Most traders fail to understand how Bitcoin (BTC) derivatives exchanges handle their risk. There is a consensus that the winners get paid by the losing parties, but it is not as simple as it seems.

Insurance funds were initially designed to protect clients positions during excessive volatile periods. Nonetheless, some exchanges such as BitMEX display a relatively steady insurance fund hoarding despite significant hourly price swings of 10% or higher.

BitMEX insurance fund vs. Bitcoin. Source: cointrader.pro

The above chart shows that the BitMEX insurance fund (orange line in BTC terms) was nearly unscathed after $1 billion worth of longs were liquidated on March 12.

Every time a position is liquidated due to insufficient margin, it is the exchange’s responsibility to handle this risk, and there are multiple ways to handle it. Most derivatives trading venues opted to create an insurance fund to manage those executions.

This insurance fund profits from liquidations executed better than bankruptcy prices, creating a questionable incentive to manage those orders more actively. This situation can be easily avoided by using stop-loss orders, although most traders fail to do so.

Let’s take a quick look at how BitMEX was able to gather this impressive $330 million pot during massive liquidations events and also how one can avoid becoming a victim.

Liquidation engines are designed to protect the exchange

Truth to be told, high leverage orders usually end up bankrupt in volatile markets. For example, any position using 20x or above must be forcefully liquidated after a 4.8% move. The problem occurs when the underlying asset price sharply moves in a short amount of time or as a result of a void in market liquidity.

The only way a liquidation engine can close a client’s bankrupt position is by executing an inverse order in the market for the same instrument. A $10 million liquidation on a long position means the derivatives exchange must sell that amount in its order book. Any realized loss above the client’s margin will leave the exchange short of funds.

This leaves Bitcoin derivatives exchanges with the option to either take back some of the gains from clients who benefited from this error (known as clawback or auto-deleveraging), or gamble with this risk by taking their chances while expecting the market to recover from high volatility.

Some exchanges designed their insurance fund to have some buffer for such financial constraints, collecting the profits from liquidations executed better than clients bankruptcy price.

Not every derivatives exchange handles liquidations the same way but the gradual liquidation process used by a few major exchanges is definitely a step in the right direction. This is because it is a more proactive approach that increases the odds of a leveraged position surviving through extremely volatile situations.

How to avoid liquidation

First and foremost, traders should never let automatic liquidation engines activate. The only way to achieve this is by manually entering stop losses. Most derivatives exchanges provide an estimated liquidation price for each position so it’s not a difficult thing to do.

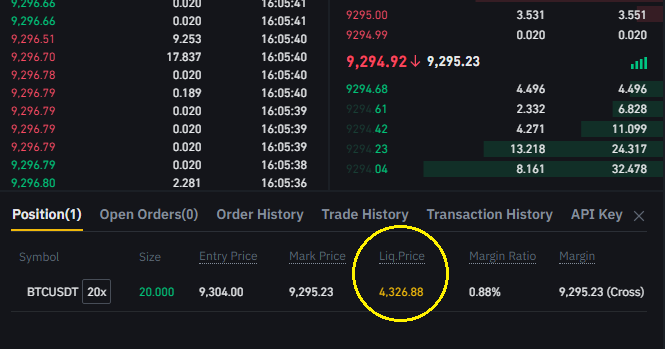

Futures contract liquidation price. Source: Binance Futures

In the example above, the liquidation price for this long position sits at $4,327. A trader should enter a stop sell order above this price to avoid liquidation and it’s also best to reduce the position gradually to prevent high volatility situations.

There’s no golden rule for this stop loss level, although usually a $50 to $300 spread is often used. A stop-loss order for a long position is a sell/short order, whereas a short seller must place a buy order to reduce its position.

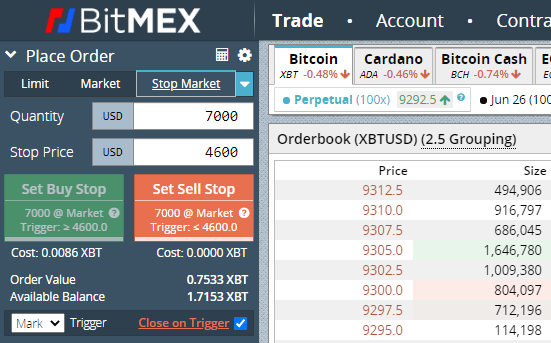

Stop-loss order entry. Source: BitMEX

For stop-loss orders, one should always activate close on triggers, also referred to as reduce-only. This will ensure no additional position is created by mistake, only allowing such order to reduce your exposure.

Another often forgotten setting is the trigger. There are three options: last price, which is based exclusively on the futures contract level, the index price, which is calculated by the average spot price of reference exchanges and the mark price which is composed by the index price plus the interest rate.

One should avoid the last price option as future contracts might differ from underlying asset prices.

Trade safely by managing size

Using excessive leverage when trading future contracts is exposing your capital to unnecessary risk and some exchanges manage liquidations very aggressively. To prevent this scenario, one can actively manage the position and its stop-loss orders.

Not every derivatives exchange handles liquidation the same way, so it is crucial to understand this process.

The mere existence of an insurance fund does not translate to more security for exchange clients. It all depends on how this risk is managed under extremely volatile situations.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.