With central banks around the world cutting interest rates and injecting stimulus, how can you position your portfolio to benefit from the resulting increase in liquidity? Read on.

Macroeconomic triggers deepen

Global liquidity is seeing a sharp increase as central banks around the world, particularly in China and the U.S., adopt policies aimed at pumping money into their economies.

China recently announced a $143 billion stimulus package, which is driving strong economic momentum. On top of that, the People’s Bank of China has mandated commercial banks to lower mortgage rates on existing home loans by at least 30 basis points below the loan prime rate by Oct. 31, all to support its struggling property market.

As a result, Chinese stocks have gone parabolic. In just the past five days, the Shanghai Composite Index surged by 20%, with an 8% jump recorded on a day alone on Sep. 30.

But it’s not just China. On Sep. 18, the U.S. Federal Reserve implemented an aggressive 50-basis-point rate cut, and according to the CME FedWatch Tool, the market now anticipates another 25 to 50 bps cut in November. If this occurs, the federal funds rate could drop to a range of 4.25-4.50% or 4.50-4.75%.

Moreover, since the Federal Open Market Committee meeting on Sep. 18, crypto assets have outperformed many traditional assets. The increasing liquidity, both in the U.S. and China, could likely boost investors’ appetite for riskier investments like crypto in the near future.

Let’s dive deeper into each of these events and explore how they could shape the future of the crypto market, especially Bitcoin, in the days to come.

Global liquidity on the rise

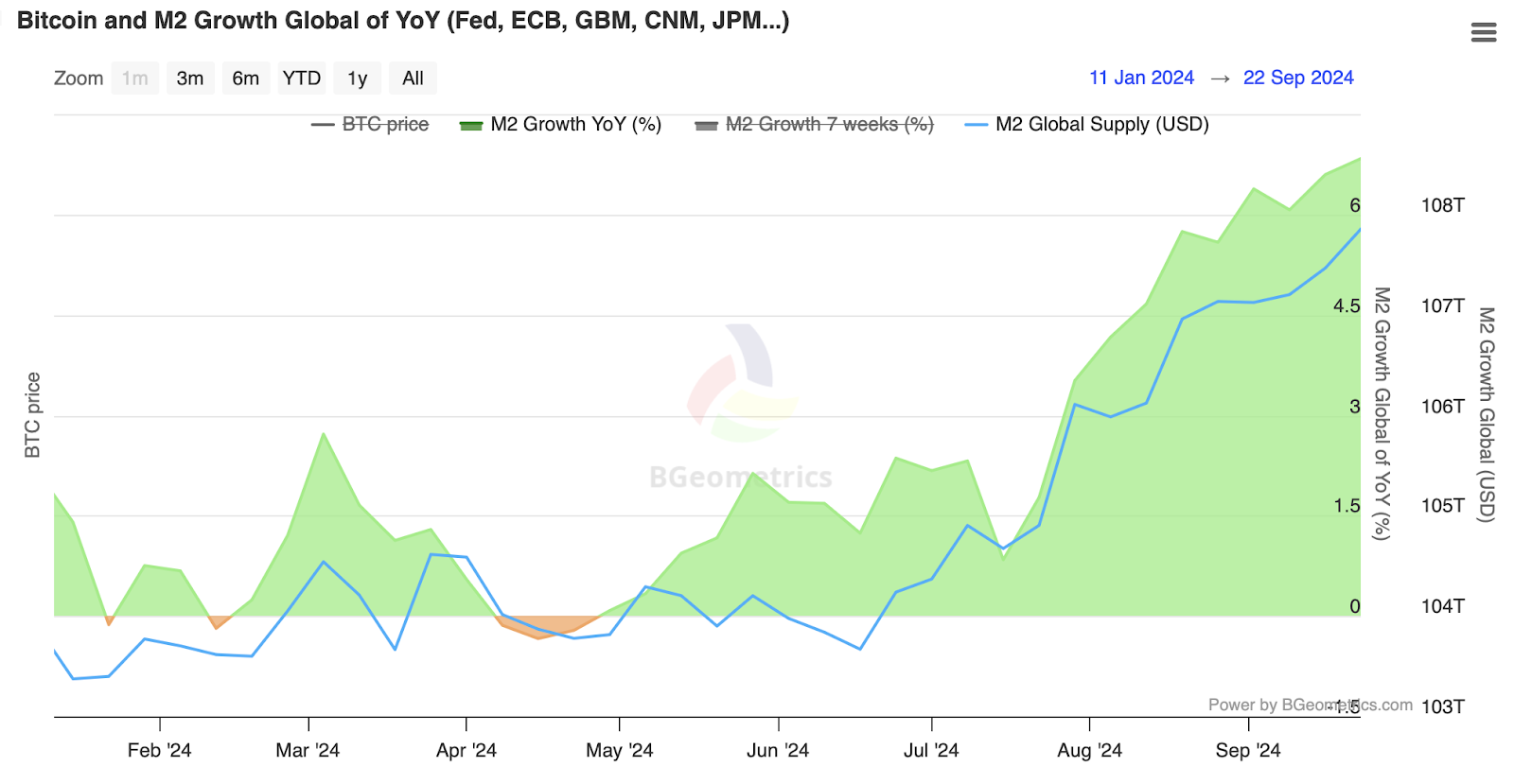

When it comes to understanding Bitcoin’s price movements, global liquidity stands out as one of the strongest indicators.

