Inflows on crypto exchanges, explained

Understanding how inflows and outflows affect crypto prices is crucial for navigating market dynamics. Inflows, representing the influx of liquidity into exchanges, can positively impact prices. Conversely, outflows, indicating the withdrawal of funds, can exert downward pressure on prices.

Liquidity – the ease with which assets or goods can be bought or sold — is vital for traders, users and investors. When referring to inflows and outflows on exchanges, it involves tracking the movement of cryptocurrencies into and out of these trading platforms.

In the crypto world, traders, users and investors closely watch crypto exchange liquidity flows because these movements reveal changes in supply, demand and potential market direction. Therefore, understanding exchange liquidity is key to making informed decisions.

Tracking these metrics helps traders assess the demand and supply of a cryptocurrency. Inflows and outflows matter because they can give traders clues to whether the market might go up or down, based on where the assets are moving.

Between Oct. 26 and Nov. 2, cryptocurrency funds saw $2.2 billion in inflows, driven by the anticipation of US elections. This brought the total year-to-date inflows to a record $29.2 billion. Bitcoin products were the primary beneficiaries, seeing a large portion of the inflows. The market sentiment was influenced by the potential for a Republican victory, boosting investor confidence.

Types of inflows on crypto exchanges

When large amounts of cryptocurrency are deposited into an exchange, this is referred to as inflow. Crypto market inflow analysis often indicates that traders are preparing to sell.

This increase in supply often pushes prices down since more assets are available for trading, and demand remains relatively constant. In simple terms, when more people are selling than buying, the market reacts by lowering prices to even things out.

Large inflows can also happen due to broader market events, like negative news regarding crypto, new regulations or economic shifts. During uncertain times, traders often move their crypto onto exchanges to sell, which can lead to more volatility and falling prices as people lose confidence.

Big players like hedge funds also contribute to inflows. When they decide to liquidate a chunk of their holdings, the market can experience a domino effect, where others follow suit, pushing prices down even further.

In times of market corrections or expected price drops, traders often send their assets to exchanges to sell before prices fall even further. Monitoring these inflows helps traders spot potential sell-offs early and adjust their strategies to avoid losses.

It is important to point out that understanding outflows in crypto markets is just as relevant as understanding inflows.

Did you know? During the 2021 bull run, crypto trading volume and inflows surged on major exchanges like Binance and Coinbase, as Bitcoin (BTC) hit all-time highs. This increased market activity brought significant volatility, with large price swings both upward and downward. Traders closely monitored these inflows to anticipate market movements and potential sell-offs.

Outflows on crypto exchanges, explained

When outflows are high, it usually shows that investors are moving their assets off exchanges, which often suggests they are holding them for the long term — a behavior that can indicate a potential price increase.

Looking at crypto exchange movement trends gives clues about how the market is behaving. Outflow metrics are valuable for understanding the movement of cryptocurrencies leaving exchanges. By studying these trends, traders can gain insights into shifts in market sentiment.

For example, a sudden spike in outflows — triggered by news of new regulations or a sharp price movement — often reveals how the market is reacting. These trends help traders make better, more informed decisions.

Types of outflows on crypto exchanges.

The impact of outflows on market liquidity can significantly shape crypto market trends and have various consequences. Some common types of crypto outflow are withdrawals to external wallets, transfers to DeFi platforms and conversions to fiat currencies.

Crypto outflows occur when users move assets from exchange wallets to personal wallets for long-term storage, security or to participate in decentralized finance (DeFi) activities like lending or yield farming. Withdrawals can also involve converting crypto to fiat currency.

