Bitcoin (BTC) starts a new week still in holiday mode with United States financial markets off for Independence Day.

The largest cryptocurrency, stuck below the increasingly daunting $20,000 mark, continues to feel the pressure from the macro environment as talk of lower levels remains omnipresent.

After a quiet weekend, hodlers find themselves stuck in a narrow range while the prospect of a breakout to the upside appears increasingly hard to believe.

As one trader and analyst singles out July 4 as the site of a “wild run to the downside” for crypto markets, the countdown is on for Bitcoin to weather the aftermath of the latest Federal Reserve rate hike.

What else could the coming week have in store? Cryptox takes a look at the potential market-moving factors for the days ahead.

BTC price bides its time over long weekend

Bitcoin emerged from the weekend unscathed, but the classic pitfalls of off-peak trading remain.

The United States will not return to trading desks until July 5, providing ample opportunity for some classic weekend price action in the meantime.

So far, the market has held off when it comes to volatility — with the exception of a brief spike to $18,800, BTC/USD has circled the area between $19,000 and $19,500 for several days.

Even the weekly close provided no real trend change, as data from Cryptox Markets Pro and TradingView showed, with the psychologically significant $20,000 unchallenged.

“While below the range low we can expect a drop down to $18,000,” popular trading account Crypto Tony reiterated to Twitter followers as part of a fresh update on July 4:

“Been a very boring few days in the markets, and this is classic for a mid range.”

In terms of targets to the downside, others continued to eye the area around $16,000.

In 2018, The Orange MA was the Bottom. In 2020, The Green MA was Bottom. Currently holding the Green MA (16-17K). If it breaks then there is a Possibility of Next Bottom Blue MA (12-13K) $BTC pic.twitter.com/rZILTAOlXf

— Trader_J (@Trader_Jibon) July 3, 2022

With no meaningful Bitcoin futures gap and flat performance on Asian markets, meanwhile, there was little to be had in terms of short-term price goals for short-timeframe traders.

The U.S. dollar, meanwhile, continued to hold near twenty-year highs after returning from its latest retracement defiant.

The U.S. dollar index (DXY) stood above 105 at the time of writing.

Gold nears “blast off” against U.S. equities

With Wall Street closed for Independence Day, U.S. equities can take a breather on July 4.

For one popular chartist, however, attention is focusing on the strength of stocks versus gold (XAU) in the current environment.

In a Twitter thread, gold monitor Patrick Karim specifically flagged the precious metal as being about to hit a historical “blast off” zone against the S&P 500 (SPX).

After bottoming out at the end of 2021, the ratio of gold to the S&P has recovered throughout this year and is now about to cross a boundary, which has historically led to significant upside afterward.

“Gold closing in on ‘blast off zone’ versus US equities. Previous take-offs have unleashed important gains for Silver & Miners,” Karim commented.

The situation cannot be said to be the same in U.S. dollar terms, with USD strength keeping XAU/USD firmly in its place below $2,000 since March.

Nonetheless, for silver fans, the implications are that even a modest push-through for the XAU/SPX ratio will bring significant returns.

Note you won’t need to get back to previous 2011 highs for the #gold versus #spx ratio to have MUCH higher nominal prices for silver & miners.

Think about that for a moment.

— Patrick Karim (@badcharts1) July 3, 2022

The forecast again calls into question the extent of Bitcoin’s ability to break with macro trends. A breakout against BTC for gold would be the natural knock-on effect should Karim’s scenario play out, thanks to the ongoing correlation with equities.

“After escaping the sideways pattern that had formed for a 1.5 year period, the correlation coefficient increased sharply to 86% vs S&P 500,” popular trader and analyst CRYPTOBIRB summarized over the weekend:

“Now, at 0.78 ratio it remains strongly positive.”

Fellow analyst Venturefounder noted that Bitcoin also remains tied to moves in the Nasdaq.

Meanwhile #Bitcoin and #NASDAQ are still trending together.

Note previous bottoms (Dec 2018 & Mar 2020) happened as #BTC and $QQQ correlation at peak, suggesting macro has always influenced BTC bottoms. We can predict more likely that macro calls bottom for BTC again this time. pic.twitter.com/szmS4c6WV8

— venturef◎undΞr (@venturefounder) June 26, 2022

Against the dollar, Cryptox, meanwhile, reported that Bitcoin’s inverse correlation is now at 17-month highs.

