The provision in the U.S. infrastructure bill signed into law in November, which will require financial institutions and crypto brokers to report additional information, could reportedly be delayed.

According to a Wednesday report from Bloomberg, the United States Department of the Treasury and Internal Revenue Service may not be willing to enforce crypto brokers collecting information on certain transactions starting in January 2023, citing people familiar with the matter. The potential delay could reportedly affect billions of dollars related to capital gains taxes — the Biden administration’s budget for the government for the 2023 fiscal year previously estimated modifying the crypto tax rules could reduce the deficit by roughly $11 billion.

Under the current infrastructure bill, Section 6050I mandates that crypto brokers handling digital asset transactions worth more than $10,000 report them to the Internal Revenue Service with personal information likely including the sender’s name, date of birth and social security number. The requirements, aimed at reducing the size of the tax gap, were scheduled to take effect in January 2023, with companies sending reports to the IRS starting in 2024.

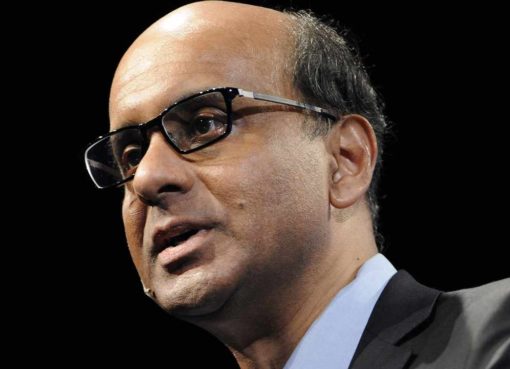

“Delaying is smart,” said Jake Chervinsky, head of policy at the Blockchain Association, in response to the news. “We’re getting closer & closer to the effective date of the infrastructure bill’s tax provisions & we’re still waiting for guidance or rulemaking on implementation.”

If true, this is good news.

We’re getting closer & closer to the effective date of the infrastructure bill’s tax provisions & we’re still waiting for guidance or rulemaking on implementation. We’ve also seen legislative proposals that could make big changes. Delaying is smart. https://t.co/m7bMDiVFFU

— Jake Chervinsky (@jchervinsky) June 29, 2022

Related: Crypto miners exempt from IRS reporting rules, US Treasury affirms

Since the passage of the $1 trillion infrastructure bill, many industry experts and lawmakers have suggested the crypto broker reporting requirements are overly broad, placing an undue burden on individuals who may not have the necessary information on transactions. In June, crypto and blockchain advocacy group Coin Center filed a lawsuit against the Treasury Department, alleging the tax reporting requirement could “impose a mass surveillance regime on ordinary Americans.”