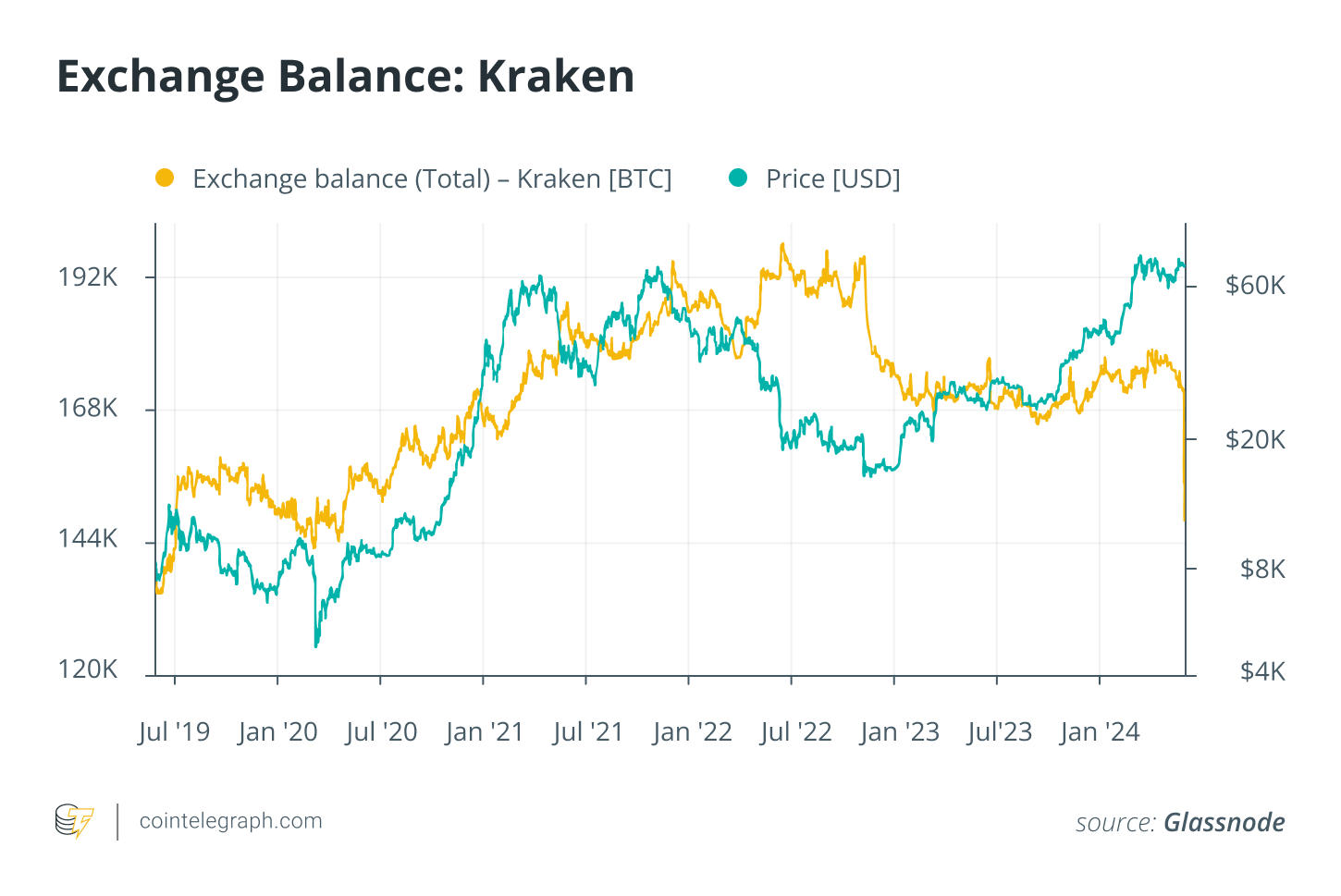

On May 30, 2024, Kraken saw its largest Bitcoin outflow, with about $1.6 billion worth (at that time) of Bitcoin (28,000 BTC) transferred out. This coincided with Bitcoin’s price surge above $69,500. The transfers occurred in five large transactions, suggesting either internal movement or possible large purchases. The outflows resulted in a significant drop in Kraken’s exchange balance to 148,000 BTC, the lowest since May 2020.

