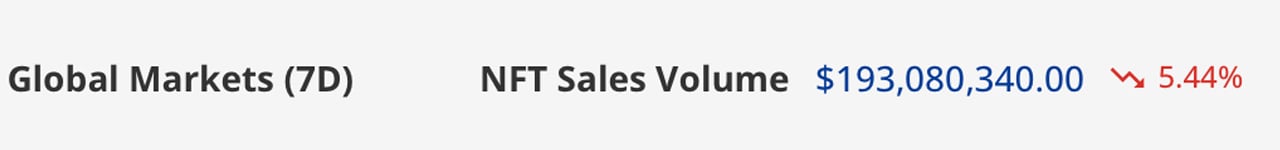

Over the past week, statistics show non-fungible token (NFT) sales totaled $193.08 million, down 5.44% from the previous week. Ethereum dominated NFT sales with more than $107 million or 55% of all sales, while Solana-centric NFT sales recorded $26.3 million or 13% of sales in the same period.

NFT Market Shows Signs of Slowdown With Declining Weekly Sales and Lower 30-Day Totals

Non-fungible token sales, or NFT sales, fell 5.44% this week compared to last week, with $193.08 million in sales recorded across 19 different blockchains. Cryptoslam.io statistics indicate that 30-day sales are generally down, with total sales of $912.54 million, more than 29% lower than last month. The top five blockchains in terms of NFT sales this week were Ethereum ($107M), Solana ($26M), Polygon ($6M), Immutable X ($5.3M), and Cardano ($3.16M).

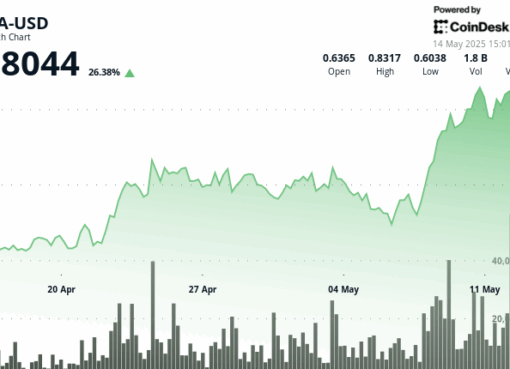

Solana’s NFT sales increased by 37.16% this week, while Cardano’s NFT sales jumped 44.27% higher than the previous week. However, Ethereum, Polygon, and Immutable X NFT sales all saw losses compared to last week’s sales. Notable gainers in terms of blockchain NFT sales include Arbitrum’s 64.49% rise and Avalanche’s 293% increase.