Global liquidity or M2 supply refers to money that’s readily available, such as cash and bank deposits. When central banks loosen their policies—by cutting interest rates or injecting stimulus into the economy—they increase the amount of money flowing through the system.

Over the years, Bitcoin has shown a strong correlation with liquidity, meaning that when the global money supply grows, Bitcoin’s price tends to rise. Conversely, when liquidity contracts, Bitcoin’s performance often falters.

According to a study by Lyn Alden Investment Strategy, Bitcoin’s correlation with global liquidity from May 2013 to July 2024 was an impressive 0.94. A correlation of 1.0 would indicate perfect alignment, so 0.94 is extremely high.

However, zooming in on shorter time frames shows a more complex picture. Over a rolling 12-month period, the correlation between Bitcoin and liquidity drops to 0.51, and over 6 months, it dips even further to 0.36.

Why is this the case? While liquidity is a major driver of Bitcoin’s long-term price movements, shorter-term fluctuations are often influenced by Bitcoin-specific events—such as regulatory updates, market sentiment, or critical crypto news. This explains why Bitcoin can sometimes deviate from the broader liquidity trend in the short term.

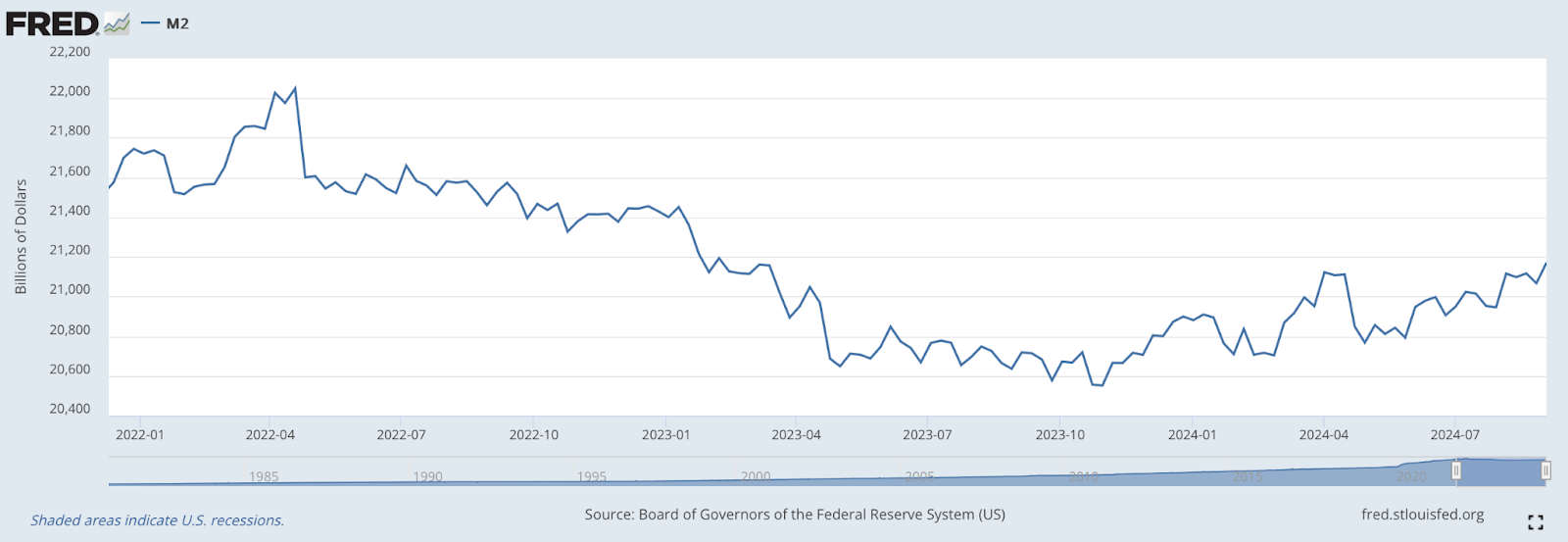

At present, the global liquidity picture is changing. After a period of contraction, the M2 money supply is growing again — and rapidly. Having shrunk for most of 2022 and early 2023 due to the Fed’s tightening policies, U.S. M2 supply saw one of its sharpest rises in recent months, reaching over $21 trillion by early September.