Crunch time for Hayes’ “wild ride to the downside”

July 4, apart from being Independence Day, is being watched by one market player in particular as a public holiday like no other — at least for Bitcoin.

With markets closed and BTC price action already teetering on the edge of support, Arthur Hayes, former CEO of derivatives platform BitMEX, has singled out this long weekend as one long day of reckoning for crypto markets.

The reasoning seems logical. The end of June saw the Federal Reserve raise key rates by 75 basis points, providing fertile ground for an adverse reaction from risk assets. Low-liquidity “out-of-hours” holiday trading increases the potential for volatile price moves up or down. Combined, the cocktail, Hayes warned last month, could be potent.

“By June 30 (second quarter end), the Fed will have enacted a 75bps rate hike and begun shrinking its balance sheet. July 4 falls on a Monday, and is a federal and banking holiday,” he wrote in a blog post:

“This is the perfect setup for yet another mega crypto dump.”

So far, however, signs of what Hayes says will be a “wild ride to the downside” have not materialized. BTC/USD has stayed practically static since late last week.

The deadline should be July 5, as the return of traders and their capital could provide the liquidity needed to steady the markets as well as buy up any coins going cheap in the event of a last-minute downturn.

Hayes added that his prior forecasts of BTC/USD bottoming at $27,000 and Ether (ETH)/USD at $1,800 already “lay in tatters” in June.

Mining difficulty is still rising

Despite considerable concern over miners’ ability to withstand the current BTC price downturn, Bitcoin’s network fundamentals remain calm.

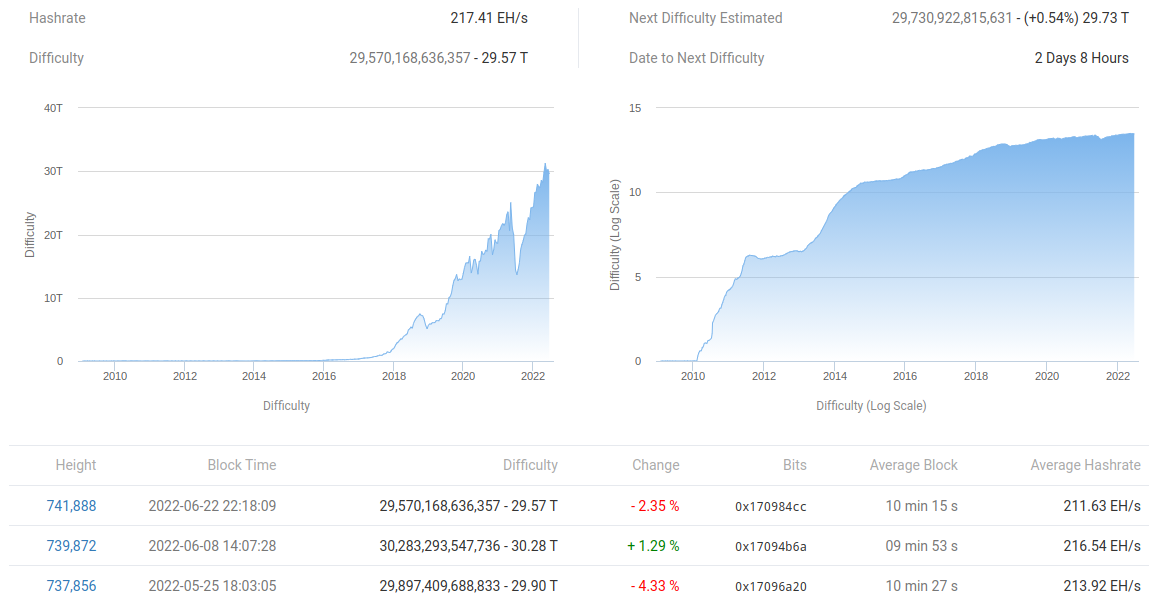

An impressive testament to miners’ resolve to stay on the network, the difficulty is not planning to reduce at the upcoming readjustment this week.

After decreasing by a modest 2.35% two weeks ago, difficulty, which automatically rises and falls to take into account fluctuations in miner participation, will hardly change at all this time around.

According to estimates from on-chain monitoring resource BTC.com, difficulty will even rise should current prices stay the same, adding 0.5% to what is a metric still near all-time highs.

When it comes to miners themselves, opinions consider that it is the less efficient players — possibly newcomers with higher cost basis — who have been forced to exit.

