- Yves Lamoureux expects another U.S. stock market sell-off as wealthy investors start to retake profits.

- The Nasdaq Composite has increased by 55.5% since March 23, despite the 11.481% drop in September.

- High-net-worth individuals are likely sitting on decent profits, as stocks become vulnerable to a COVID-19-induced pullback.

Analysts anticipate a new wave of profit-taking in the stock market, despite the Nasdaq’s 11.481% drop this month.

According to the macroeconomic research firm Lamoureux & Co.’s president Yves Lamoureux, wealthy investors are beginning to retake profits.

The dwindling stock market sentiment, combined with high-net-worth individuals’ selling pressure, could cause another pullback in stocks.

Factor #1: Wealthy Investors Are Selling Stocks

In an interview with MarketWatch.com, Lamoureux said rich investors are selling stocks amid rising speculation in the stock market.

Although tech-heavy indices fell by 9% to 11% in September, the Nasdaq still increased by 55.5% since March 23. That means many wealthy individual investors are likely sitting on profits despite the recent pullback.

Based on the growing concerns in the stock market regarding various fundamental issues, Lamoureux expects another sell-off. He said:

“So we have a second wave coming, we have very wealthy people taking profits [on stocks] and we see a lot of speculation in the market. I think the market is going to start to go down again.”

But Lamoureux does not anticipate a rapid correction in a short period, like the latest correction. He suggested that the new pullback phase could bridge over to 2021.

The strategist also hinted that investors’ optimistic expectations in the aftermath of the pandemic could be premature.

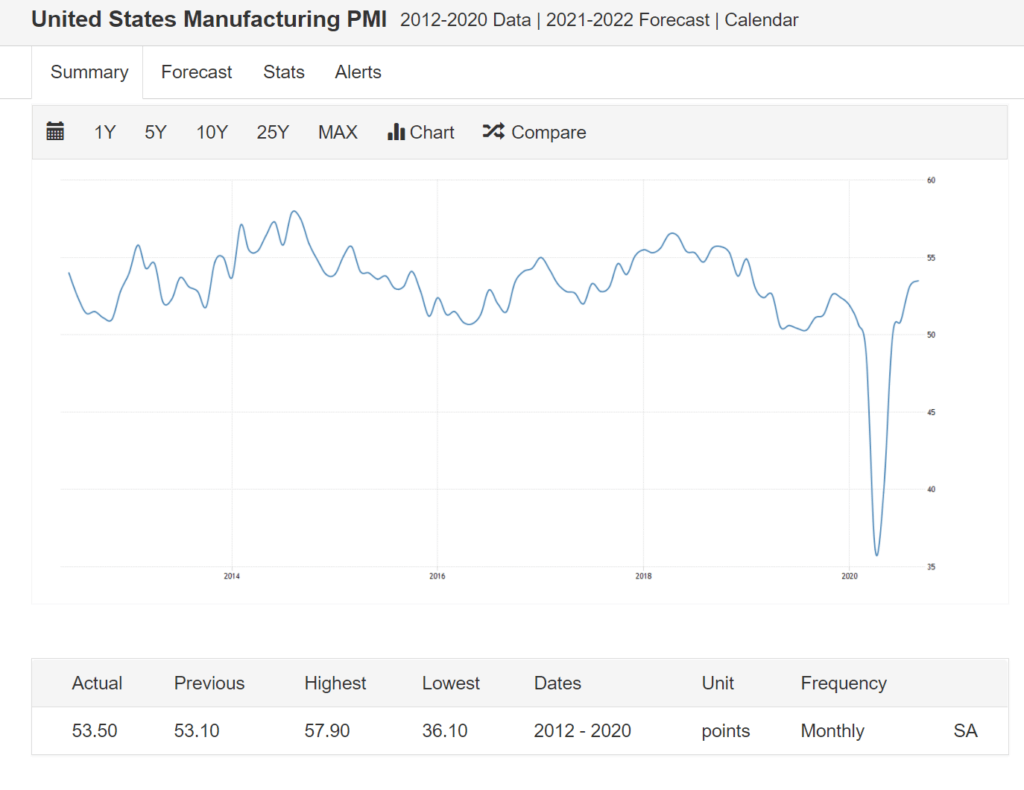

The pandemic severely hindered major supply chains, millions of small businesses, and large-scale manufacturers.

An escape from the pandemic would kickstart a recovery phase, but it would take time for all sectors to rebound. He asked:

“Eventually we’re out of the pandemic, but we’re facing these three big threats that are as big as the pandemic. What do you expect once you get out of this pandemic?”

Atop the fear about the declining business productivity and economic growth is the continuous increase in virus cases.

Factor #2: COVID-19 Resurgences is Rattling the Stock Market

Two persistent themes behind the stock market drought heading into 2021 would likely remain the pandemic and the election.

The election has fueled significant uncertainty in the markets, as CCN.com previously reported. The struggle of Europe and the U.S. to reach a clear peak in COVID-19 places additional pressure on stocks.

The stock market is reaching an unprecedented territory where it has to offset the slowing economy for a relief rally.

But as factories and major manufacturers attempt to resume their operations fully, scientists are warning against COVID-19 figures. Epidemiologists say that the U.S. baseline cases are substantially high, and the increasing daily cases pose a severe risk.

John Hopkins is encouraging the U.S. to refocus the national COVID-19 strategy. Watch the video below:

A recent study from Texas suggested that the mutation of COVID-19 could be evolving to bypass masks and hand-washing.

Factor #3: Not Even the Fed Can Calm the Markets

The Federal Reserve is noticeably trying to calm the markets by ensuring low-interest rates.

On September 24, as CCN.com reported, Fed Vice Chair Richard Clarida said the rates might stay low for longer. He said:

“We could actually keep rates at this level beyond that, but we are not going to even begin thinking about lifting off until we get observed inflation equal to 2%.”

Yet, the stock market has barely reacted to the Fed’s reaffirmation of a dovish stance.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.

Samburaj Das edited this article for CCN.com. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us.