Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided.

OBV sparks 2021 recovery comparisons

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp.

In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot.

While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside.

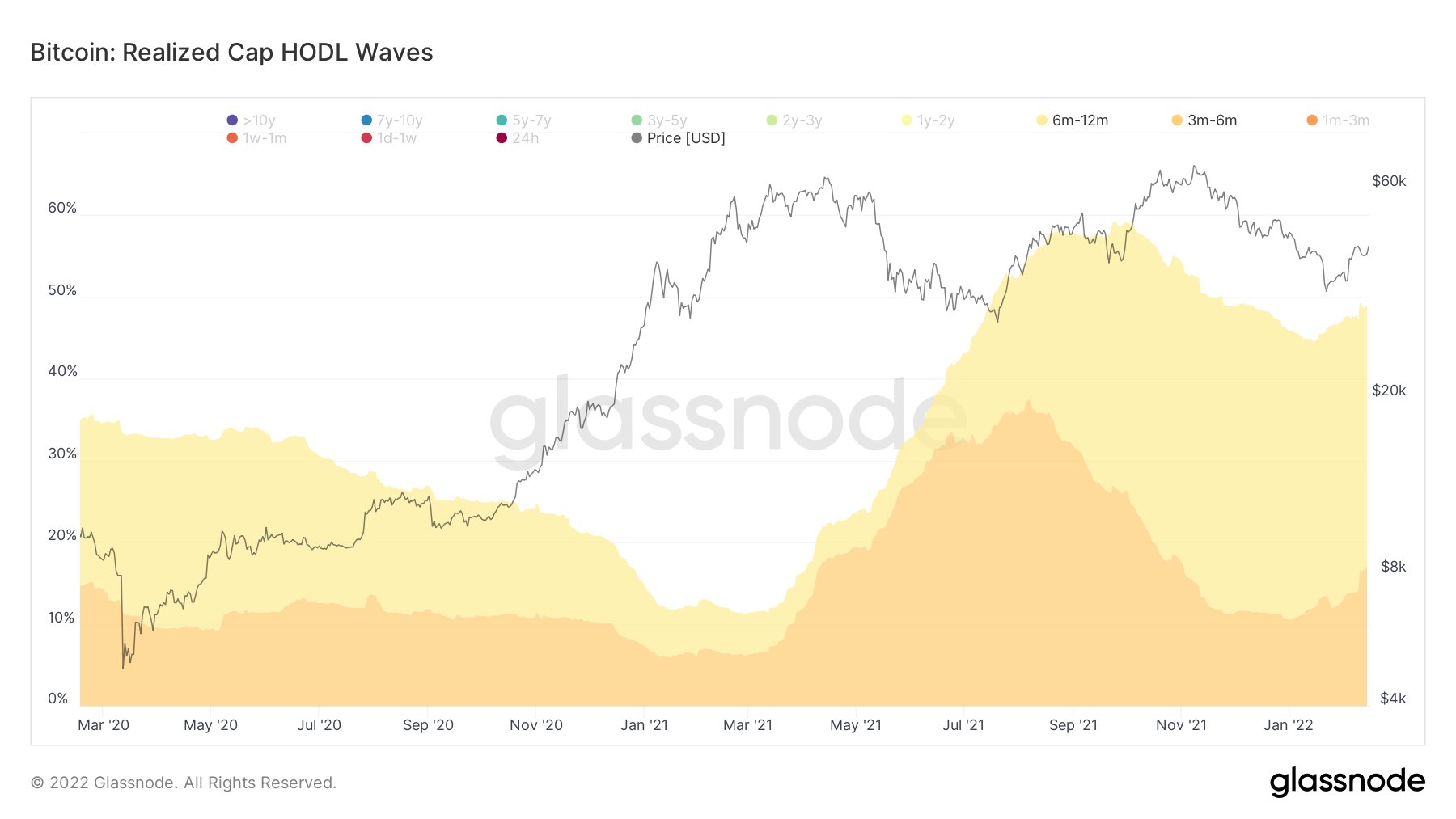

“When I consider everything BTC HODLers withstood in 2021- When I observe global de-risking for 3+ months- When I see 48% of Realized Cap STILL held from 3-12 months ago after a $33k scare- I ask: with all existing FUD priced in, barring surprises, who remains to sell here?” TXMC argued.

An accompanying chart highlighted coins that last moved between three and six months ago — the run-up to the $69,000 all-time high — growing as a proportion of the overall BTC supply.

On-balance volume, a metric designed to estimate buy and sell pressure, likewise recovered in a style which popular education resource IncomeSharks claimed mimicked last year’s rebound from $30,000.

$BTC – Daily OBV chart. And people telling me we aren’t bottomed out… This is almost a more bullish move than last time we went from $30,000 to $60,000. Double bottom, very sharp bullish V spike. Price action is just noise and people are listening too much to #CryptoTwitter. pic.twitter.com/vURzxYeImG

— IncomeSharks (@IncomeSharks) February 15, 2022

“These are the conditions where retail waits to buy Bitcoin after it’s at an all time high and it’s all over the news again,” it added in a tweet on the day.

“Meanwhile the whales and smart buyers who loaded up near $35,000 will 3x their money if we go to $100,000.”

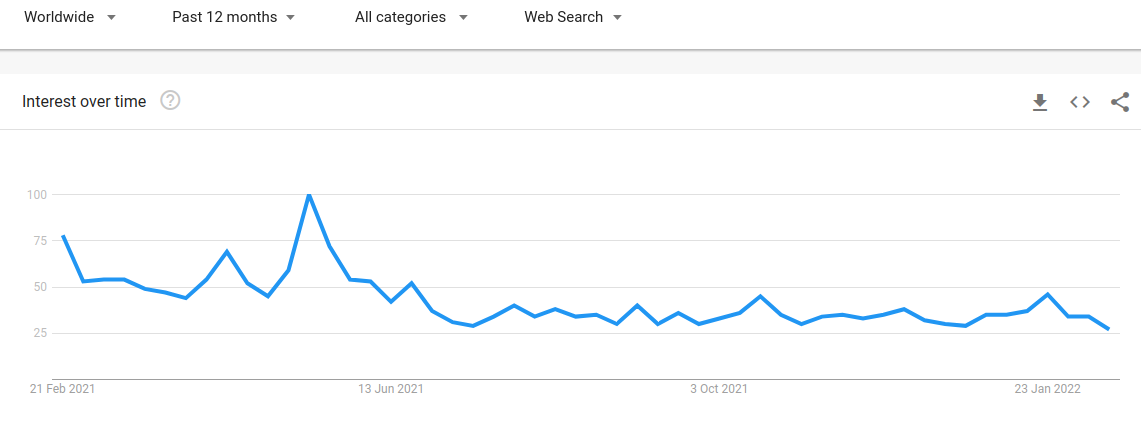

Despite the recovery from last month’s lows, interest in Bitcoin stayed practically nonexistent from mainstream sources, with Google Trends data showing a distinct lack of curiosity from users.

AVAX leads top ten altcoin gains

There was better short-term news for some altcoins, with Ether (ETH) gaining on the day to cement support above the $3,000 mark.

Related: Traders say $4,000 Ethereum back on the cards ‘if’ this bullish chart pattern plays out

ETH/USD briefly hit $3,200 before returning to consolidate, still at five-day highs.

The top-ten cryptocurrencies by market cap were led by Avalance (AVAX), meanwhile, which put in 24-hour returns of over 10% to continue its success from recent weeks.