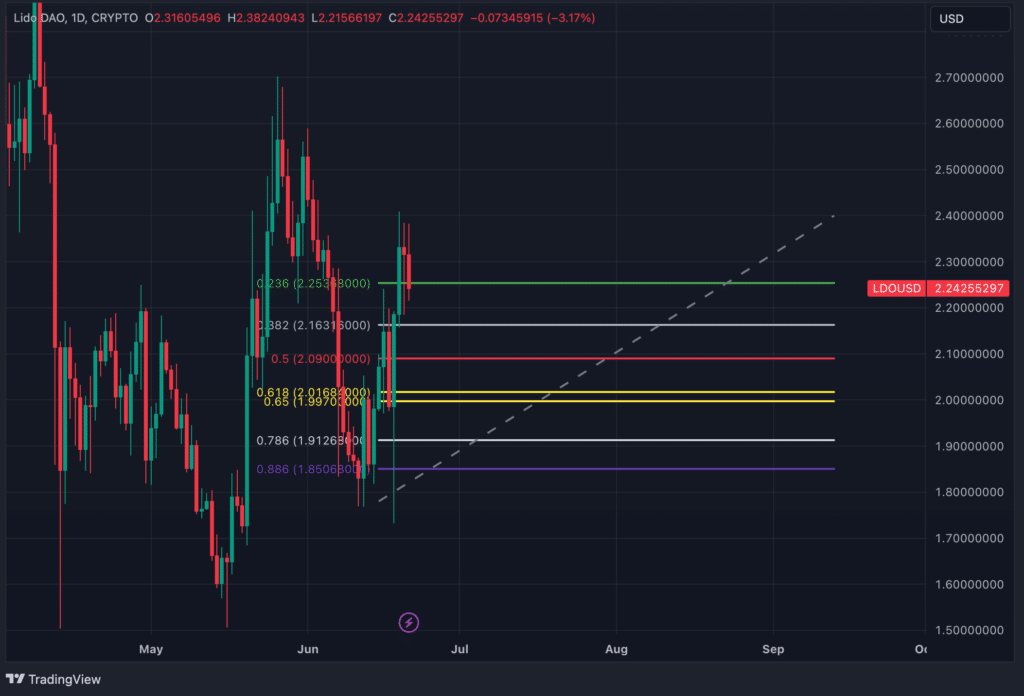

As of June 21, 2024, Lido has experienced a surge of 20.57% in the past seven days. However, the likelihood of continued upward movement seems limited. The primary factor is its proximity to a historical resistance level at $2.30 on the daily timeframe. This resistance level has historically posed a significant barrier, and without a decisive breakout above $2.30 and, subsequently, $2.40, sustained upward momentum remains doubtful.

Technical Indicators

Resistance and Support Levels

- Current resistance: $2.30

- Additional resistance: $2.40

- Support level: $2.00

Relative Strength Index

The current RSI is approaching the historical resistance level of 60. This suggests that the price is entering overbought territory, which could limit further gains.

Fibonacci Retracement

If Lido fails to break through $2.30 and $2.40, a drop to the Fibonacci retracement levels between $1.997 and $2.016 (golden pocket) is likely.

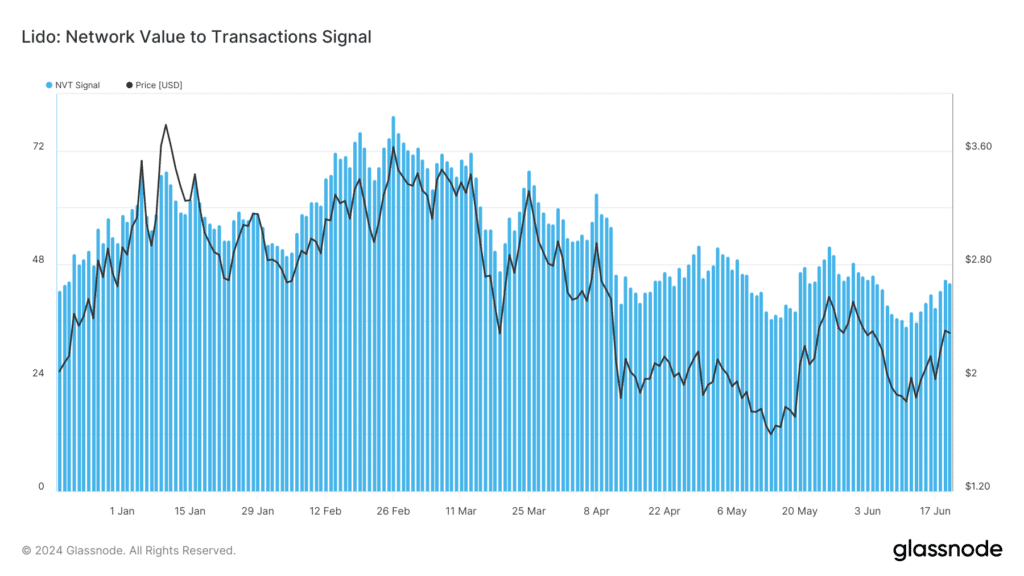

Network Value to Transactions Signal

The NVT signal is a key metric for evaluating Lido’s valuation. An NVT signal above 55 indicates overvaluation, while a signal below 25 suggests undervaluation. As of June 21, 2024, Lido’s NVT stands at 44, up from 35 a week ago, indicating it is currently fairly valued. The NVT ratio peaked at 79.5 in March, which demonstrates the potential for an upside, but current market conditions and historical performance suggest otherwise.

Historically, the period from June to September tends to be slow for the cryptocurrency market, with an average return of 1.45%. Given that Lido’s performance often correlates with Bitcoin and especially Ethereum, major movements in these cryptocurrencies could impact Lido’s price trajectory.

- Bitcoin and Ethereum Trends: If Bitcoin and Ethereum experience downturns, Lido is likely to follow suit.

- Ethereum Staking: As a staking platform for Ethereum, Lido’s performance is closely tied to Ethereum’s market movements.

Strategy

Considering the current market analysis, it is advisable to adopt a cautious approach:

- Short Position: Given the strong resistance at $2.30, consider going short on Lido at the current levels.

- Reentry Point: Look to reenter around the $2.00 support level, provided it holds this line.

- Monitoring BTC and ETH: Keep a close watch on the broader market trends, particularly Bitcoin and Ethereum, as their movements will likely influence Lido’s price.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.