Crypto mining comes in many shapes and sizes, from mega mines under the blazing Texas sun to small facilities nestled in Italy’s snowy Alps.

CoinDesk reporters traveled across Europe, Asia and North America to capture the diversity of crypto mining farms. Mining is a little understood industry, in large part because miners tend to be extremely secretive. Security concerns coupled with regulatory uncertainty have made this industry wary of the limelight. The fact that many miners started as maverick entrepreneurs plugging straight into hydropower plants in China did not help the industry’s reputation..

As a result, the image often conjured up when thinking of crypto miners is one of gigantic facilities burning fossil fuels or stealing electricity from the grid – which is far from the whole truth. The public debate around crypto mining understandably relies on this image, as incomplete as it is.

There is no question that crypto mining requires energy. Miners convert it into hashes, or algorithmically produced strings of letters and numbers. These represent the “guesses” that each mining rig makes in trying to “find” a new bitcoin block. The best miners can produce over 100 terahashes per second (TH/s). The latest model from Bitmain, the biggest manufacturer of specialized mining hardware, can reach 255 TH/s. (One terahash equals 1 trillion hashes. One petahash represents 1 quadrillion hashes. One exahash represents 1 quintillion hashes.)

The industry today employs a patchwork of approaches to this task, and it has grown in innovation and sophistication over the years.

This photo essay is aimed at informing the conversation around crypto mining by showing its modes of existence, many of which are powered by renewable energy.

Kryptovault, Hønefoss, Norway

Electricity sub-station that powers a bitcoin mining farm in the suburbs of Hønefoss, Norway. (Eliza Gkritsi)

Just an hour outside Oslo, the capital of Norway, lies Hønefoss (population: 14,000). When CoinDesk visited in late February it was an unusually sunny day for winter, and the snow was slowly melting. The cold weather is perfect for a crypto mining farm, as it decreases the cost of cooling the machines.

Retired Bitmain ASICs at Kryptovault’s facility in Norway. (Eliza Gkritsi)

Oslo-based Kryptovault runs a 40-megawatt (MW) crypto mine in the suburbs. Of that capacity, only 18 megawatts are currently running, CEO Kjetil Pettersen told CoinDesk during a tour. The firm unplugged all of its Bitmain Antminer S9s in late 2021 and is replacing them with newer, and more energy-efficient S19s.

This is a common practice among crypto miners: as newer machines come online, older models can’t keep profits up, unless the operation has access to very cheap electricity.

Kryptovault installed noise-cancelling panels, seen at left, at its Hønefoss mine after complaints from neighbors. (Eliza Gkritsi)

Due to the facility’s proximity to the residential area and complaints from the neighbors, Kryptovault had to spend just under $2 million to install noise-reducing panels.

Wood drying in a container using heat produced from the bitcoin mining rigs at the Kryptovault mining farm in Norway. (Eliza Gkritsi)

Heat is pumped from the room where the bitcoin mining ASICs are working into containers where wood is dried at the Kryptovault mining farm in Norway. (Eliza Gkritsi)

Piles of wood waiting to be dried, outside Kryptovault’s mining farm in Norway. (Eliza Gkritsi)

The Kryptovault mine is also offering a byproduct of bitcoin (BTC) mining to a local company for free: heat. A lumber company is using the excess heat from the computation to dry wood that it later sells. Heat from the mining rigs is pumped into containers outside the facility where the wood is dried.

South Spain, PoW Energy, PoW Containers, Meatze

Solar panels power the mining rigs in a container. (Eliza Gkritsi)

We drove from Madrid to the south of Spain for about four hours to visit the PoW Containers mining farm. We passed through countless almond and olive groves, took several turns down country roads, including one long dirt road, to arrive at the solar-powered mine.

This general-purpose solar farm has a maximum capacity of 10MW, and the bitcoin mine consumes in about 500 kilowatts (KW) – a tiny portion. The mine is a hedge for the farm which otherwise only has one option, to sell the energy to the grid, said Jon Arregi, founder of Meatze and Proof of Work Containers, two firms that are building modular container mines and deploying them at sites across Europe. Similarly, at night the mine draws its energy from the grid.

Left, the electricity transformer that feeds power straight to the mining container on the right, at a small mining farm in southern Spain. (Eliza Gkritsi)

Electricity from the solar farm is converted from low to high voltage and is pumped straight into the machines, Arregi said.

The mining machines, which produce about 12 petahashes/second in total, are housed in an unmarked container to avoid prying eyes – security is a big concern in an industry where an individual machine can cost more than $10,000. This particular mine is not visited frequently barring emergencies, and is far from any residential facility, making security an even bigger challenge.

