After an agonizing 35% loss in the past 24-hours, Bitcoin (BTC) finally bounced at $30,000 earlier today in the May 19 trading session. A total of $3.5 billion in liquidations took place, which might have accelerated the movement, but they can’t really be entirely blamed for the move.

However, the weakness in derivatives markets did give some strong signals that panic was instilled, causing unsustainable levels. These can be measured by the price gap between the futures markets and regular spot exchanges, along with the negative funding rate on perpetual contracts.

Multiple culprits catalyzed the drop, including Elon Musk, Tether and U.S. regulation

Pinpointing the exact culprit of the price movement is a daunting task, although Elon Musk’s remarks on Bitcoin mining coal usage likely played some role. However, May 19 marked the deadline for Tether Holdings Limited’s breakdown of Tether’s (USDT) reserves to the Office of the New York Attorney General.

Caitlin Long, founder and CEO of Avanti Financial, stated that traders might have felt compelled to sell other cryptocurrencies to reduce their total risk exposure given the credit risk that emerged from Tether’s reserve disclosure.

As reported by Cryptox, regulatory uncertainties entered the spotlight earlier this month when United States Treasury Secretary Janet Yellen and Securities and Exchange Commission Chair Gary Gensler expressed their concerns about the cryptocurrency sector.

On May 18, a banking and trade association under the People’s Bank of China issued a statement titled “Preventing the risk of virtual currency transaction speculation.” It then went on to call on member institutions to abide by existing regulatory provisions regarding digital currencies.

Futures markets finally showed signs of stress

The combination of these bearish factors resulted in the 50% correction seen in the past nine days, and its impact on futures markets finally showed clear signals of exhaustion. By analyzing the futures markets’ price difference versus regular spot exchanges, one can better understand how the price move has impacted professional traders.

Typically, the three-month futures should trade with an 8% to 15% annualized premium, comparable to the stablecoin lending rate. By postponing settlement, sellers demand a higher price, causing the price difference.

Over the past couple of weeks, the indicator sustained above the 8% level, signaling confidence. However, during the dip to $30,000 on May 19, the situation changed drastically as a backwardation emerged for the first time in a year. In this case, the futures markets trade below the regular spot exchange prices — a very concerning situation.

As the futures premium quickly reestablished a healthy 7% level, one might conclude that it had been caused by stop loss and liquidation orders that pushed the price down to $30,000.

Retail traders have also been stopped out

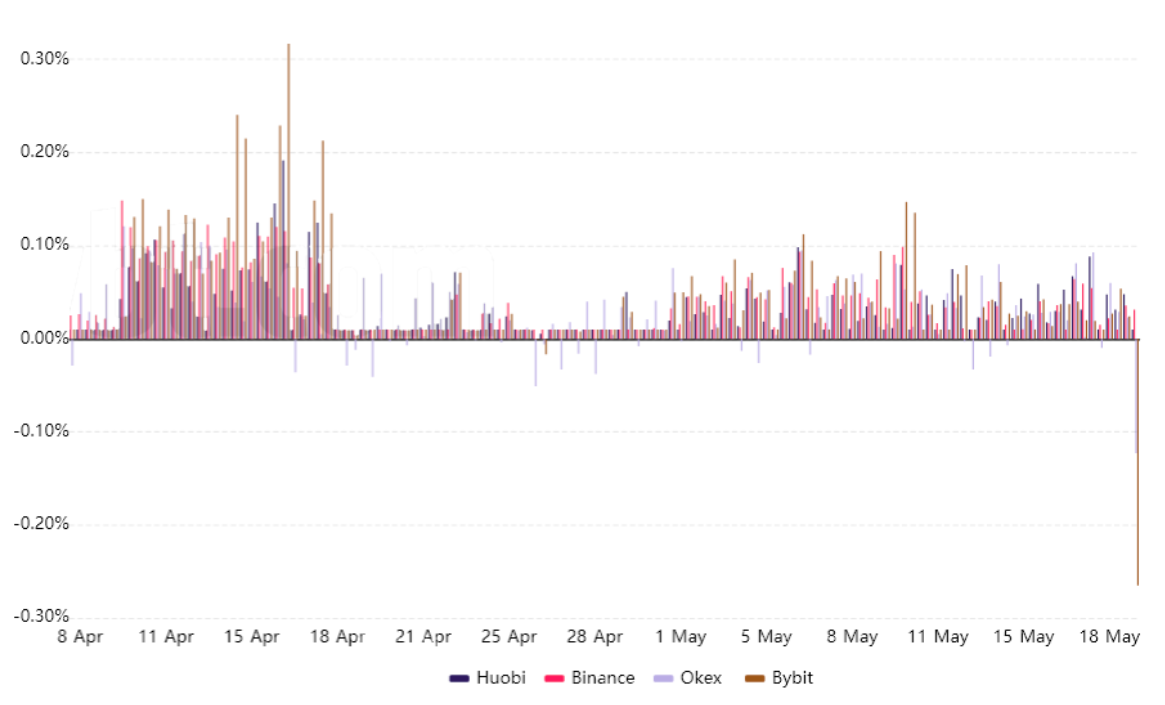

To better assess whether this movement was something specific to the monthly and quarterly futures, we should look at the perpetual futures contracts. These derivatives, also known as inverse swaps, have an embedded rate usually charged every eight hours to ensure there are no exchange risk imbalances.

Whales, arbitrage desks and market makers avoid exposure on these contracts due to their variable funding rate. When longs demand more leverage, they are the ones paying the fee. The opposite holds when shorts are using more leverage, thus causing a negative funding rate.

As shown above, the indicator entered unsustainable levels, as a -0.20% rate equals a 4.3% weekly fee paid by short-sellers. This situation is seldom sustainable for more than a couple of days, as it incentives buyers to enter long positions.

Both the U.S. regulatory uncertainty and Office of the New York Attorney General’s action on Tether’s disclosure might take months or years to develop. Meanwhile, China’s actions show no difference from the September 2017 move when the country announced the shutdown of all exchange operations and initial coin offerings.

Thus, considering the negative futures premium and perpetual contracts funding rate impact, it is safe to say that $30,000 was the rock bottom of liquidations.

The 54% price correction from the $64,900 all-time high marks the exaggerated market reaction to speculation rather than the reaction to news that could harm Bitcoin’s functionalities and importance as a scarce, censorship-resistant asset.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk, and you should conduct your own research when making a decision.