Bitcoin (BTC) is showing tenacity above $50,000 on March 25. The 10% drop over the last 24 hours happened despite Tesla allowing customers to buy vehicles using BTC in addition to CEO Elon Musk affirming that it will not be converted to fiat currency.

On March 22, the United States Federal Reserve chair, Jerome Powell, stated that Bitcoin was too volatile, “backed by nothing,” and more of an asset for speculation. Curiously, on that same day, BTC lost its $56,000 support, which became a resistance.

Traders worry that the pump might have been news-driven, while the downtrend movement shall prevail. Although this is possible, derivatives indicators aren’t leaning bearish, and any decent correction will likely meet strong support at $50,000.

Part of the uncertainty investors might have derived from the record $6.1 billion options expiry on March 26. Nevertheless, 84% of the neutral-to-bearish put options are already deemed worthless as BTC price soared above $50,000.

Moreover, CME holds $980 million futures contracts set to expire on the same day. Although buyers (longs) and sellers (shorts) are matched at all times, some traders worry that BTC prices could be pressured by futures traders looking to roll over their positions into April and May.

Unlike perpetual futures, those fixed-calendar CME contracts have a set expiry date. Thus, to maintain a long position, one must buy the April or May futures while simultaneously selling the March contract.

Thus, to better assess whales and arbitrage desks influence on the market, one should closely monitor derivatives indicators.

The futures premium remains bullish

By measuring the expense gap between futures and the regular spot market, a trader can gauge the level of bullishness in the market.

The three-month futures usually trade with a 10% to 20% versus regular spot exchanges to justify locking the funds instead of immediately cashing out. Whenever this indicator fades or turns negative, known as “backwardation, it indicates that the market is bearish.

The above chart shows that the indicator recently bottomed at 17% on March 25 while BTC tested the $50,000 support. This is extremely bullish as it signals leveraged buyers remained optimistic and unwilling to reduce their positions.

Whenever the basis reaches 35% or higher, it indicates extreme buyers’ leverage, but that’s clearly not the case right now.

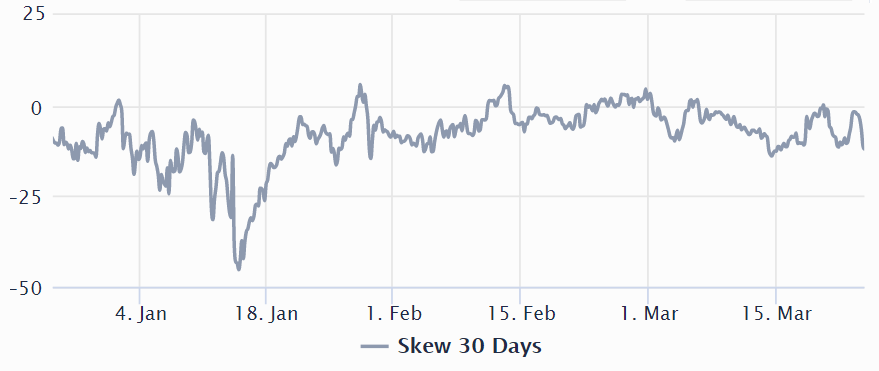

The options skew has been neutral since Jan. 19

When analyzing options, the 25% delta skew is the single-most relevant gauge. This indicator compares similar call (buy) and put (sell) options side-by-side. Some analysts point to the put-to-call ratio, but this metric fails to exclude worthless options such as a right to sell BTC at $45,000.

Thus, delta skew offers a less polluted number and will turn negative when the put options premium is higher than similar risk call options. Such a positive skew translates to a higher cost of downside protection, indicating optimism.

The opposite holds when market makers are bearish, causing the 25% delta skew indicator to gain positive ground.

Over the past five weeks, the skew indicator remained flat, indicating no optimism or pessimism from whales and option market makers. A skew indicator between negative 10 and positive 10 is deemed neutral, meaning a balanced risk assessment.

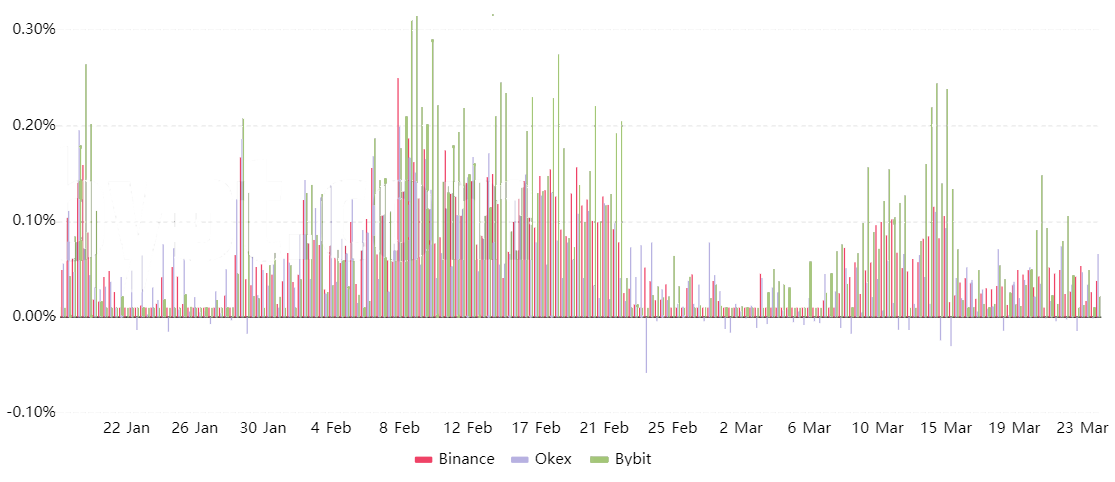

Retail traders are not behind the high futures’ basis

As futures and options provide mixed sentiment, one should also monitor the perpetual futures funding rate. Such a fee is charged every eight hours to ensure derivatives exchanges hold no risk imbalances. Wherever it turns positive, it means buyers (longs) are the ones paying the carry cost due to larger leverage use.

The current 0.04% average is relatively neutral, equivalent to 0.8% per week. Although longs are the ones facing such fees, it is far from being considered costly. Such data indicates that retail traders are not creating an arbitrage opportunity causing fixed-calendar futures to trade at a premium.

Overall, derivatives indicators are healthy considering BTC is down 16% from the $61,800 all-time high on March 13. Such data leaves room for further buying activity, so traders shouldn’t consider the current as anything out of the ordinary.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.