Bitcoin mining ASICs submerged in immersion cooling liquid at a facility in southern Spain. (Eliza Gkritsi)

To avoid the machines overheating in the hot Spanish sun, the PoW company uses immersion cooling. This technology involves putting the machines in drawers and then filling the drawers up with a specialized mineral oil. When the machines are running, the hot oil rises to the surface and is then cooled down as it passes through a series of pipes, which touch separate pipes through which cold water runs. The cold oil is then pumped back into the drawer.

HIVE Blockchain, Boden, Sweden

Moving through HIVE Blockchain’s ethereum mining facility in Boden, Sweden, feels like teleporting between the Arctic and a tropical beach every few feet. (Sandali Handagama)

In March, CoinDesk visited one of HIVE Blockchain’s (HIVE) largest crypto mining farms located in Boden, a military town in north Sweden. The sprawling 6,000 square-foot facility, set up in what used to be a military helicopter hanger, now houses more than 15,000 mining rigs. When CoinDesk visited, the facility was being expanded further and will soon be home to upwards of 17,000 machines and 120,000 graphics processing units (GPU). A majority of the machines are RX580s by AMD.

The sprawling HIVE Blockchain facility in Boden, Sweden, used to be a military helicopter hangar (Sandali Handagama)

The 30MW facility draws energy from two hydropower plants nearby. A majority of its energy is purchased from Vattenfall, a Swedish state-owned multinational power company. Ether (ETH) accounts for around 80% of the crypto mined at the facility. The rest is bitcoin.

Boden’s HIVE facility draws energy from two local hydropower producers including Vattenfall, one of Sweden’s largest state-owned power companies. (Sandali Handagama)

The HIVE facility draws energy from two local hydropower producers including Boden, the regional power producer. (Sandali Handagama)

The Boden crypto mining farm is an impressive maze of machines, organized in a way that optimizes the cooling systems and pressure conditions for high efficiency. As we moved through the facility, every few feet the temperature changed dramatically, as if we were teleporting between the Arctic and a tropical beach each time. The area just outside an opening through which hot air leaves the facility is dubbed the “no snow” zone, and is the only stretch of space on the property not covered in ice or a dusting of snow.

Aside from mining ethereum, the Boden HIVE Blockchain facility is also home to ASICs for mining bitcoin. (Sandali Handagama)

Boden’s HIVE facility houses around 15,000 mining rigs, most of them mining the cryptocurrency ether. (Sandali Handagama)

The facility is constantly evolving to improve mining efficiency, a HIVE representative told CoinDesk. The team is always testing new machines, replacing old rigs with the latest ones, looking for ways to stack more machines into a smaller space. “We even use the same air twice,” the representative said.

