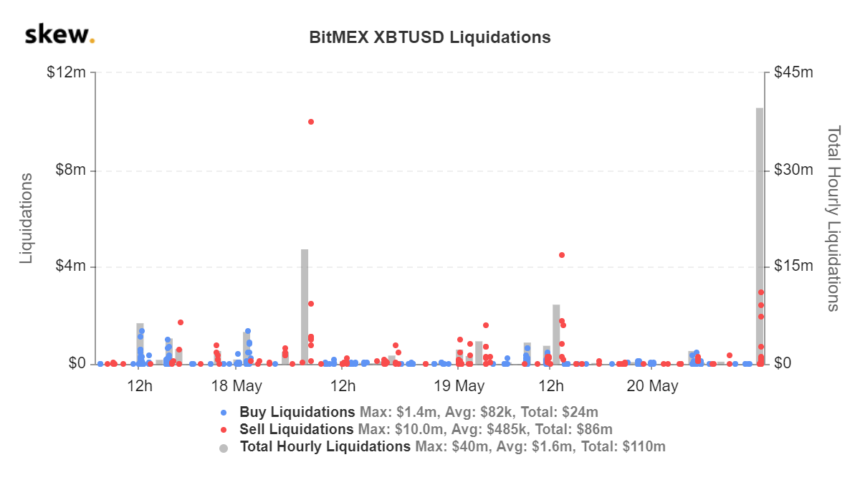

According to data shared by crypto derivatives tracker Skew.com, over $40 million worth of BitMEX long positions were liquidated during this dump lower. Notably, Bitcoin only fell as low as $9,300 on BitMEX compared to $9,100 on Bitstamp, preventing millions more in liquidations.

Liquidations on the BitMEX Bitcoin futures market from Skew.com.

Fears That Satoshi is “Dumping Bitcoin”

Bitcoin’s recent weakness coincides with news that an ancient BTC address, from early 2009, just made an outgoing transaction of 10 coins out of 50 coins. The address involved is from February 2009, and the 50 coins that originally were in the address were obtained by the mining of one BTC block.

Due to the proximity of this address’ age to the launch of the Bitcoin network in January 2009, many were quick to speculate that this is “Satoshi dumping his coins.” For reference, the creator of the cryptocurrency Satoshi Nakamoto is believed to hold over one million coins, obtained by mining over BTC’s first and second years in existence.

“Expect serious volatility. Yeah, panic selling going on,” one trader wrote on the transaction.

The claims that this transaction is related to Satoshi Nakamoto have largely been disproven by chain analysis firms like Glassnode and Coin Metrics through its founder Nic Carter.

Though this reassurance hasn’t resulted in Bitcoin rocketing back up to pre-crash levels, as fears remain that an early BTC holder will dump thousands of coins on the open market.

Related Reading: Crucial On-Chain Metrics: BTC on the Verge of Its Fourth Macro Bull Market

Start of a Larger Reversal

While the movement of “old BTC” was a market catalyst that no one expected, some expect it to be the start of a larger reversal in this nascent market.

As reported by NewsBTC, a trader recently identified four market trends as to why Bitcoin could sustain a “dip” towards the $8,800-9,100 region. They are as follows:

- There is a growing block of resistance in the $9,900-10,600, which could halt any rally trying to surmount this region. Estimates suggest there are dozens of millions of sell orders at that level.

- The funding rates of Bitcoin futures contracts have risen well above zero, indicating a potential market top.

- The “BTC Fear and Greed” index is nearing a two-month high.

- Spot trading of BTC has decreased over recent weeks, signaling slowing momentum.

Related Reading: Turkey’s Economic Turmoil Shows BTC Is a Better Bet Than Emerging Markets

Featured Image from Shutterstock