Data uploaded to social media by CEO of asset manager Capriole Charles Edwards last week put the production cost for miners en masse at around $26,000. Of that, $16,000 is electricity, meaning that miner overheads directly influence their ability to limit losses in the current environment.

“We traded below Electrical Cost in June, however the floor has since dropped as inefficient miners capitulate,” Edwards noted.

A sea of lows

Bitcoin on-chain metrics pointing to record overselling is nothing new this year and in recent weeks especially.

Related: Top 5 cryptocurrencies to watch this week: BTC, SHIB, MATIC, ATOM, APE

The trend continues in July, as the network returns to scenarios not seen since the aftermath of the March 2020 cross-market crash.

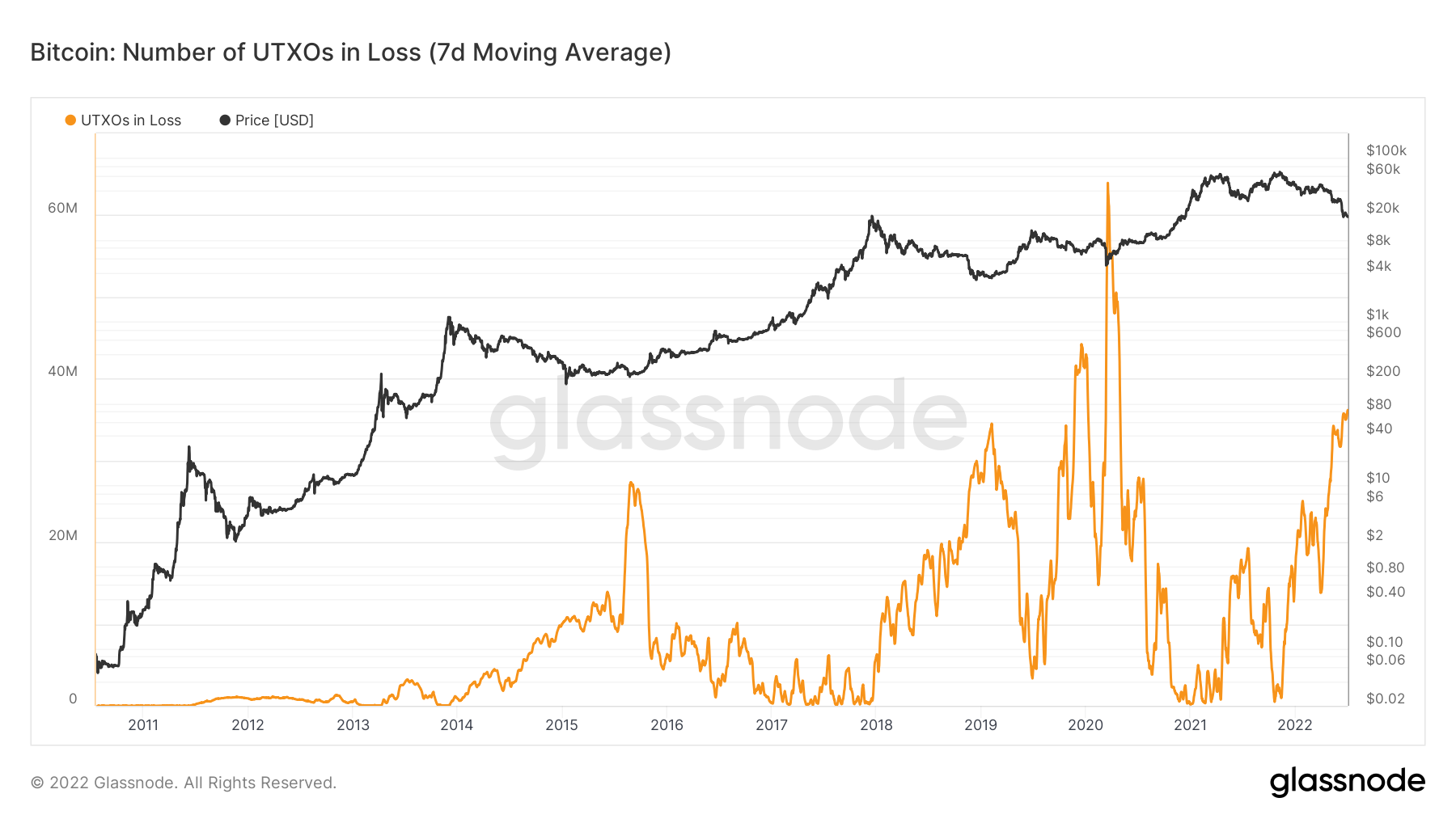

According to on-chain analytics firm Glassnode, the number of coins being spent at a loss is now the highest since July 2020. Glassnode analyzed the weekly moving average of unspent transaction outputs (UTXOs) in a loss.