Here’s what crypto exchanges’ outflows reflect:

- Outflows and liquidity impact: Large outflows often lead to reduced liquidity on exchanges, meaning there may be fewer assets available to trade, potentially pushing prices upward.

- Market sentiment indicators: Moreover, exchange outflows and market impact can serve as indicators of whether investors expect long-term gains.

- Volatility increase: Reduced liquidity due to outflows can also increase price volatility. With fewer assets available, even small buy or sell orders can cause larger price swings, making the market more volatile in the short term.

- Investor confidence: In addition, substantial outflows often reflect investor confidence in the asset’s future price. When investors move their holdings off exchanges, it suggests they are less likely to sell in the near future, reducing immediate selling pressure.

- Accumulation and long-term supply reduction: During periods of accumulation, when investors are holding assets in anticipation of higher future returns, outflows help reduce the immediate supply of assets available on exchanges. Over time, this can lead to sustained price increases as the shrinking supply meets continued or growing demand.

Monitoring outflows provides insights into market sentiment, but it’s important to consider them alongside other factors such as trading volume, price trends and onchain data for a complete market analysis. Outflows alone don’t provide a full picture of market conditions.

How to monitor inflows and outflows of crypto exchanges

Understanding exchange dynamics is key to making informed trading decisions. Tools that allow for analyzing crypto flows provide a clearer picture of what is happening across the market.

Some tools that help traders monitor inflows and outflows are tracker systems on crypto platforms that include Glassnode, CryptoQuant and Nansen. These tools provide crypto exchange data analysis, which includes both onchain inflows and outflows.

