Cardano price has made a swift recovery to $0.54 after hitting a 50-day low of $0.43 on Jan. 23, speculative traders are betting big on further gains.

After two weeks of active Bitcoin ETFs trading, the dreaded sell-the-news cycle that saw the global crypto market capitalization shrink by more than $270 billion between Jan. 11 and Jan. 23 appears to have cooled. The $180 billion uptick in the past week has raised optimism across the altcoin markets.

Layer-1 altcoins lead the crypto market resurgence

As the crypto market entered recovery mode this week, prominent Layer-1 coins, including Solana (SOL), Avalanche (AVAX), and Cardano (ADA), have been at the forefront of the rally.

With 24.1% and 20.2% gains, respectively, Avalanche and Solana have collectively added $14.9 billion in market capitalization between Jan. 23 and Jan. 30.

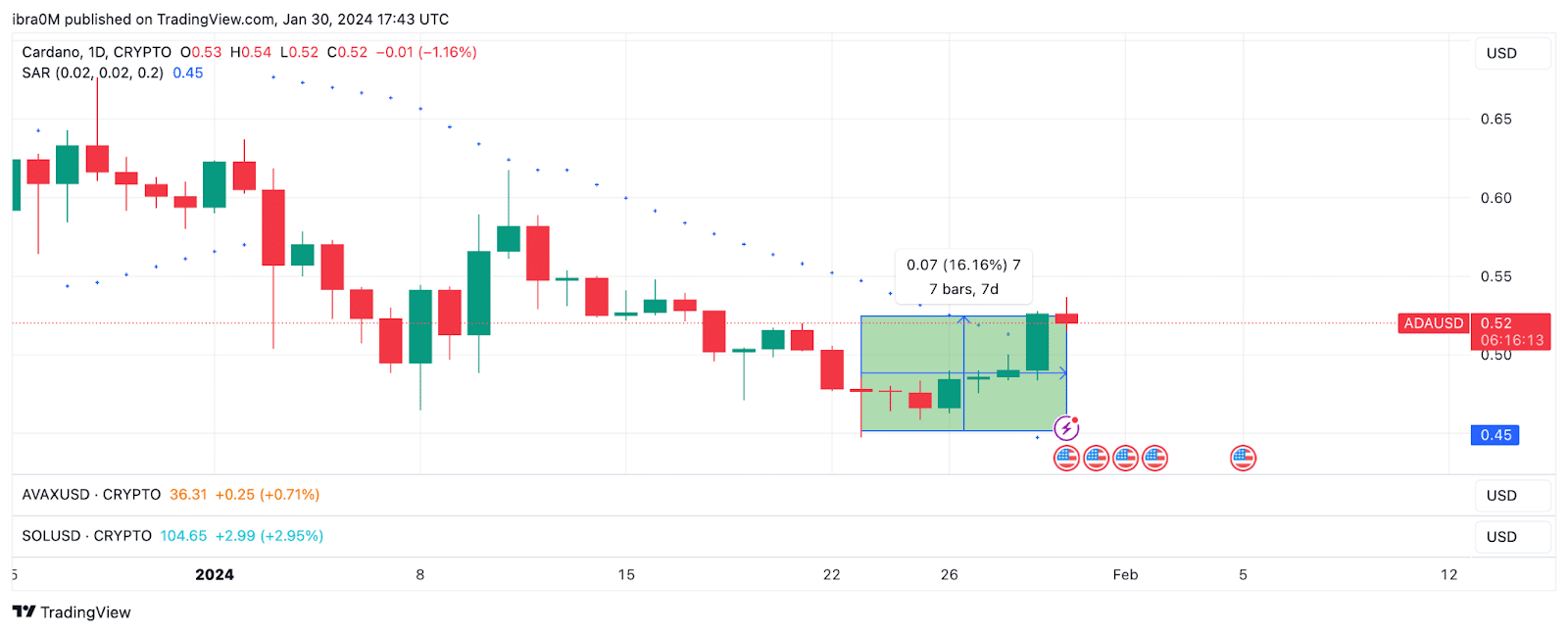

The chart below notably shows that ADA price is trailing with a lower 16% jump.

While Cardano’s 16.2% increase to a $2.2 billion market cap over the past week is nothing to scoff at, vital derivative market data trends observed on Jan. 30 suggest that ADA price could be next in line for a major breakout.

Cardano records 800% spike in funding rate

Cardano and its rival mega-cap layer-1 coins have stolen the show in the crypto spot markets this week, adding billions of dollars in market capitalization. But looking beyond the price charts, derivatives traders appear to be placing unusually large bullish bets on an imminent ADA price breakout.

