Four congressmen have accused the U.S. Securities and Exchange Commission (SEC) under Chairman Gary Gensler of “regulatory hypocrisy and inconsistency.” They added: “While the SEC is failing to comply with federal transparency and record-keeping laws, the SEC is aggressively enforcing record-keeping laws on private businesses.”

Gensler’s Regime at SEC ‘Has Been Characterized by Regulatory Hypocrisy and Inconsistency’

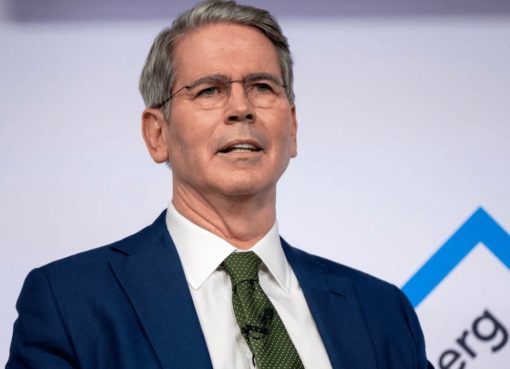

Four lawmakers sent a letter to the chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, on Tuesday “denouncing the Biden administration’s inconsistency and hypocrisy of enforcing record-keeping laws, this time at the SEC.”

The letter was signed by U.S. Representatives Tom Emmer (R-MN), Patrick McHenry (R-NC), Jim Jordan (R-OH), and James Comer (R-KY). They wrote:

Recent reports suggest that SEC officials are using ‘off-channel’ communications platforms, such as Signal, Whatsapp, Teams, and Zoom, for official business and without producing these records in response to open-record requests.

The letter details that in 2013 while Gensler served as chairman of the Commodity Futures Trading Commission (CFTC), the agency’s Office of Inspector General (OIG) discovered that he used a personal email account to conduct official business.

“During an investigation into your handling of the collapse of MF Global Holdings, the OIG found that you used your personal email 7,005 times to conduct official business related to that matter alone. Your defense to violating federal record-keeping requirements was that you apparently ‘did not know how to access [your] official email at home,’” the letter explains.

“While the SEC is failing to comply with federal transparency and record-keeping laws, the SEC is aggressively enforcing record-keeping laws on private businesses,” the lawmakers continued. “The SEC recently charged 16 firms more than $1.1 billion combined for allegedly failing to maintain and preserve electronic communications.”

Congressman Emmer stressed:

Chair Gensler’s regime at the SEC has been characterized by regulatory hypocrisy and inconsistency. Unacceptable that Gary Gensler doesn’t hold himself to the same transparency standards that he places on the private sector.

“It is inappropriate for SEC to target the private sector for failing to comply with record-keeping laws when the SEC itself is in violation of similar transparency laws,” Emmer said. “The American people deserve transparency from their regulators, but time and time again, Chair Gensler refuses to practice what he preaches.”

Congressman Comer opined: “It appears the Biden administration has rules for thee but not the SEC … This type of government hypocrisy undermines Americans’ trust in our institutions and fails to deliver the transparency they deserve. Chair Gensler must provide answers to Congress and the American people.”

Congressman McHenry described:

This is yet another example of Chair Gensler’s hypocritical mismanagement of the SEC. Chair Gensler is aggressively pursuing enforcement actions against companies who use off-channel communications while at the same time reportedly failing to comply with federal record-keeping laws.

Emphasizing that “The SEC must practice the transparency and accountability it preaches,” the lawmakers ended their letter with five questions they want Gensler to provide answers to no later than Nov. 15.

For example, they asked him to certify that the SEC is following all applicable federal record-keeping and transparency requirements and that he has never used a private email account or off-channel communications for official SEC business. Another question asks him to explain whether any SEC employees have used off-channel communications to conduct official SEC business and if so, provide a list of all such platforms and all SEC employees who have used off-channel communications for official business.

Do you think SEC Chair Gary Gensler has mismanaged the SEC as alleged by the lawmakers? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.