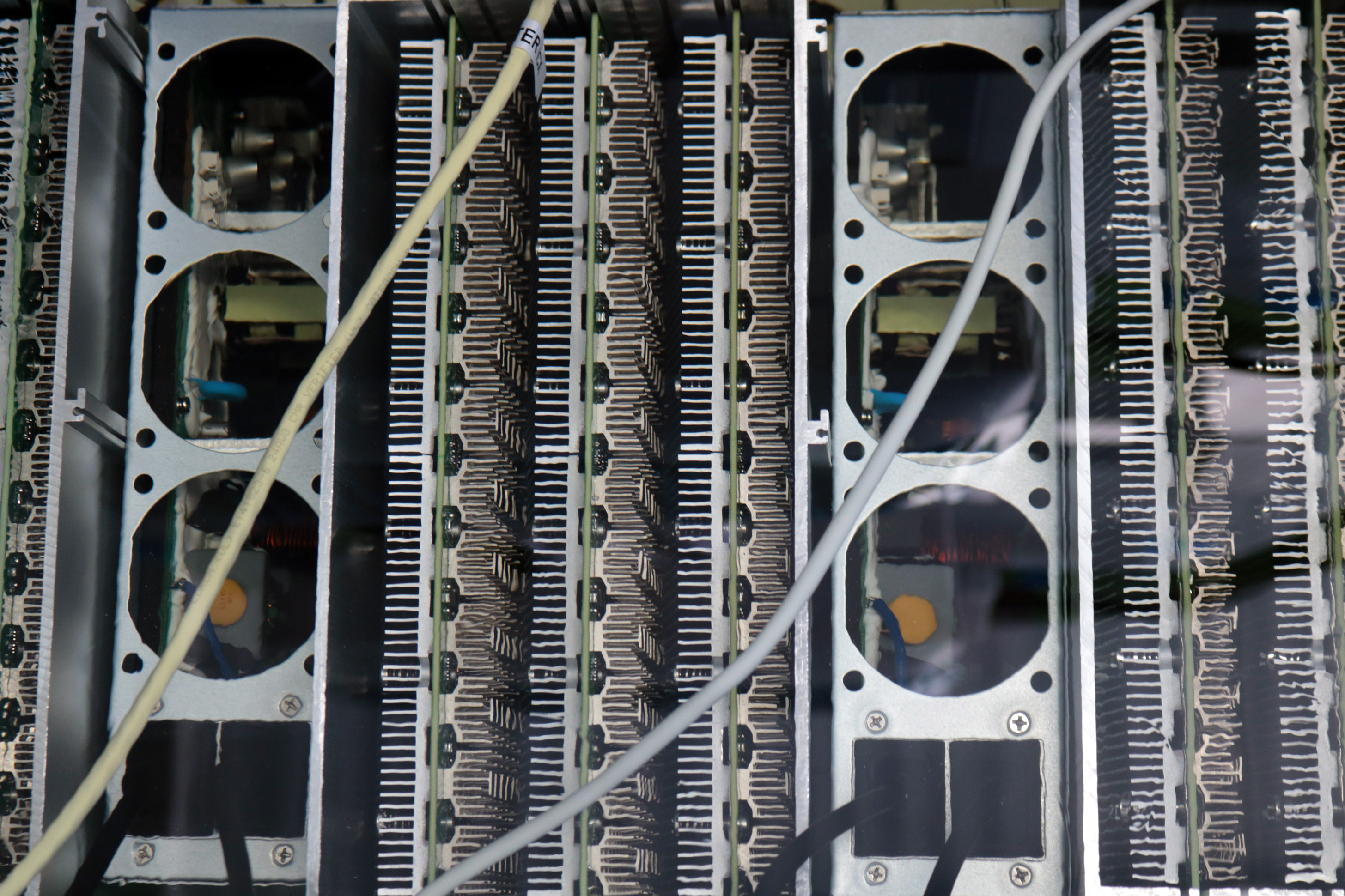

Boden’s HIVE Blockchain facility is a complex maze of machines and wiring, optimized for efficiency. (Sandali Handagama)

HIVE blockchain is a publicly traded company, with mining facilities in Sweden, Iceland and Canada. The Boden ether mining farm was set up in 2017.

Alta Novella, Borgo d’Anaunia, Italian Alps

Alta Novella, a small hydropower plant belonging to a Northern Italian municipality called Borgo d’Anaunia recently started mining bitcoin. (Sandali Handagama)

After a short scenic train ride southward from Northern Italy’s famed Alpine ski towns, and a grizzly 20-minute car ride down icy mountain roads, we arrived at Alta Novella, a small hydropower plant belonging to the town of Borgo d’Anaunia, home to around 2,500 people.

Alta Novella recently became home to Italy’s first bitcoin mining farm run by a municipality. Nestled against a wall behind the power plant’s turbine are 40 ASIC miners. Borgo d’Anaunia’s Millennial mayor Daniele Graziadei persuaded his constituents to invest in the miners as a way to diversify the plant’s income.

The Alta Novella hydropower plant houses 40 ASIC miners in the turbine room. (Sandali Handagama)

Municipal workers manage the power plant while tech startup Alps Blockchain takes care of maintaining the miners. (Sandali Handagama)

The power plant draws water from a small river. Depending on the river’s flow, the plant can generate 120 to 600 kilowatt hours. If the plant’s total production reaches 600KW, about a fifth of it goes to the miners.

This winter, rain was scarce. During low production times, small plants like this would typically shut down because they cannot cover costs. But Graziadei told CoinDesk that thanks to the miners, the plant can stay operational during low seasons with around half of its production channeled to the miners. When CoinDesk visited in February only a handful of the 40 ASICs stood blinking against the wall. It’s a small operation; one you might easily fit into your average basement. However, it is projected to make a significant impact on the power plant’s sustainability, said Graziadei.

Mayor Daniele Graziadei said there has been a notable lack of snow and rain this winter, stalling Alta Novella’s power production as a result. (Sandali Handagama)

Thanks to a lack of precipitation, only a few miners stood blinking on a shelf against the wall. (Sandali Handagama)

Alps Blockchain, the Italian mining startup that set up the machines and now takes care of maintenance, purchases the computing power produced by Alta Novella’s miners at around 35% more than what the government offers per kilowatt hour of energy. The computing power is then sold to mining pools around the world. The profits from mining helps Alta Novella cover maintenance costs, Graziadei said.

Valstagna, Veneto, Northern Italy

The Valstagna hydropower plant located in the Veneto region of Italy houses 300 ASIC miners set up by Alps Blockchain. (Sandali Handagama)

In February CoinDesk visited Valstagna, a century-old historic hydropower plant located in the Veneto region of Italy. Nestled in a valley framed by mammoth mountains, Valstagna, which supplied power to the local steel industry, now supplies power to the national grid. It is also one of 18 hydropower plants across northern Italy that have partnered with local tech startup Alps Blockchain to mine bitcoin on site.