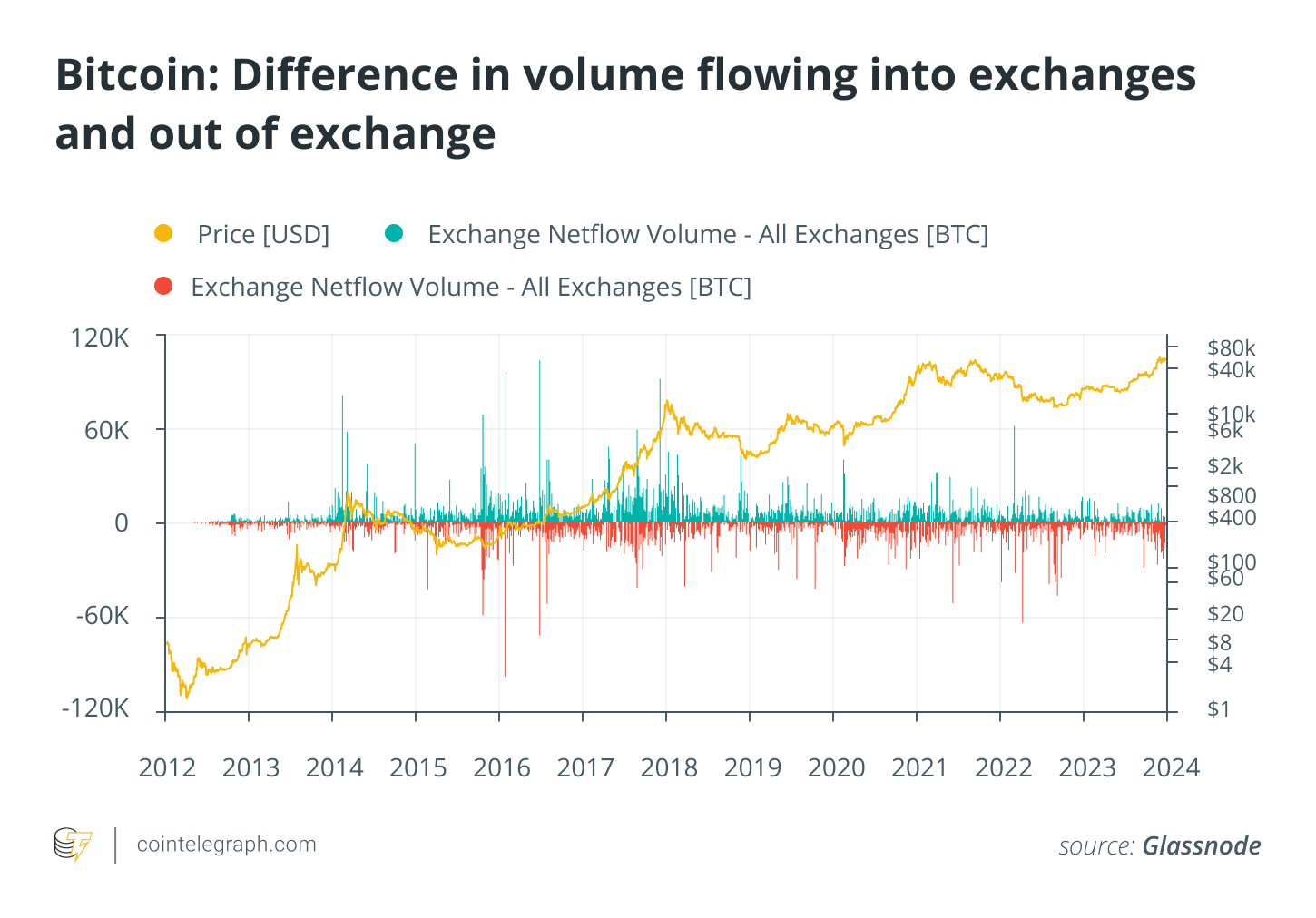

Tracking the movement of crypto in real time gives traders insight into potential trends, allowing them to respond quickly to market changes. For instance, the chart below illustrates Bitcoin’s price trajectory (yellow) alongside exchange netflows, both inflows (teal) and outflows (red) of BTC across all exchanges from 2012 to 2024. Netflows represent the balance of BTC entering and exiting exchanges. Positive values indicate more BTC flowing into exchanges, while negative values show more BTC leaving.

Surges in exchange inflows, marked by teal bars, often signal potential selling pressure as investors move BTC to exchanges for selling, which can precede price drops. Conversely, significant outflows (red bars) suggest accumulation, as BTC is withdrawn from exchanges, often signaling price increases. Traders use these netflows to adjust strategies, anticipating corrections with high inflows and accumulation phases with high outflows.

With tracking tools, traders can watch these flows in real time and get a better handle on overall market trends. This helps them stay ahead of price changes and make quick moves in a fast-paced market.

How inflows and outflows inform crypto trading strategies

Tracking exchange netflows helps traders assess market sentiment and potential price movements, offering insights for strategic decisions like buying, selling or hodling.

Here are some strategies based on exchange netflows:

- Sell on high inflows: If inflows surge, it may indicate impending selling pressure, suggesting it’s a good time to sell before a price drop.

- Buy on high outflows: When outflows increase, it suggests accumulation, signaling a potential rise in prices — ideal for buying or holding.

- Range trading: During periods of steady inflows and outflows, traders might use a range trading strategy, capitalizing on price oscillations while liquidity remains stable.

- Trend following: If outflows continue to rise steadily, traders may follow the uptrend, staying long on assets as it signals demand and potential price increases.

- Reversal strategy: High inflows followed by a drop suggest the market may be overbought, signaling a potential price correction. Traders could enter short positions or exit existing ones to capitalize on reversal.

- Liquidity hunt: Significant inflows combined with sharp price movements indicate institutional or large traders positioning for volatility. Traders can take advantage of these moves by following the liquidity flow for short-term profits.

While netflows provide valuable indicators, no strategy is foolproof — it’s essential to manage risk with stop-loss orders and position sizing, as market conditions can shift unpredictably, leading to false signals.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.