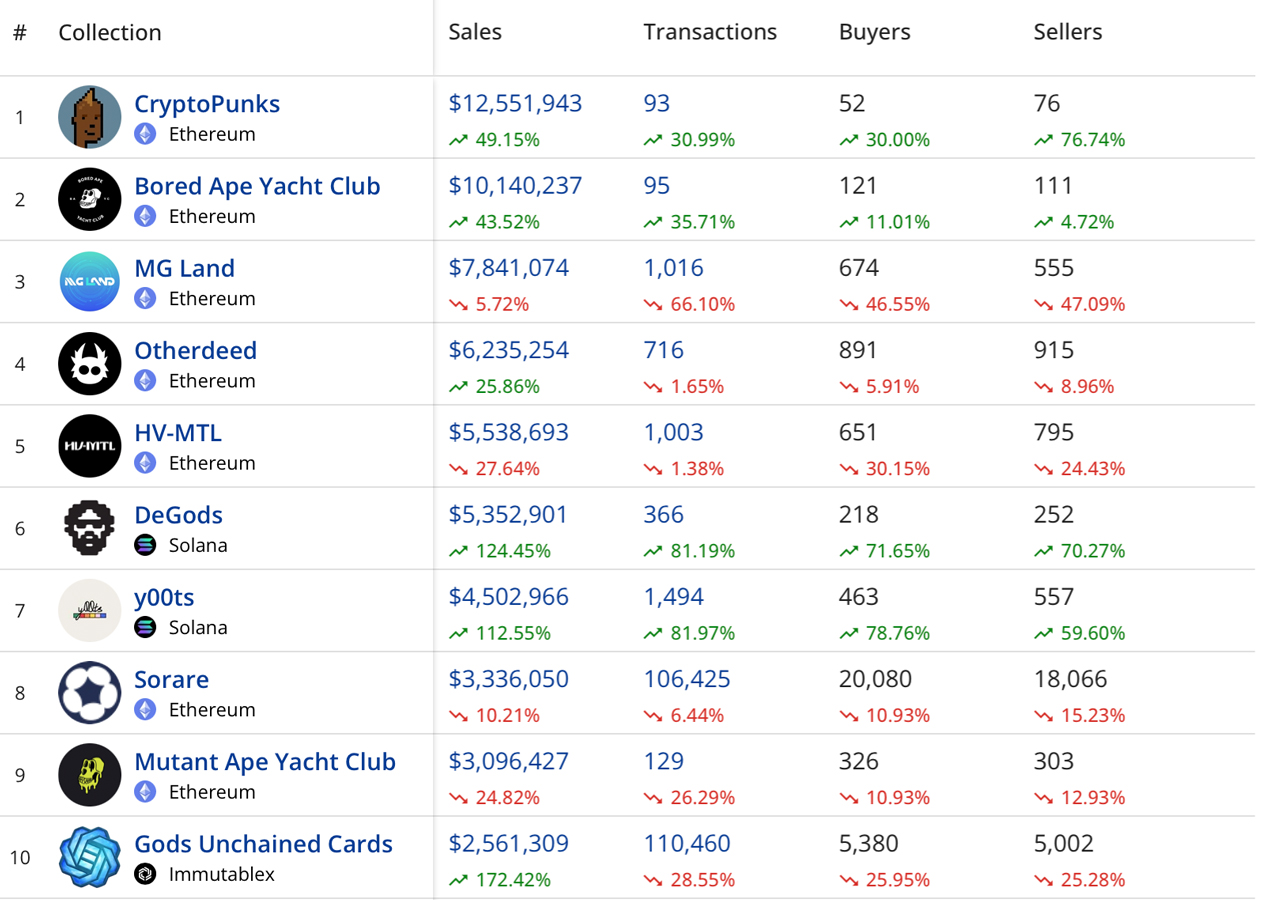

Palm blockchain sales increased by 370%, and Algorand NFT sales rose 58% higher than the previous week. While Ethereum dominates NFT sales with 55%, 18 other blockchains represent 45% of the remaining sales. The top five NFT collections this past week, with the most sales, were Cryptopunks, Bored Ape Yacht Club (BAYC), MG Land, Otherdeed, and HV-MTL.

Following those collections, the fifth through tenth top sales were Degods, Y00ts, Sorare, Mutant Ape Yacht Club (MAYC), and Gods Unchained Cards. Cryptopunks recorded $12.55 million in sales this week, up 49.15% higher than last week. BAYC sales were approximately $10.14 million this week, up 43.52% higher, while MG Land captured $7.84 million, down 5.72% from the previous week.

In terms of the highest-valued NFT sales this week, Otherdeed #2,118 was the most expensive, selling for $375,979 three days ago. Cryptopunks #6,036 sold for $365,508 two days ago, and Bored Ape Yacht Club (BAYC) #5,647 sold for $263,537 six days ago. Lastly, Cryptopunk #2,353 sold for $217,454 two days ago, and Otherdeed #99,728 sold for $205,711 three days ago. While there was close to $1 billion in sales over the past 30 days, the number of NFT buyers increased 17.36% to 1,904,731 this month.

What are your thoughts on the current state of the NFT market? Do you think the recent decrease in sales is a temporary dip or a sign of a more long-term trend? Share your opinions in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.