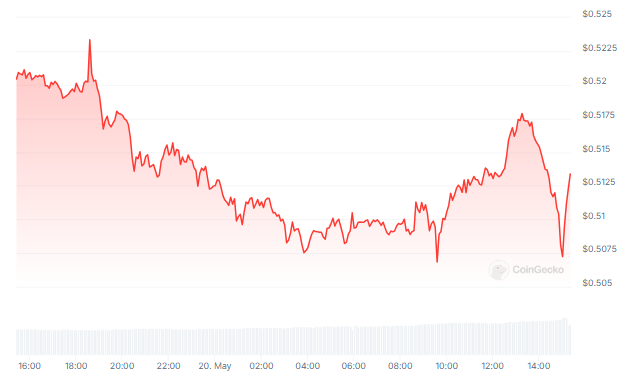

The price of XRP, the native token of Ripple, seems to be teetering on the edge of a short-term decline, according to an analysis of on-chain data by NewsBTC. While bulls might want to hold their horses, the report paints a picture of a market potentially succumbing to selling pressure in the immediate future.

RR

Whales Shedding Weight: A Bearish Signal?

The report raises a red flag with the movement of XRP in large wallets. Investors holding between 100,000 and 1 million XRP have been noticeably reducing their holdings. This suggests a potential increase in sell pressure, as these “whales” unload their tokens onto the market.

The combined holdings of this group now represent a smaller percentage of the total circulating supply, which could lead to a temporary glut of XRP and a corresponding price drop.

The behavior of these large XRP holders could indicate a shift in market sentiment, prompting concerns about the future stability of XRP prices. As these whales liquidate their positions, the market could face increased volatility, with prices reacting sharply to the influx of sell orders.

Additionally, the reduction in whale holdings might signal a lack of confidence in XRP’s short-term prospects, potentially discouraging smaller investors from maintaining or increasing their positions.

Open Interest and Active Addresses: Not Shining a Bullish Light

Further dampening the enthusiasm for XRP is the Open Interest (OI) metric. OI refers to the total value of all open positions in XRP futures contracts. A decrease in OI, as observed recently, signifies a decline in market activity and potentially more sellers closing their positions.

CC

This trend aligns with the dwindling number of active addresses on the XRP network. Active addresses represent the unique number of wallets involved in XRP transfers within a specific timeframe. A recent drop in active addresses suggests a decrease in overall market participation, which can often precede a price slump.

RR

Volatility: A Double-Edged Sword

A silver lining some might see is the recent spike in XRP’s one-day volatility. Volatility can be a double-edged sword, however. While it can indicate heightened market activity and potentially lead to price surges, the current situation seems to be leaning towards the opposite.

The rise in volatility, coupled with the selling pressure and declining participation, might simply reinforce a downtrend rather than spark a price increase.