In a surprising turn of events, the approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) has not yielded the anticipated immediate upside impact on the Bitcoin price.

Contrary to expectations within the crypto community, BTC has experienced a sharp drop of over 16% since the ETF approval on Wednesday, January 11, dipping below the key $40,000 level. The failure of BTC bulls to hold the support level has led to a testing phase at the $38,000 level, accompanied by a 4.5% price drop within the past 24 hours.

Bitfinex Whales Buck The Trend

Amidst the market volatility, according to Datamish, Bitfinex whales have accumulated Bitcoin long positions since November 2023. This accumulation of approximately 4,230 BTC since January 17 marks the first sustained increase in Bitfinex BTC long positions following a sharp decline in November last year.

However, the recent downturn in the BTC price can be partly attributed to increased selling pressure from miners and asset manager Grayscale. Grayscale has notably increased its BTC sell-off since the ETF trading commenced.

Transferring a significant amount of BTC from the Grayscale Trust address to Coinbase, totaling 69,994 BTC ($2.9 billion), has influenced the market dynamics.

Additionally, reports indicate substantial sell-offs of Grayscale’s Bitcoin Trust GBTC shares, including a notable sale of 22 million GBTC shares by the FTX estate, worth nearly $1 billion.

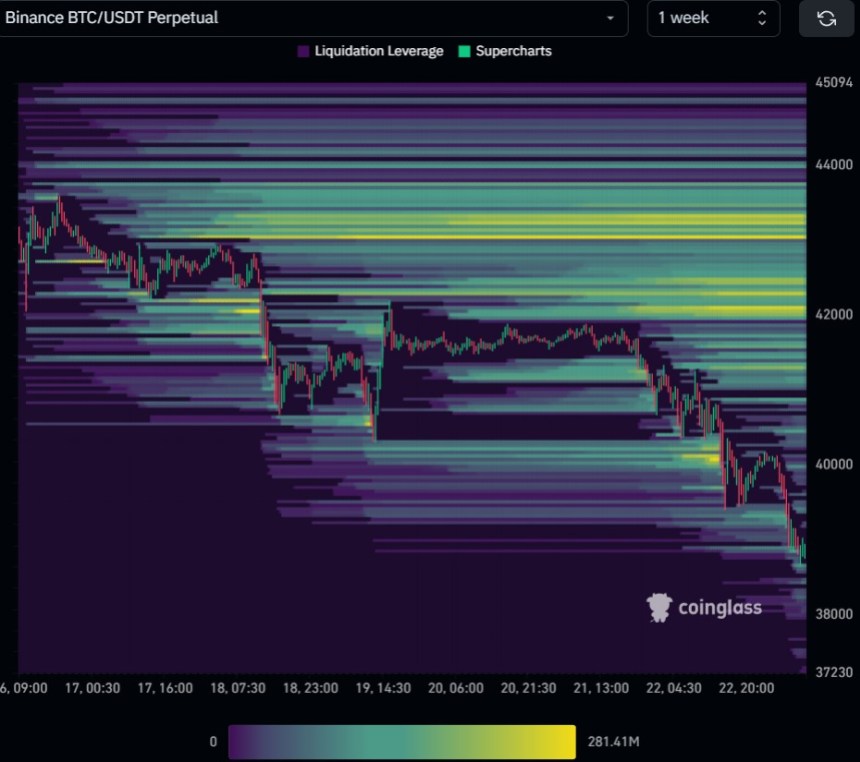

Bitcoin Liquidation Zones Wiped Off

The impact of Grayscale’s sell-off is evident in CoinGlass’ liquidation heatmap, which shows notable liquidation zones being wiped off in the 1-week chart.

While Grayscale’s BTC dump has contributed to the price drop, the increased accumulation of BTC long positions on Bitfinex indicates a potential change in sentiment. A price reversal could occur if the $38,000 support line holds, pushing BTC back above $40,000.

Furthermore, excluding Grayscale, institutional investors and asset managers involved in the ETF market have collectively acquired over 86,320 BTC at an average price of $42,000, representing a substantial $3.63 billion investment.

Market experts such as Ali Martinez suggest that these institutions are likely to adopt a strategic, long-term view rather than engage in peak purchases. This level of institutional investment underscores the growing recognition of Bitcoin as a legitimate asset class and signifies confidence in its long-term growth potential.

Currently, the Bitcoin price is at $38,800, reflecting a substantial year-to-date decline of over 12% and a 9.7% drop in the past seven days. The duration and extent of the selling pressure caused by Grayscale’s BTC dump remain uncertain, leaving the question of how much further the BTC price may decline.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.