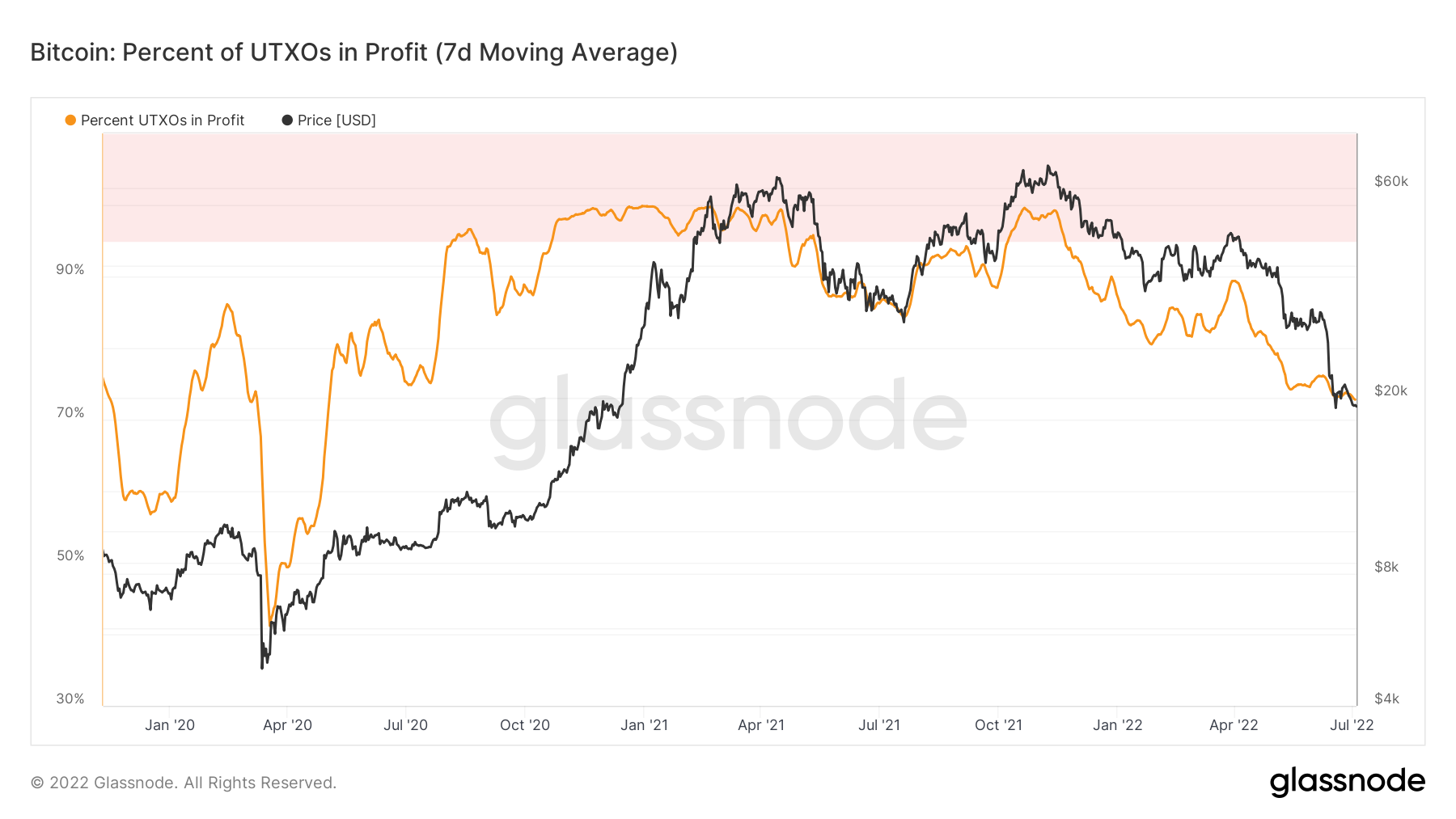

Similarly, the percentage of UTXOs in profit hit a two-year low of just over 72% on July 3.

