Ripple (XRP) Price is hovering above the $0.50 on Friday Jan. 26, with monthly losses approaching the 20% mark, market indicators signal imminent rebound phase.

Since hitting a peak of $0.63 on the opening day of 2024, XRP price has entered a steep 19% correction phase as it tumbled toward the $0.50 area at the time of writing Jan. 26.

However, vital market signals show that the sixth-largest crypto asset by market capitalization could now be on the verge of a major rebound phase.

After month-long retracement, XRP is approaching oversold territory

XRP holders have endured a 19% price correction, between Jan. 1 and Jan. 26. The negative performance has come on the back of rumbling controversy surrounding Ripple’s long-running legal run-ins with the US Securities and Exchange Commission (SEC), as well as the overall tepid sentiment that gripped the crypto market in the aftermath of the spot Bitcoin ETF approval.

However, after a month-long correction phase, market indicators now suggest that XRP is approaching oversold territory and could be on the verge of an imminent rebound.

The relative strength index (RSI) is a technical indicator used in financial markets to assess the magnitude and velocity of recent price changes, helping traders identify overbought or oversold conditions in an asset. It is measured on a scale from 0 to 100, with levels above 70 indicating overbought conditions and levels below 30 indicating oversold conditions.

On Jan. 26, XRP relative strength index (RSI) technical indicator tumbled below the 30 threshold, suggesting the local bottom has been reached.

When an asset approaches oversold territories, strategic investors may consider it perfect timing to buy in at the bottom. This rapid inflow of funds then inadvertently triggers a rebound.

A closer look at the chart above reveals that Sep. 11, 2023, was the last time XRP RSI dropped below 30. And notably, it was quickly followed by a double-digit price rally before the end of the month.

If this pattern repeats, XRP price could experience a substantial upswing in the coming weeks.

On-chain signal suggests XRP market cap is now undervalued

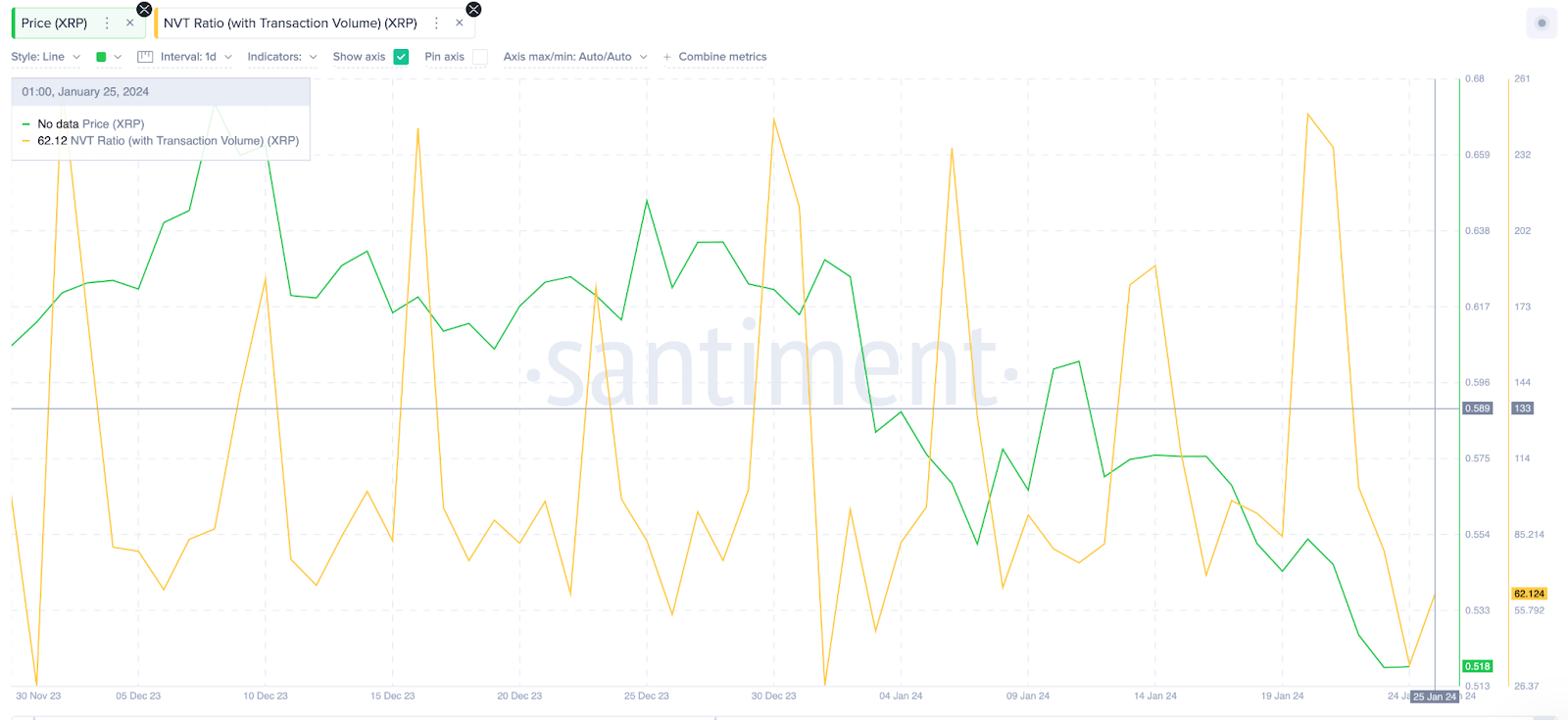

The network value to transactions ratio is another vital market signal highlighting XRP’s current undervalued status. This metric compares the market capitalization of an asset to the economic value of transactions currently being executed on the network.

XRP Network Value to Transactions Ratio (NVT Ratio) is currently trending at 62.1, its lowest for the month, according to the latest data culled from Santiment. This is a prime indication that XRP market cap is now undervalued compared to the level of transactions executed on the network.

Typically, a decline in NVT ratio during a price downtrend is an indication that the price decline has not been driven by a commensurate deterioration in network usage and fundamental growth traction.

The rapid drop in the NVT ratio, as observed above, suggests the underlying asset is currently undervalued in comparison to its current economic utility. This scenario often plays out during periods of widespread negative speculative trading and market-wide bearish sentiment.

XRP price forecast: bulls could target 20% gains

In summary, the RSI and NVT ratio both point towards XRP price approaching oversold territory. Within the current conditions, the majority of current holders become less likely to sell as loss margins widen, while strategic new entrants may also consider it perfect timing to buy-in at the bottom.

A combination of these data-driven factors could send XRP price into a major rebound phase toward $0.60 the coming weeks.

The Bollinger band technical indicators also affirm this positive outlook. As things stand, XRP price is approaching a major reversal point at the lower Bollinger band at $0.50.

If the bulls can stage a rebound as predicted, XRP price could hit the 20-day simple moving average (SMA) at $0.56 before facing a major resistance. A decisive breakout of above that area could see XRP price rise 20% toward $0.60.

Still, things could take a more negative turn if the bulls fail to stage a rebound from the $0.50. If that psychological support caves in, XRP price could drop sharply toward the next psychological resistance at $0.45.