- The concentration of tech companies in the U.S. stock market has soared to a new high, surpassing dot-com era levels.

- Tech stocks surpassed the valuation of the entire European stock market.

- The tech sector still has firepower left as positive earnings and struggling offline businesses buoy investor sentiment.

Tech stocks are showing no signs of slowing down after surpassing the entire stock market valuation of Europe. Three key catalysts could fuel more gains in the near term.

Investors are reluctant to short stocks, offline businesses are continuously declining, and tech stocks’ dominance has hit a new high. All of these factors benefit the surging tech market.

Factor #1: Big Tech Dominance Hits Record High

Following the explosive growth of “Big Tech” since March, analysts drew comparisons between the ongoing rally and the dot-com bubble.

Data show that tech stocks are far more dominant than they were during the early 2000s. This time around, superior earnings are supporting the rally of the tech sector.

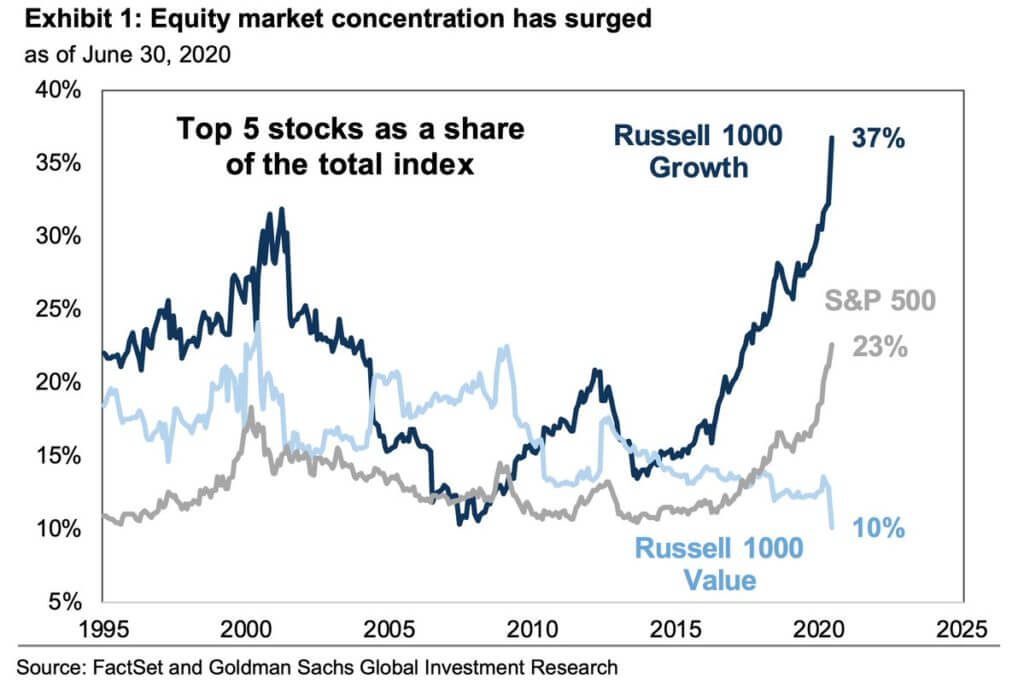

According to Welt’s market analyst Holger Zschaepitz, the five most significant tech stocks account for 23% of the S&P 500. That is substantially higher than the dot-com bubble’s 18% two decades ago:

Tech is eating the world: The 5 largest stocks – FB, AMZN, AAPL, MSFT, GOOGL – now account for 23% of S&P500, well above the high of 18% in 2000’s, Goldman says. Concentration appears even more extreme within Russell 1000 Growth Index. Those same 5 stocks represent 37% of market cap.

Tech stocks are more dominant in the current stock market landscape than in the dot-com bubble, so some analysts say the comparison isn’t accurate.

Analysts at JPMorgan Cazenove, the bank’s equity research business, said they are skeptical about forecasts calling for a correction.

In contrast to the 1990s, the analysts said that the “current rally has been supported by strong earnings delivery.”

The continued strong performance of Big Tech reduces the probability of a widespread profit-taking pullback.

In the short to medium term, Wall Street analysts expect many tech stocks to rally off positive earnings.

Most recently, Wedbush’s Daniel Ives upped his bull case for Apple (NASDAQ:AAPL) to $700. He said the iPhone 12 launch would result in Apple’s “most significant product cycle.”

Factor #2: Offline Businesses Continue to Suffer

New economic data hint at a slow economic recovery due to the resurgence of COVID-19.

The eurozone economy is on track to see its fastest quarterly rebound since 1995, says Oxford Economics. But several major European economies, including Spain and France, have are seeing soaring new virus cases.

If the number of new cases increases steeply heading into the fourth quarter, it might become more challenging to reopen offline businesses.

Schools, cinemas, restaurants, hotels, and other travel-related businesses have faced various restrictions since March.

Jefferies economist Marchel Alexandrovich said the possibility of a V-shaped recovery depends on the handling of the virus.

Factor #3: Investors Now Scared to Short

To top it all off, short positions in the U.S. stock market have declined to levels unseen for over ten years.

The Fed’s “good news” around inflation targeting is boosting market sentiment. Watch the video below.

The Federal Reserve’s highly accommodative monetary policy and Big Tech’s continued dominance have caused investor confidence to surge.

Against this backdrop, the tech sector is poised to outperform the broader market, especially as earnings recover while the broader economy continues to struggle.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.