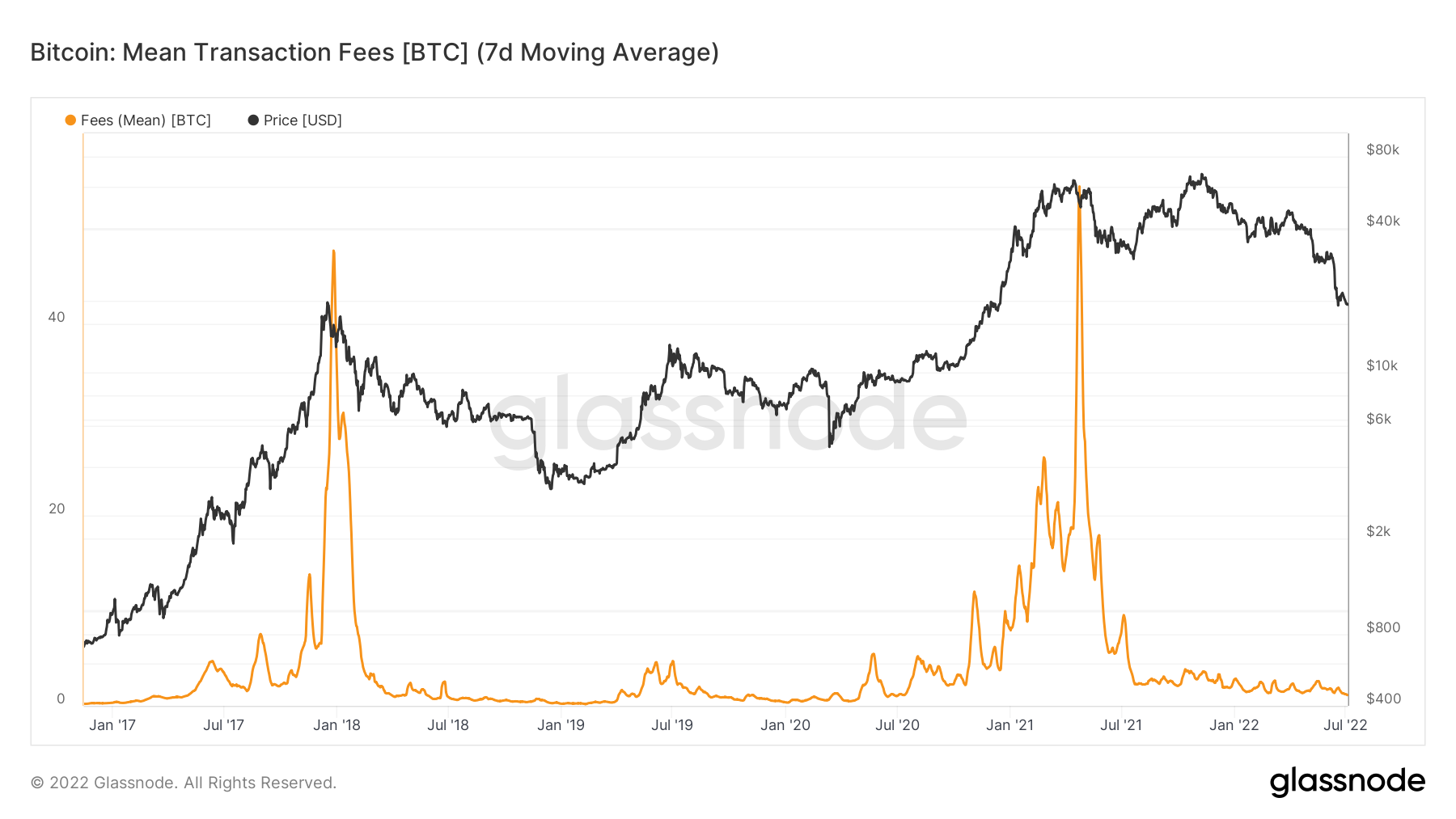

Bear markets can produce some welcome, if rare, silver linings. Bitcoin transaction fees, once painfully high during bullish periods of intense network activity, are now also at their lowest since July 2020. The median fee, Glassnode reveals, is $1.15.

As Cryptox reported, the same is true for Ethereum network gas fees.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.