On a global scale, M2 supply hit approximately $108 trillion by late September, signalling a clear upward trend after months of dormancy.

This increase in liquidity is critical because, as history has shown, Bitcoin’s price often rises alongside growing liquidity. A similar pattern played out during the COVID-19 pandemic in 2020, when central banks, especially the Fed, injected massive amounts of money into the economy. M2 supply soared, and Bitcoin’s price followed suit.

But in 2022, when the Fed began raising interest rates and withdrawing liquidity, M2 growth turned negative, and Bitcoin’s price dropped sharply.

The key takeaway is that Bitcoin is highly sensitive to liquidity conditions. As the global M2 supply rises, Bitcoin will often benefit. With the current surge in liquidity, particularly in the U.S. and China, another Bitcoin price increase may be on the horizon.

However, as history shows, short-term fluctuations may deviate from this long-term trend. It’s crucial to monitor both liquidity conditions and Bitcoin-specific factors to gauge where the price might be heading next.

The trickle down effect

As global liquidity rises due to central bank actions worldwide, this influx of capital gradually ripples through the economy, eventually making its way into the crypto markets.

The process starts with increased cash flow in traditional sectors, where businesses and consumers have more capital at their disposal. This boost leads to greater spending and investment across a variety of asset classes.

Initially, this liquidity flows into safer assets such as bonds, gold, or real estate. These assets are typically the first to benefit as investors seek to park their capital in more stable and well-established markets.

However, as liquidity builds and confidence in the economy strengthens, the next stage begins: investors start searching for higher returns and shift their focus to riskier assets.

For example, over the past two decades, China has seen five major equity rallies, three of which were driven by large stimulus packages. Now, as the country launches another round of economic stimulus, some analysts believe we may be at the start of a fourth rally.

As investors become even more comfortable with risk, they begin looking beyond stock markets for even greater returns. This is where crypto enters the picture.

Assets like Bitcoin are seen as high-risk, high-reward investments. As more money flows through the financial system, fueled by central bank policies, some of that liquidity inevitably spills into the crypto space.

This process unfolds gradually, following economic growth, investor sentiment, and the ongoing search for yield in a liquidity-rich environment.

Ultimately, this cascading effect—moving from economy to bonds to stocks and eventually to crypto—shows how central bank policies can drive demand in the crypto space, making it a highly attractive destination for investors during periods of monetary expansion.

What do experts think?

Many experts believe that the combined forces of liquidity injections, economic stimulus, and interest rate cuts are setting the stage for risky assets like Bitcoin to take centre stage.

Quinten Francois, co-founder of WeRate, offers a historically optimistic outlook, noting that ‘80% of Octobers were green,’ referring to both stock and crypto markets, which tend to perform well in the fourth quarter.

More intriguingly, he points out that every election year has seen a green October, November, and December. What makes this even more compelling is that whenever September ends positively, the last quarter tends to follow suit.

But not everyone views the flood of liquidity through rose-tinted glasses. Daniel Lacalle, an economist and professor, has taken a more cautious approach.

He warns that while liquidity is indeed ‘exploding,’ this isn’t necessarily all good news. Lacalle cautions that this massive influx of cash could lead to ‘unprecedented monetary destruction.’

According to Lacalle, the increased liquidity may eventually fuel inflation, economic stagnation, and asset bubbles—risks that could harm even strong-performing markets like crypto in the long run.

Meanwhile, Max Sultakov, CEO of Yona Network, shared exclusive insights with crypto.news, stressing the role of liquidity in driving Bitcoin’s price.

‘’Historically, Bitcoin has surged during periods of global liquidity expansion,’’ Sultakov said. He believes that ‘institutional investors will likely shift more capital into Bitcoin and crypto as a hedge against fiat instability.’

Another key factor to watch, according to Sultakov, is the role of decentralized assets in regions with strict capital controls, particularly in China.

‘’In China, crypto isn’t just an investment — it’s a lifeline to move wealth out of government reach.’’

As liquidity expands in these markets, people could likely turn to decentralized assets like Bitcoin to preserve wealth beyond government control.

From a macro perspective, Fed Chair Jerome Powell recently signalled that more interest rate cuts are likely on the way, though they will probably be smaller than the recent 50-basis-point reduction.

With U.S. interest rates still hovering around 4.8% and a long-term target of 3%, Powell explained that ‘this would mean two more cuts, but not more 50s,’ indicating that the Fed is treading carefully to avoid overheating the economy.

For crypto, this means that as liquidity continues to grow, the flow of capital into risk assets could increase. However, the balance between inflation and economic stability remains a critical factor to watch.