The mining rigs sit on two shelves towering over the turbines. (Sandali Handagama)

The facility houses 300 ASIC miners and is currently adding 150 more. (Sandali Handagama)

The contrast between the old and new is stark: Towering over the power plant’s turbines are two shelves carrying 300 ASICs. When CoinDesk visited, the facility was preparing to set up another shelf with 150 more mining rigs. The residents in the surrounding town have no idea their neighborhood power plant is mining bitcoin, a representative at the plant told CoinDesk.

The historic Valstagna power plant is around a century old and used to supply energy to the local steel industry. (Sandali Handagama)

The Valstagna power plant has a maximum capacity of 10MW, but production varies significantly. A portion of around 1MW is constantly used for mining bitcoin. Alps Blockchain purchases the computing power produced at the power plants for more competitive rates. Valstagna is one facility belonging to a large local power producer: it is looking to expand mining operations to its other locations in partnership with Alps Blockchain.

CoinDesk visited three Bitfarms (BITF) mining facilities, one of the biggest bitcoin mining operations in Canada. The publicly traded company has a total of six sites in Canada and three upcoming in Washington state, Paraguay and Argentina. The company is aiming to reach a hashrate of 3 exahashes per second (EH/s) by the end of Q1 2022 and 8 EH/s by year’s end.

Bitfarms’ president Geoff Morphy in front of rows of miners (Aoyon Ashraf)

A Bitfarms employee inspecting miners at Cowansville (Aoyon Ashraf)

CoinDesk visited Bitfarms’ three sites in the province of Quebec, Canada. One site, in the small town of Cowansville, is fully operational. The other two, in the larger town of Sherbrook, are under construction. All of the miner’s sites operate using hydropower at an average cost of about $0.04 cents per kilowatt hour. For comparison, Marathon Digital (MARA), one of the largest publicly traded miners, said recently that to host its more than 100,000 miners across the U.S., the total cost for the miners will be about $0.042 per kilowatt hour. Meanwhile, the average retail electricity cost during 2020 in Texas, home of many bitcoin miners, was $0.0858 per kilowatt hour, according to the Global Energy Institution.

Bitfarms’ Cowansville bitcoin mining facility in Quebec (Aoyon Ashraf)

Miners at Bitfarms’ Quebec facility (Aoyon Ashraf)

The Bunker facility in Sherbrook, which was designed by the previous tenants to be an ethanol distillery, is a bomb-proof plant (hence the name). It will have 18MW in phase one, another 18MW in phase two and a further 12MW in phase three during the summer. When completed, the facility will produce almost 1 EH/s from this one facility alone.

Bitfarms’ bomb-proof, under construction, mining facility “Bunker” in Sherbrooke, Quebec (Aoyon Ashraf)

The Leger facility, which is about 3 kilometers (1.86 miles) away from Bunker, will have 30MW and 800 PH/s mining power. Both Sherbrook facilities are entirely powered by hydro electricity, which 99% is green energy, meaning a renewable source of energy.

Outside Bitfarms’ Leger facility in Sherbrooke, Quebec (Aoyon Ashraf)

Aside from hydro power, another big advantage of being in Quebec is “passive” heat management. To counteract the heat generated by Bitfarms’ massive operation, the facilities don’t need an active air cooling system. Instead, due to the colder climate, Bitfarms is able to use outside air to cool the mining computers, limiting the operating cost and energy use.

Bitfarms’ air cooling system in Quebec (Aoyon Ashraf)

Hydro-electric power plant that supplies energy to Bitfarms’ Cowansville facility (Aoyon Ashraf)

BitCluster, Norilsk, Russia

BitCluster’s mine in Norilsk, Siberia, is located above the Arctic Circle. Warming up the mining machines is sometimes a concern, said a company representative. (BitCluster)

The frozen steppes of north Russia are perfect for crypto mines (notwithstanding the geopolitical climate), with ample space and cool temperatures in a location that few other industries want to inhabit.

“Sometimes our task is not to cool devices but to warm them,” a BitCluster representative told CoinDesk. The company also trains its own employees to run the mines, hiring from local cities, the representatives said.

A technician inspects mining rigs at BitCluster’s mine in Norilsk, Siberia. (BitCluster)

In Norilsk, the second-largest city above the Arctic Circle, bitcoin mines coexist with the metallurgy industry. The city, where temperatures can drop to -40 degrees Fahrenheit, gets most of its income from processing nickel, copper, cobalt, platinum, palladium and coal mined in nearby deposits.

The bitcoin mine is housed in a former nickel processing plant and has a capacity of 31MW, the firm told CoinDesk.

“All our data centers are located in special industrial zones,” a BitCluster representative said. In Russia, these are often inaccessible to the public, and journalists need special permission to enter.

UPDATE (March 21, 17:37 UTC): Fixes typos in Bitfarms section.