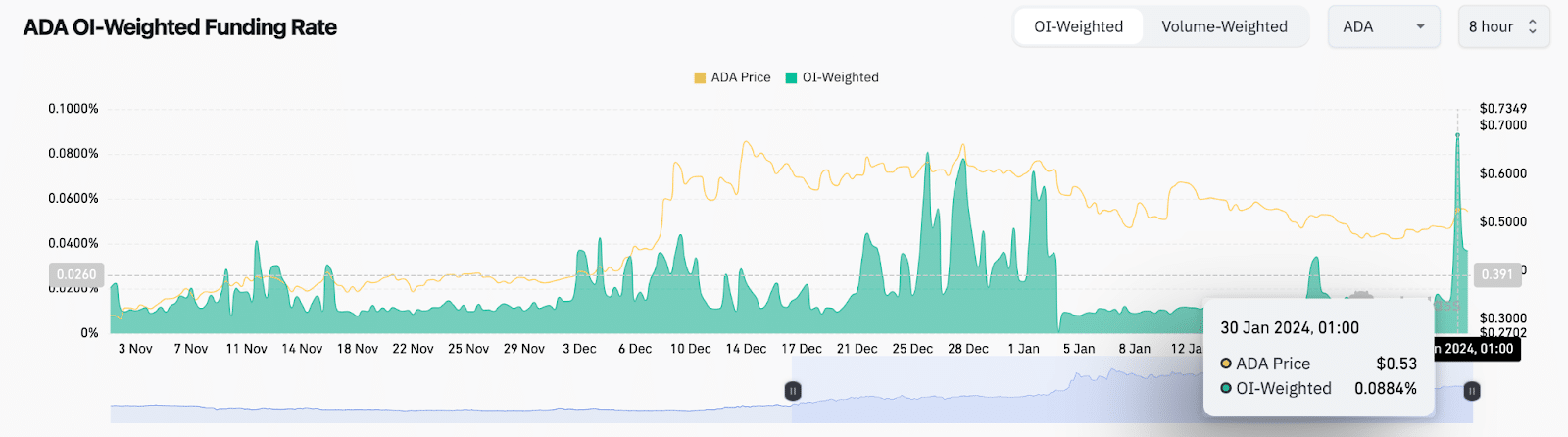

CoinGlass’s funding rates metric tracks changes in fees paid by futures contract holders to opposing parties, providing insights into market dynamics and dominant sentiment among traders.

Positive funding rates mean that LONG position holders pay short traders to keep their positions open, anticipating that prices will increase and result in larger profits.

The chart below shows that Cardano’s open-interest weighted funding rate rose 800% to hit 0.09% on Jan. 30 after maintaining an average of 0.01% since Jan. 2.

The chart above shows bullish speculative traders pay record fees to keep their LONG ADA positions active. Such a rapid increase in positive funding rate often occurs when speculative traders rapidly react to a bullish catalyst.

Given the dominant bullish momentum observed in rival layer-1 altcoin markets this week, this could indicate that traders are betting big on ADA price, potentially catching up to AVAX and SOL, both of which have delivered superior performance.

The historical data trend in the chart also affirms that ADA price has often made a leg-up whenever the Cardano funding rate has recorded comparable spikes.

Cardano price forecast: All eyes on $0.60 resistance

From an on-chain perspective, the current Cardano price uptrend can be attributed to bullish headwinds surrounding the altcoin markets, and the rising funding rates could propel it further.

The Parabolic Stop and Reverse (SAR) technical indicator supports this Cardano price prediction. When the Parabolic SAR dot points below an asset’s current price, it indicates a growing bullish momentum.

In this case, the ADA Parabolic SAR dot pointing to $0.45 while the current price is $0.52 aligns with the bullish on-chain prediction.

Traders may interpret this as a buying opportunity or a signal to go long in the derivatives markets, anticipating further Cardano price appreciation.

If this scenario is predicted, the bears can mount initial resistance at the $0.55 milestone price. However, a decisive breakout could set off margin call triggers and short squeeze alerts, possibly sending ADA prices above $0.65 for the first time in 2024.

Conversely, the bears could invalidate this optimistic price forecast if a downswing below $0.40 is forced.

However, as outlined by the SAR chart, the support at $0.45 could prove daunting. Traders taking highly leveraged positions could make frantic purchases to avert major losses once prices approach the $0.45 area, likely triggering another price bounce.